EUR/USD

The Euro was confined to narrower ranges on Wednesday as markets were unable to break any significant technical levels. The Euro was blocked in the 1.3280 region against the dollar while there was solid support on dips towards 1.32. The Euro gained significant support from demand on the crosses as there was a further covering of short positions which was important in providing support against the US currency.

Consolidation was also the general theme following the Greek loan package agreement the previous day. Fitch downgraded Greece’s rating to C from CCC, although this was basically a technical move following the loan deal and debt restructuring. The IMF warned that there were still very big implementation risks associated with Greece’s restructuring and there were also important risks surrounding Portugal and Spain. In contrast, there was relief that margin requirements on Irish bonds were reduced.

As far as the economic data is concerned, the Euro-zone PMI manufacturing index was slightly weaker than expected with only a marginal increase of 49 from 48.8 previously while the services figure dropped to 49.4 from 50.4 as there was a significantly weaker result from Germany. The data did dampen expectations that the economy would be able pull out of downturn and recession fears increased to some extent. There were also fears over deteriorating conditions within the peripheral economies.

The US existing home sales data was slightly weaker than expected with a figure of 4.57mn from 4.38mn previously, although this was still a four-month high as the sector continued to show an underlying recovery. The dollar gained some defensive support from unease over global growth due to very high oil prices, although high energy prices are usually negative for the currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar maintained a strong during the European session on Wednesday and challenged resistance levels above the 80.30 area with a peak close to 80.40.

The dollar continued to gain underlying support on yield grounds following a generally robust set of economic data releases. Underlying yen sentiment remained weak as players also looked to maintain momentum.

The yen was undermined by high oil prices, especially given the increased impact on Japan from major closures within the nuclear industry. There was still some speculation that there would be capital repatriation flows back into the yen which curbed selling pressure to some extent and there was some pressure for a correction.

Sterling

As expected, the Bank of England minutes recorded a 9-0 vote for interest rates to be left on hold at 0.50%. There was a split 7-2 vote on the decision to raise quantitative easing by GBP50bn at the meeting. Posen and Miles votes for a GBP75bn boost to quantitative easing while there were other members of the committee who had reservations about any further boost even though they eventually voted with the majority.

The central bank was slightly more optimistic surrounding the growth outlook, but estimated that further easing was required to prevent inflation under-shooting in the medium term.

The minutes were more dovish than expected and pushed Sterling significantly weaker. Technical considerations also played an important part as the Euro advanced on stop-loss buying and investor demand once it broke above the 0.84 level against the UK currency with 2012 high near 0.8450. Sterling retreated to two-week lows near 1.5650 against the dollar with a limited correction on Thursday as the US currency dipped lower.

Swiss franc

The dollar was unable to make any impression on the franc during Wednesday and retreated to re-test support below 0.91 as ranges narrowed. The Euro drifted weaker against the Swiss currency and tested support below 1.2060 with some suspicion of National Bank intervention in this area.

The Swiss Economy Minister expressed hopes that the franc would weaken towards its estimated purchasing parity value around 1.40 against the Euro, although the government has no powers over the central bank. There will be continuing jitters surrounding central-bank action if the 1.20 area is approached.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

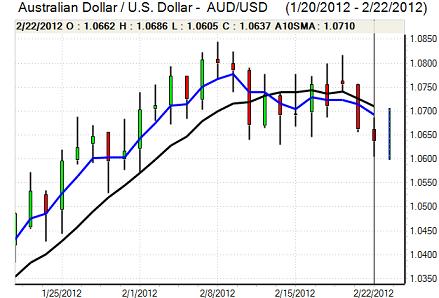

Australian dollar

There was further generally choppy trading in the Australian dollar during the day and the currency found support in the 1.06 area before a recovery to the 1.0630 area later in the US session. There were concerns over the global growth outlook, especially with China’s leadership indicating that they will target a lower growth rate over the current year.

Domestically, political uncertainty had a negative impact on the Australian currency as Prime Minister Gillard announced a leadership election next week following destabilising criticism from former leader Rudd. There were some concerns that there would be prolonged uncertainty which undermined sentiment. There was solid Australian dollar support close to the 1.06 level.