EUR/USD

The Euro remained above 1.35 in Europe on Thursday, although rallies were encountering significant selling which initially dampened headway.

The US jobless claims data was close to expectations with a decline to 439,000 in the latest reporting week from a revised 445,000 the previous week and the 4-week moving average declined to the lowest level since September 2008.

The ISM index for manufacturing rose to 59.6 from 56.5 the previous month, maintaining optimism surrounding the manufacturing sector. The employment component in the index was also comfortably above the 50 level. In contrast, there was a further monthly decline in construction spending which fell to the lowest level since 1992.

The data overall will maintain expectations of positive employment growth in the monthly payroll data due for release on Friday. Consensus estimates for payroll expansion have edged lower over the past 48 hours which will tend to cushion the dollar if there is a weaker than expected outcome.

There were further gains in the Euro in US trading with cross-trading an important feature. The Euro secured a strong advance against the Swiss franc which also pushed the Euro higher against the dollar with a peak close to the 1.3580 level. There was also reduced defensive dollar demand as risk appetite remained firm.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Domestically, the Japanese Tankan business confidence index improved to -14 from -25 the previous quarter which was in line with market expectations and maintained expectations of a slow recovery while the capital spending projections remained weak. Regionally, there were advances in the Chinese PMI manufacturing indices which helped underpin confidence in growth prospects and also tended to lessen defensive demand for the yen on defensive grounds.

The dollar pushed higher to challenge resistance levels above 93.50, but it was still finding it difficult to make much headway as demand for both currencies remained slightly weaker as risk appetite remained firm.

The dollar pushed to a high just above 94 in US trading as the dollar gained support from yield considerations while the yen was undermined by generally strong risk appetite.

Sterling

The UK currency held firm in early Europe on Thursday with support above the 1.5150 level against the US dollar.

The latest PMI index for the manufacturing sector was firmer than expected with an advance to a fresh 15-year high of 57.2 from 56.5 the previous month. The Bank of England reported an improvement in credit conditions which also helped lessen fears over a near-term credit contraction.

Political developments remained a strong focus and there was an opinion poll which suggested a reduced chance of a hung parliament and this also boosted confidence that there could be decisive action to curb the budget deficit following the election.

Sterling also gained some degree of support from generally firm international risk appetite. The UK currency was able to hold near 1-month highs stronger than 0.8880 against the Euro and also strengthened to a peak near 1.53 against the dollar in New York.

Swiss franc

The franc maintained a strong tone in early Europe on Thursday with the Euro under pressure near record lows against the Swiss currency.

The PMI index also rose to a record high for March which also provided initial support for the Swiss currency.

The franc then weakened sharply later in the European session with rapid Euro gains to a high near the 1.44 level before a retreat back to 1.4320. There was convincing evidence of intervention by the National Bank and there was also indications that there had been heavy franc selling. There will be pressure on the bank to sustain intervention and volatility is likely to remain a key short-term feature.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

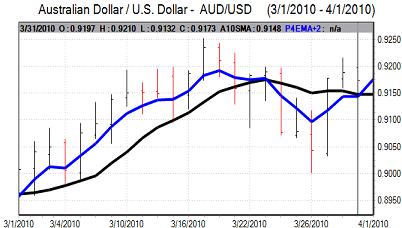

Australian dollar

The Australian dollar found support near 0.9150 against the US currency on Thursday and maintained a generally firm tone during the day. As the US currency weakened, there were gains to a peak just above the 0.92 level.

The Australian dollar was supported by an improvement in risk appetite and optimism over the regional economy, but was still tending to under-perform on the crosses