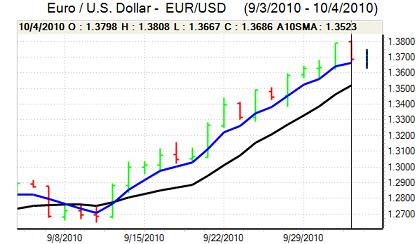

EUR/USD

The Euro was vulnerable to profit taking on Monday in a technical correction following recent rapid gains. The latest IMM positioning data also recorded the longest short dollar position for over 2 years which increased pressure for a short-covering US rally.

Underlying financial-sector doubts were also a significant factor in hampering the Euro during the day. There was a further downgrade of Irish GDP growth forecasts which reinforced fears over the banking sector and there was also speculation that the Euro-zone banks as a whole would need to raise substantial amounts of additional capital in the medium term. The Sentix consumer confidence index edged stronger to 8.8 from 7.6 the previous month, although the impact was limited.

The data also suggested that the ECB had increased its buying of Euro-zone peripheral bonds during the latest week which will increase fears that underlying stresses are building.

The US pending home sales data was slightly stronger than expected with 4.3% increase for August following a revised 4.5% gain the previous month while factory orders weakened slightly. The data will not have a significant impact on interest rate expectations with markets still expecting further quantitative easing by the Federal Reserve.

The Euro slipped to lows near 1.3650 before finding support with rally attempts later in the US session blocked below 1.3750 as the corrective tone persisted.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The yen was weaker in Asian trading on Monday with underlying capital flows less robust at the beginning of the month with importers buying the US currency. The Bank of Japan was a significant focus with further speculation that the central bank on Tuesday will expand its credit-support packages in an attempt to support bank lending and undermine the yen. There was also speculation over further intervention by the central bank which discouraged yen buying.

The dollar pushed to a high near 83.90, but rallies still attracted selling pressure quickly given the lack of confidence in the US fundamentals and it retreated back to 83.40.

The US currency was unable to make any progress during the US session as it remained dogged by a lack of yield support and an unwillingness to push capital out of Japan. Markets will remain on high alert to see whether the central bank reinforces the monetary policy decision with fresh intervention.

Sterling

Sterling found support on dips to near 1.5750 against the dollar during Monday and had a significantly firmer tone during the European session. The UK currency recovered from four-month lows as the Euro was subjected to wider pressure on the crosses.

The construction PMI data was stronger than expected with an index gain to 53.8 for September from 52.1, halting the series of declines seen over the past few months. The services-sector index will be watched very closely on Tuesday and any slide in the index to below the 50 level would have an important negative impact on the UK currency.

There will also inevitably be caution ahead of Thursday’s Bank of England interest rate decision given some speculation that the quantitative-easing programme could be extended. Sterling consolidated above the 1.58 level against the US dollar.

Swiss franc

The Euro hit resistance above 1.3450 against the franc on Monday and then dipped sharply to lows below 1.33 before finding some support. Despite some relief elsewhere, the dollar remained under pressure against the Swiss currency and weakened to fresh 30-month lows close to 0.97 before finding some degree of support.

There were renewed concerns surrounding the Euro-zone financial sector which helped underpin the franc during the session even though there was speculation that the Swiss commercial banks would need to raise additional capital. Expectations that the National Bank would resist devaluation policies was important in providing background support for the franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

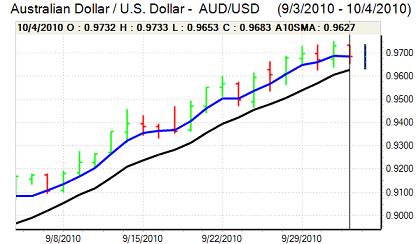

Australian dollar

The Australian dollar tested resistance above 0.97 against the US currency during Monday, but was unable to sustain gains and dipped to test support near 0.9650. There were further concerns surrounding the global economy which hampered the Australian currency.

The Reserve Bank of Australia interest rate decision will be a very important focus and there is likely to be substantial selling pressure on the currency if the bank does not increase rates to 4.75%. It is also the case that the Australian dollar may find it difficult to gain fresh support on an increase given that it has been priced in. Underlying sentiment towards the currency is still likely to be robust which should limit selling pressure.