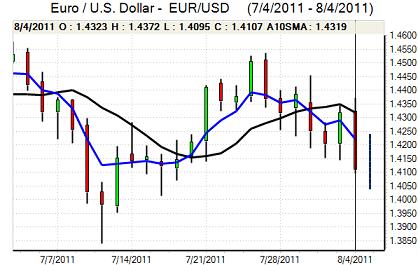

EUR/USD

There was no surprise in the ECB interest rate decision with rates left on hold at 1.50%. At the press conference following the meeting, there was still some tough talk on inflation from President Trichet, but he also stated that the growth outlook had deteriorated.

The ECB announced the provision of unlimited liquidity through six-month financing operations and also announced the resumption of peripheral bond buying. The move did have a brief impact in boosting the Euro, but the effect was reversed quickly. The ECB buying was confined to Ireland and Portugal with no action in the crucial Spanish and Italian bond markets. This division caused major doubts over the ECB commitment which undermined market confidence. The German Bundesbank opposed the decision and sources from within the ECB indicated that there were other votes against the move.

In this environment, sentiment deteriorated and there was a fresh widening in peripheral spreads which triggered sharp Euro losses. There were negative comments from EU commission head Barroso and Italian Finance Minister Tremonti which criticised the official response.

The US jobless claims data was slightly better than expected with a dip to 398,000 in the latest week, but the impact was overshadowed by a sharp decline in equity markets as fear over the economy increased. There was fresh speculation over a fresh move to expand quantitative easing and the Friday employment report will be watched very closely.

The dollar secured strong net gains overall as fear increased with rapid appreciation against commodity currencies as growth fears increased. There was a rise in Libor rates and fears over a banking crisis in Italy which triggered further defensive demand for the dollar, but the Euro did find support below 1.41.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The Bank of Japan continued to intervene during the European session on Thursday and briefly managed to push the yen weaker than the important 80 level against the dollar. Official amounts will not be revealed for some weeks, but there were estimates that as much as JPY4trn had been sold to weaken the Japanese currency

Risk conditions deteriorated again during the New York session on Thursday which triggered fresh defensive demand for the Japanese currency as equity markets fell sharply.

Confidence remained extremely fragile in Asia on Friday and the yen secured further support with gains back to the 78.50 area. Markets will watch the G7 response very closely both on Friday and over the weekend. There was speculation over yen selling late in the Asian session, but it appeared to be a private bank and not the Bank of Japan.

Sterling

Sterling was blocked below 1.64 against the dollar during Thursday and weakened sharply to lows near 1.6220 during the day as Euro losses triggered a US advance against Sterling. The UK currency did secure net gains against the Euro with a two-month high near 0.8650 before a partial retreat.

Given the high degree of stresses within global markets and fears surrounding the Euro-zone, the Bank of England interest rate decision went almost un-noticed.

The MPC left interest rates unchanged at 0.50% while the amount of quantitative easing was also left on hold at GBP200bn. There was no statement with the decision and the vote split will not be known for two weeks.

The financial sector will remain under close scrutiny in the short term as banking-sector shares continue to fall sharply. If there is any further widening in interbank spreads, then the net cost of borrowing will increase which will further damage the economy and could force additional quantitative easing by the Bank of England.

Swiss franc

The dollar was unable to regain the 0.78 level against the franc on Thursday and weakened sharply to lows near 0.76. There was an even sharper move for the Euro which weakened sharply to lows near 1.07. Fear dominated markets during the European and US sessions and this triggered a fresh wave of safe-haven franc buying as equity markets fell sharply and Euro-zone peripheral spreads widened. Signs of disarray within the European authorities were particularly important in triggering fresh demand for the Swiss currency.

There was no evidence of Swiss National Bank action, but there will certainly be the possibility of further action given the fresh surge in the franc with President Hildebrand warning that further action could be taken.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

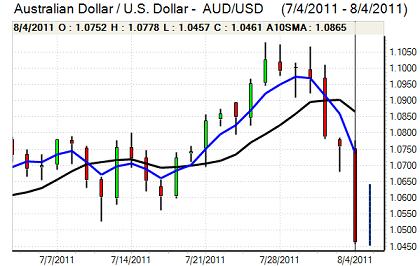

Australian dollar

The Australian dollar hit resistance close to 1.07 during Thursday and weakened sharply during the day with lows close to 1.0420 against the US currency as Wall Street fell rapidly. Risk appetite deteriorated very sharply during the day which undermined the Australian dollar, especially as commodity prices also fell sharply.

The IMF cut its GDP growth forecast and the Reserve Bank also cut its 2011 growth forecast to 2.0% from 3.2% previously, although it also remained concerned over the inflation outlook. There will be further concerns over the growth outlook, especially if there is a contagion effect on Asian economies which would further undermine regional confidence.