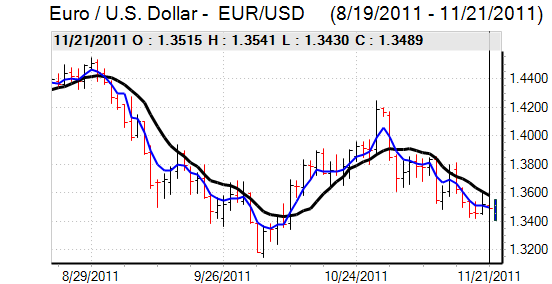

EUR/USD

The Euro was subjected to renewed selling pressure during Monday as risk conditions continued to deteriorate, but the currency again proved resilient and bounced strongly from support levels.

The Euro was undermined initially by warnings from Moody’s that France’s credit rating could be vulnerable if there was an extended period of higher borrowing costs. Market fears intensified as French yield spreads over German bunds widened to a record high and there was also further upward pressure on Spanish yields.

There was further German opposition to the concept of more aggressive ECB bong buying while tentative proposals for Eurobonds made little headway as rumours surrounding the Euro’s future continued. The ECB bought fewer peripheral bonds than expected in the latest week with a figure below EIUR10bn which helped ease tensions slightly in the New York session

There was a further increase in funding pressures as dollar Libor rates continued to increase with the benchmark 3-month rate close to the 0.50% level while other gauges of stress were at the highest level since 2008. There was evidence of capital repatriation which underpinned the Euro as commodity currencies came under heavy selling pressure while the dollar secured defensive demand.

The US existing home sales data was slightly better than expected which had a small positive impact on risk conditions. Congressional sources confirmed the high probability that the Super Committee looking at long-term budget options would fail to reach agreement this week. This initially undermined risk appetite, but there was some relief following an announcement from the major rating agencies that there would be no immediate impact on US credit ratings. The Euro rallied to a peak around 1.3540 before losing support again during the Asian session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support in the 76.80 area against the yen on Monday and rallied slightly during the US session following better than expected US data. There were more substantial, although temporary gains in Asia with a peak in the 77.30 area as risk appetite improved.

There was no confirmation of Bank of Japan intervention, although markets were inevitably nervous over the possibility which triggered a flurry of dollar buying.

The yen will still gain important support from a lack of confidence in the global economy. There will be a persistent threat of capital repatriation and Japanese funds will also be much more cautious over pushing funds overseas in the current environment of risk aversion.

Sterling

Sterling remained on the defensive during Monday and dipped to 6-week lows and technical support levels just above 1.56 against the dollar before correcting slightly higher with Sterling also weakening to beyond 0.86 against the Euro.

There was a persistent lack of confidence in the UK outlook following a raft of negative media reports on business conditions and reports of weak consumer spending.

Sterling has been an important beneficiary of safe-haven capital flows over the past few weeks as confidence in the Euro-zone deteriorated. There were increased concerns that flows may fade at current yield levels, especially given medium-term fears over the UK outlook.

Sterling was also generally more vulnerable when risk aversion increased and this was an important feature during Monday as equity markets were subjected to heavy selling pressure. A large weighting of mining stocks in the UK FTSE index compounded the impact.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

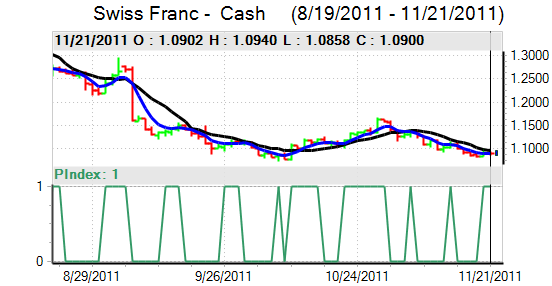

Swiss franc

The dollar maintained a strong tone against the franc on Monday, but there was tough resistance in the 0.92 area and it weakened to lows just below 0.9150 before finding fresh traction. As has been the case in recent sessions, the Euro was unable to hold above the 1.24 level.

There were further suspicions that the National Bank was intervening in the forward markets as the Swiss currency failed to gain any support as risk appetite deteriorated. There will be the potential for continued high volatility in the short term, although a decline in liquidity ahead of the US Thanksgiving Holiday should make it easier for the central bank to curb any franc gains.

Australian dollar

The Australian dollar was subjected to further selling pressure on Monday with a decline to lows around 0.9815 against the US currency, which was the weakest level since the second week of October. Global risk conditions dominated and a further sharp retreat in equity markets triggered selling pressure on the currency.

There was also further concerns surrounding the regional economic outlook with a further round of GDP forecast downgrades which tended to undermine confidence in the Australian dollar with fears that commodity prices would come under sustained pressure. There were no significant domestic developments during the day.