EUR/USD

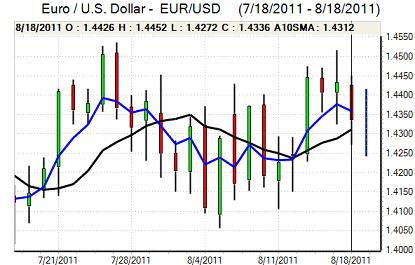

The Euro hit resistance close to 1.4450 against the dollar during Thursday and then came under sustained selling pressure with accelerated losses during the New York session.

The US jobless claims data was slightly higher than expected at 408,000 in the latest reporting week, but the main surprise was in the Philadelphia Fed survey. The index declined sharply to -30.7 for August from 3.2 previously with all the main components deteriorating and this was the lowest reading since 2009. With existing home sales also weaker, the data reinforced market fears over the economy even though regional indices can give a misleading impression of national trends.

Headline consumer prices rose 0.5% for July which was also significantly higher than expected to give a 3.6% annual increase and there was a core reading of 0.2%. The combination of weaker growth and higher headline inflation will create significant discomfort within the Federal Reserve and comments from key officials will remain under close scrutiny in the short term.

There was further unease surrounding the European banking sector, especially with further reports that some banks were having problems in securing necessary liquidity. There was a further increase in Libor rates and there will be some dollar support on structural grounds, although central bank liquidity provisions should prevent major difficulties. US 10-year Treasury note yields also dipped to record lows below 2%, a clear indication of defensive demand.

Confidence in the Euro-zone economy also persisted, especially with reports that Finland was looking for additional collateral on loans to Greece. As equity markets came under heavy selling pressure, the Euro fell sharply to lows around 1.4270 before correcting higher. There was a further suspicion of sovereign Euro buying at lower levels which protected the currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was again trapped with very narrow ranges against the yen on Thursday with both currencies gaining some degree of defensive support as the Japanese currency advanced strongly against the Euro and Australian dollar.

Finance Minister Noda continued to warn over one-sided markets and there was the threat of intervention, but he repeated that action needed to surprise markets to be effective. The dollar spiked higher in Asia on Friday with a high near 76.90, but it quickly retreated back to the 76.50 area

There will be further defensive demand for the yen if equity markets are subjected to further selling pressure, especially as confidence in the regional economy is also likely to weaken.

Sterling

Sterling hit resistance near 1.6550 against the dollar on Thursday and dipped sharply to lows around 1.6420 as risk appetite deteriorated, although the currency was still broadly resilient. The UK currency advanced to highs beyond 0.8670 against the Euro.

The retail sales data was slightly weaker than expected with a headline increase of 0.2% for July after a revised 0.8% the previous month to give unchanged sales over the year.

Underlying confidence in the UK economy remained weak and yield support was also extremely low. In part this was a reflection of defensive support for Sterling, especially given its position outside the Euro-zone. Trends in the UK banks will be watched very closely and any stresses in the UK sector would be potentially extremely dangerous for Sterling.

Bank of England MPC member Weale attempted to sound optimistic over the outlook with hopes that third-quarter GDP growth would be stronger than the second quarter. The latest government borrowing data on Friday will also be important for market sentiment. Sterling was trapped just below 1.65 against the dollar in Asian trading on Friday.

Swiss franc

The Swiss franc was subjected to further volatility during Thursday with rumours that additional measures could be taken to curb franc strength. With no further action announced, defensive considerations tended to dominate and there was renewed safe-haven support for the franc as risk conditions deteriorated sharply.

The franc strengthened to a high near 0.7850 against the dollar, but was unable to sustain the gains and weakened back to the 0.7930 area while the Euro found support below 1.1250. The European banking sector will be watched extremely closely in the short term and tensions within the Euro-zone would support the Swiss currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar was unable to move back above the 1.0550 area on Thursday and was subjected to heavy selling pressure with a break below the 1.04 level triggering stop-loss selling. The Australian dollar was undermined by a fresh slide in equity prices as risk appetite deteriorated sharply following the US economic data.

The currency will remain extremely sensitive to trends in the global economy as fears over a downturn will undermine risk conditions and tend to put downward pressure on commodity prices. There were no domestic economic releases, but markets continued to sense that the Reserve Bank would move towards a less restrictive policy. The Australian dollar dipped to lows just above 1.03 before finding some fresh support.