EUR/USD

The Euro was unable to gain any fresh momentum in European trading on Wednesday as the currency remained dogged by structural vulnerabilities. There were rumours that ratings agency Fitch was going to put the French rating on negative watch for a possible downgrade. There were also comments from financier George Soros that Germany could bring down the Euro, reinforcing a lack of market confidence in the Euro’s outlook.

The Euro-zone industrial data did not have a major impact with the PMI manufacturing index declining to a four-month low and there will be unease that the German new orders index dipped to near the 50 level. German consumer confidence held steady at 3.5 in the latest month.

US new home sales fell sharply to an annual rate of 300,000 in May from a revised 446,000 the previous month and this was a record low reading for sales. Recent sales figure have been distorted by changes in tax credits and the ending of incentives was important in pushing sales lower. Nevertheless, there will still be unease over the threat of an underlying deterioration in conditions which will tend to undermine risk appetite.

As expected, the Federal Reserve left interest rates on hold at the 0.00-0.25% range following the latest FOMC meeting. The statement was slightly more pessimistic than previously with comments that financial conditions were now less supportive of growth. Although Regional Fed President Hoenig again dissented against the decision to maintain rates at very low levels for an extended period, there will be reduced expectations of a near-term rate hike. The statement undermined the dollar with the Euro able to bounce back above the 1.23 level and it consolidated just above this level late in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Markets initially struggled to find fresh incentives on Wednesday with a generally soft tone in equity markets again providing underlying yen support with the dollar unable to gain any significant backing. The mood of caution prevailed in the European session with the dollar weakening to test support close to the 90 level.

The dollar initially failed to gain any support following the Federal Reserve interest rate decision and dipped to lows near 89.80. Thereafter, dollar moves were linked with Wall Street trends and the dollar dipped back to below 90 as a Wall Street rally also faded.

Sterling

Sterling held a steady tone in early Europe on Wednesday and then gained some additional support during the day.

The Bank of England minutes recorded a 7-1 vote for unchanged interest rates at the June meeting with 1 vacancy on the 9-member MPC. Sentence dissented against the decision and voted for an immediate increase in rates to 0.75%. The vote for an increase will increase speculation that the bank could move towards an earlier than expected tightening which would also provide some Sterling support.

The impact may be limited as there will also be expectations that the fiscal tightening announced on Tuesday would discourage any significant increase in interest rates.

There is also still a positive impact from Tuesday’s budget with ratings agency Moody’s stating that the fiscal measures would help the UK maintain its AAA credit rating. This will be an important positive Sterling influence, especially given the Euro-zone vulnerabilities.

Swiss franc

The dollar again hit resistance close to 1.1140 against the franc on Wednesday and weakened to lows around 1.1040 following the Federal Reserve interest rate decision. Franc strength on the crosses continued to have a negative impact on the US currency.

The Euro remained under pressure against the Swiss currency during the day with a further test of support levels below 1.36. The franc continued to gain support from concern over Euro-zone fundamentals and the potential risk of capital flight into Swiss assets.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

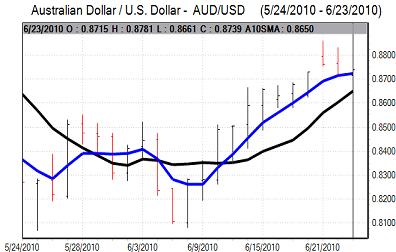

Australian dollar

The Australian dollar has remained on the defensive over the past 24 hours, although losses have been measured. The currency was unsettled by political stresses with Prime Minister Rudd facing a leadership challenge.

Underlying risk appetite was also generally fragile as markets fretted over the risks of a renewed downturn in the global economy. A decline in the Baltic index of freight rates for the 19th consecutive session reinforced the mood of caution with an Australian dollar low near 0.8660. A generally weaker US currency allowed a recovery back to test resistance above 0.8750 later in the US session.