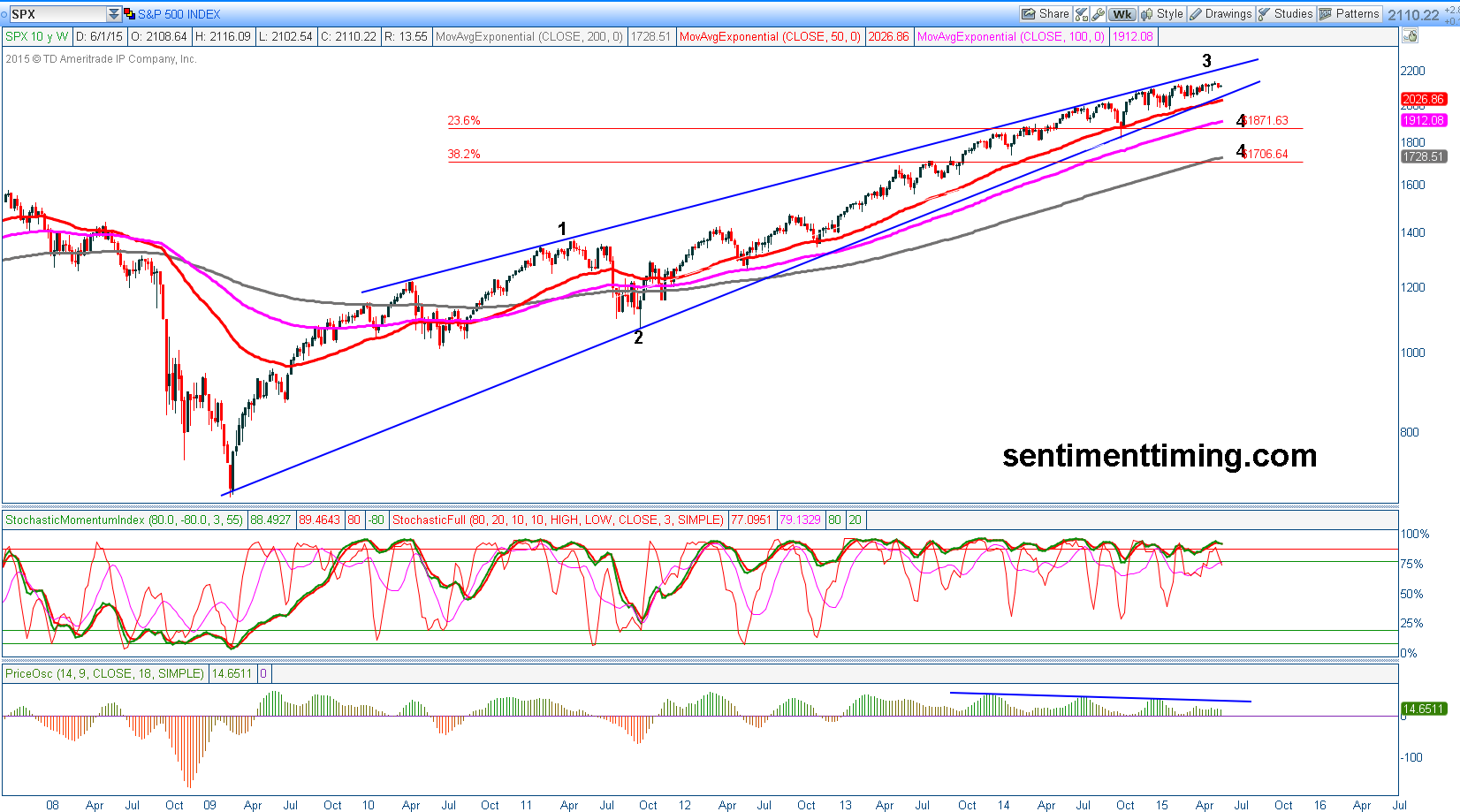

The SPX (SP 500 index) has been trading within a bearish wedge that started at the 2009 lows. The top of the wedge is getting tighter and tighter and eventually, it will break and the waterfall down will start. The Street has taken notice of this extreme bearish pattern, as we have seen each new high over the last 9 months last no more than 2 weeks —and lately, it hasn’t lasted more than 4 days.

But trying to predict the crash is a losing game and by the time it happens (it will happen) most positioning their portfolios for the crash, will be long gone and miss the move. According to Woody Dorsey, who predicted the September 2014 mini crash 1 month before it happened, says another “black hole” drop is coming during the third quarter of 2015. July 1, is the start of the third quarter and between July and September, we will see another big drop down.

On a shorter term view, in the next two weeks, we have another important turn date. Intermediate term investor sentiment is at extreme bullish levels and the pending drop could be important. The “black hole” drop may come after some type of drop starting in June, and ends up being a back test of previous highs that fails. If we see something like that forming, take notice-because wave count wise on a loner term view-is looking for a wave 4 down, that could shed anywhere from 300-450 SPX points when finished and still be in a bullish wave count.