EUR/USD

The Euro was vulnerable, but little changed in early Europe on Thursday as support in the 1.33 region held with relatively narrow ranges.

The US jobless claims were higher than expected at 460,000 in the latest week from a revised 442,000 the previous week which may have been distorted by the Easter weekend. Markets will wait for further evidence over the next few weeks before assessing whether there is a new trend developing. The movements in long-term interest rates will remain under scrutiny and the US currency should still be able to secure underlying support from the recent rise in yields relative to German bunds.

As expected, the ECB left interest rates on hold at 1.00% following the latest council meeting. In the press conference following the meeting, President Trichet stated that monetary policy remained appropriate and he maintained a neutral stance on the economy.

Trichet also stated that default was not an option for Greece while the deal was described as a workable framework as he looked to foster a greater sense of confidence surrounding the Euro-zone economy and Euro area.

Underlying confidence was still extremely fragile, but Trichet’s comments did help to stabilise sentiment and the Euro edged back to the 1.3350 area later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The domestic economic data was mixed with a weaker than expected figure for machinery orders as core orders declined by 5.4% over the month which will maintain some fears over the investment outlook. In contrast, the latest consumer confidence data was stronger than expected which could help underpin spending levels.

There was still a generally more cautious attitude towards risk appetite and the dollar was trapped near the 93.25 level while the yen also convincingly broke Euro support in the 125 area with a generally firm Japanese currency tone on the crosses.

There was renewed speculation over a Chinese revaluation during Thursday following a batch of media comments with some expectations that a move was imminent. This speculation also helped underpin the yen during day. The dollar dipped to lows near 92.85 before recovering to 93.25 as risk appetite looked to stabilise.

Sterling

In a similar pattern to recent days, Sterling found support below 1.52 against the dollar. The economic data was stronger than expected and provided some support. The Halifax bank reported a 1.1% increase in house prices for March following a revised 1.6% decline the previous month while there was also a larger than expected 1.0% increase in industrial production for February.

As expected, the Bank of England left interest rates at 0.5% following the latest Monetary Policy meeting and the amount of quantitative easing was also left on hold at GBP200bn. The Bank will be very reluctant to get involved in the political debate and comments are, therefore, likely to remain very limited in the short term. The May meeting will be much more important both for the bank and for Sterling.

The government debt issue will remain a very important background factor and there is still the risk that confidence will deteriorate rapidly on fears that the position is unsustainable.

As the US dollar failed to sustain a advance, Sterling moved back to the 1.5270 area later in New York trading while the UK currency held its position at a 7-week high against the Euro.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Swiss franc

The dollar hit resistance around 1.0785 against the franc on Thursday and edged back to the 1.0730 area later in US trading as major resistance levels were not subjected to a major attack. The Euro was again able to hold above the 1.43 level.

Markets will continue to monitor National Bank comments and actions very closely in the short term and fear of intervention will help underpin the Euro, but the inability to make significant gains will maintain the risk of renewed downward pressure over the next few days.

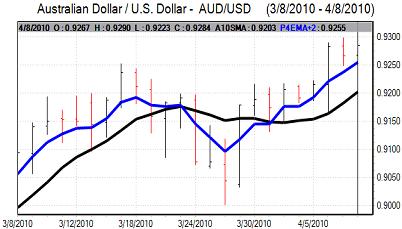

Australian dollar

The Australian dollar was unable to make a break above this level with reports of options barrier a significant influence in curbing gains. The employment data was close to expectations with an increase of close to 20,000 for March which maintained underlying confidence in the Australian economy.

Risk appetite was, however, more fragile which dented demand for the currency and there was a decline to the 0.9235 area against the dollar in European trading on Thursday. There were renewed gains in US trading with a push back to the 0.9285 area as risk appetite stabilised. Chinese moves will remain an important focus and a move to revalue the yuan could unsettle the Australian currency.