EUR/USD

The Euro was unable to strengthen above 1.2350 against the dollar on Tuesday and had a generally weaker tone even though ranges were slightly narrower in cautious trading.

The German IFO index rose slightly to 101.8 for June from 101.5 the previous month which was contrary to expectations of a small monthly decline. Resilience in business confidence will provide some support to sentiment over the Euro-zone economy, although the impact is likely to be measured given persistent structural fears.

There were further doubts surrounding the European banking sector during the session which also dampened confidence in the Euro, although there was support close to 1.2250 against the dollar.

The US housing data was weaker than expected with a decline in existing home sales to 5.66mn for May from a revised 5.79mn the previous month. Markets had been expecting a rise in sales ahead of a tax-break expiry and the decline will reinforce fears over a deterioration in second-half housing prospects.

The Federal Reserve meeting will be watched closely on Wednesday and there will be some speculation that FOMC members will take a slightly more cautious tone towards growth prospects. Any shift in rhetoric would undermine dollar support on yield grounds.

Defensive considerations will also be important and the dollar will gain some support if confidence in the US and global economy falters, especially as it would tend to undermine the Wall Street performance. In this context, a Euro rally to above 1.23 faltered again later in New York with a retreat back towards daily lows.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The mood towards risk remained more cautious on Tuesday with stock markets slightly weaker and the yen also drew some support from further doubts over the European banking sector. In this environment, the US currency weakened to the 90.80 support area against the yen with narrow ranges.

Stock markets were generally on the defensive during the session, especially later in New York and this continued to curb selling pressure on the yen as there was a greater reluctance to sustain carry trades. The dollar dipped to a low near 90.30 before stabilising just below 90.50. There was further speculation over semi-official US currency buying near the 90 level which helped protect the dollar from further selling pressure.

Sterling

Sterling came under pressure ahead of the UK budget on Tuesday with a low just below 1.47 against the US dollar.

The UK government statement was broadly in line with expectations as the administration pledged to eliminate the structural budget deficit within 5 years through a mixture of spending cuts together with tax increases.

The principal tax proposal was an increase in the sales to tax to 20% from 17.5%, but the increase will not be introduced until the beginning of 2011. A delay in increasing taxes will tend to lessen near-term fears over a renewed downturn in consumer spending which will also provide some degree of Sterling support as it will help lessen the immediate threat of a slide back into recession. The measures also maintained expectations that a near-term credit rating would be avoided which helped underpin confidence.

Sterling recovered to a high just above 1.4850 against the US currency before stabilising close to 1.48 while it strengthened through 0.83 against the Euro.

Swiss franc

The dollar was unable to make any impression on resistance above the 1.1120 area against the Swiss currency on Tuesday and dipped to lows just below 1.1040 during the European session. The franc maintained a firm tone on the crosses as the Euro tested record-low support levels just below 1.36.

The comments from National Bank members continued to maintain expectations that there would be no near-term intervention to weaken the Swiss currency which maintained buying support for the franc.

The trade surplus narrowed sharply for May, but the underlying export performance was firm which will tend to lessen immediate fears surrounding competitiveness and ease pressure for franc gains to be resisted.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

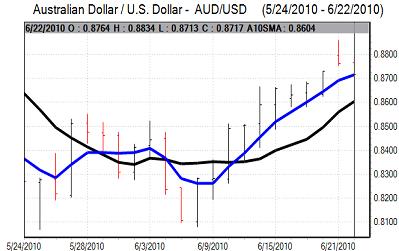

Australian dollar

The Australian dollar was unable to regain the 0.8850 level against the US dollar during Tuesday and declined steadily during the day to lows near 0.8710.

There was a late decline on Wall Street and this contributed to downward pressure on the Australian dollar, especially with commodity prices also generally weaker during the day.

Confidence in the domestic economy is also likely to be weaker which will tend to limit currency support.