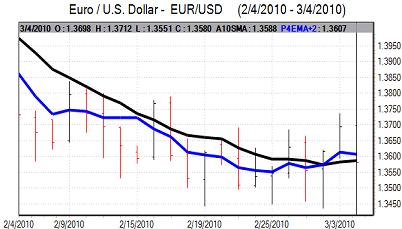

EUR/USD

The Euro failed to extend gains in Asian trading on Thursday and weakened toward the 1.3650 region against the dollar ahead of the ECB interest rate decision.

The central bank interest rate decision was in line with expectations as interest rates were left on hold at 1.00%. The bank continued the gradual removal some of the longer-term liquidity measures which had been introduced during the crisis, but the 7-day and 30-day liquidity auctions will be maintained until at least October which illustrates that the bank will continue to take a cautious stance given the uncertainties.

ECB President Trichet also commented that IMF support for Greece would not be appropriate and these remarks tended to renew unease over the debt situation surrounding Greece. Overall Euro sentiment is liable to remain generally very fragile in the short term.

The US jobless claims data was in line with expectations with a decline to 469,000 in the latest week from a revised 498,000 the previous month. The pending home sales data was weaker than expected with a 7.6% monthly decline following a series of robust reports during the second half of 2009 and some housing doubts will persist.

The US payroll data will be watched closely on Friday and there is certainly a risk that bad weather conditions will trigger a weaker than expected result. Market expectations have been scaled back over the past few days and this should help protect the dollar from selling pressure unless the data is very weak. Unemployment and work-week data will also be watched closely in the report.

The Euro was subjected to further selling pressure following the ECB meeting and dipped to lows near 1.3550 before a marginal recovery. Volatility will remain a key threat following the US data on Friday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Asian equity markets were weaker on Thursday, undermined in part by speculation over further Chinese monetary tightening measures and this caution was significant in providing some yen support with the dollar weakening to near the 88 level during Asian trading.

Yield trends were also important during the day and Japanese Libor rates dipped to below US rates for the first time since August. This was significant in boosting US support on yield grounds and the dollar advanced during the European session.

The dollar was able to maintain a firmer tone despite the weaker than expected pending home sales data and the dollar pushed above the 89 level. The Friday US employment report will inevitably have an important impact on market confidence and the dollar performance on Friday.

Sterling

Sterling held firm above 1.5050 against the dollar in European trading on Thursday ahead of the Bank of England interest rate decision.

The central bank held rates on hold at 0.50% following the meeting which was in line with market expectations. There was no expansion of the quantitative easing programme which was left at GBP200bn while the bank did not release a statement.

The decision to resist any further easing provided some support for the UK currency and there were gains to near 0.9030 against the Euro. Sterling, however, dipped to lows near 1.50 against the dollar as there was a generally firmer US currency.

Underlying confidence in Sterling remained weak as markets continued to fret over government debt levels and the political stresses and it will be difficult to secure a significant improvement in the near term.

Swiss franc

The dollar found support below 1.0680 against the franc on Thursday and strengthened to a high of 1.0795 in US trading.

The Euro was unable to gain any support during the day and tested support close to 1.4620 against the Swiss currency as underlying confidence in the Euro-zone remained weak. There was also a more cautious tone surrounding risk which provided some degree of franc support.

National Bank member Jordan continued to warn that franc appreciation would be blocked and markets remained on high alert over the intervention threat.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

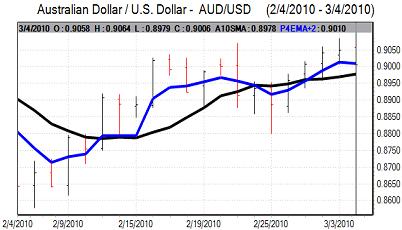

Australian dollar

The Australian dollarfailed to sustain the gains on Thursday as weaker Asian equity markets triggered a fresh bout of risk aversion with a low below the 0.8980 level

There were also fears that there would be further monetary tightening measures by the Chinese government which also had a negative impact on confidence surrounding the Australian dollar. The currency was able to resist heavy selling pressure and consolidated just below 0.90.