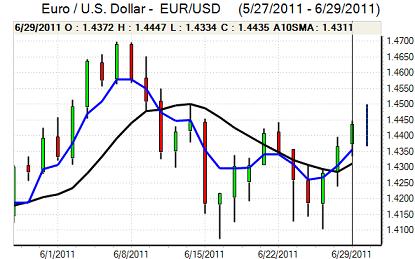

EUR/USD

The Euro moved higher during the European session on Wednesday with markets increasingly confident that the Greek parliament would back the EUR78bn austerity package. From lows in the 1.4350 area, the Euro pushed above 1.44 ahead of the vote.

The austerity plan was approved by 155 votes to 138 with 1 PASOK MP rejecting the plan . The Euro retreated back to the 1.4350 area, but then rallied again strongly as risk appetite improved and there were widespread dollar losses. There were further reports of sovereign Euro buying which continued to underpin the currency, especially with suggestions that China was buying aggressively and there was also evidence of month-end Euro buying.

There will be a second parliamentary vote on Thursday related to the implementation of individual components and approval here will also be needed. Another yes vote is certainly the most likely outcome while rejection would trigger rapid Euro losses. There will still be medium-term doubts whether the package will be implemented in practice, especially as privitisation targets are liable to be unrealistic and there will also be unease within Germany over the prospect of debt roll-overs.

Assuming the package is approved on Thursday, attention will switch to the ECB meeting next week with widespread expectations that the central bank will increase interest rates again and the Euro gained support on yield grounds.

The US pending home sales data was stronger than expected with a 8.2% gain for May which may ease fears over the housing sector to some extent, although it’s a very volatile series. Defensive demand for the dollar continued to decline as risk appetite improved and the Euro tested resistance levels above 1.45 in Asia on Thursday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar failed to break above 81.20 against the yen during Wednesday and came under heavy selling pressure during the US session with a rapid retreat to the 80.55 area and the US currency was unable to regain any momentum.

There were expectations that there would be increased capital outflows from Japan with the launch of new investment funds. There was also a general recovery in risk appetite, but the Japanese currency was generally resilient despite the potential for speculative capital outflows.

The Japanese PMI manufacturing index dipped to 50.7 for June from 51.3 previously which maintained some caution over the industrial sector even though the recent run of data has been broadly favourable. The dollar remained on the defensive in Asia on Thursday.

Sterling

Sterling found support on dips to below 1.60 against the dollar during Wednesday and rallied firmly during the US session and pushed to a high above 1.61 in Asian trading on Thursday. The UK currency gained strong primarily from a weaker US currency. There were reports that the Bundesbank was buying Euros against Sterling and there was also month-end Euro demand as it tested resistance levels above 0.90.

The latest consumer lending and mortgage approvals data was slightly stronger than expected, but there was little evidence of any strong rebound in consumer spending. There was also a renewed deterioration in consumer confidence according to the latest GfK index and overall sentiment towards the economy remained weak with little fundamental support and low yields.

The public-sector strikes will be watched closely in the short term and any escalation in tensions would tend to have a negative impact on the UK currency, although the impact should be measured at this stage.

Swiss franc

The Swiss franc weakened on the crosses in the run-up to the Greek vote on Wednesday as the Euro rallied back to above the 1.20 level. There were fluctuations following the vote before stabilisation in the 1.2050 area. The dollar rallied to the 0.8360 area against the franc before retreating back to near record lows near 0.8310.

Immediate fears surrounding the Euro-zone eased slightly following the Greek vote which curbed defensive demand for the Swiss currency and there was also a wider improvement in risk appetite which dampened demand for the franc with a reversal of recent speculative buying.

There was still an underlying mood of caution surrounding the Euro-zone situation which curbed selling pressure on the franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

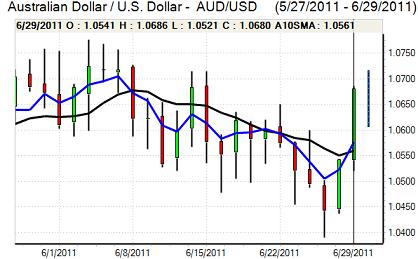

Australian dollar

The Australian dollar rallied to just above 1.06 against the US currency ahead of the Greek vote and after a period of consolidation it rallied strongly with highs close to the 1.0750 area during the Asian session on Thursday. There was also a rally in commodity prices which boosted demand for the Australian currency and there strong gains on the crosses with Sterling at a 26-year low.

Risk appetite improved following the Greek vote which boosted demand for high-yield assets such as the Australian dollar. Domestic influences were limited with the latest private-sector credit growth close to market expectations.