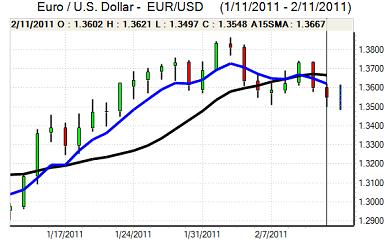

EUR/USD

The Euro was unable to regain the 1.36 level against the dollar on Friday and retreated to re-test important technical support in the 1.35 area before correcting higher in choppy trading conditions. The dollar gained some support on increased tensions surrounding Egypt, but fears eased to some extent late in the US session as President Mubarak resigned.

There were further concerns surrounding the Euro-zone debt situation as Portuguese debt yields remained above the 7.00% level with further speculation that a bailout package would be required soon. There were also further developments surrounding the issue of ECB presidential succession with reports that Bundesbank President Weber was set to resign from his post at the end of April. There will be further uncertainty surrounding the ECB situation which will unsettle the Euro to some extent.

The US trade deficit rose to a three-month high of US$40.6bn for December as exports and imports both continued to rise. Elsewhere, the University of Michigan consumer price index rose to 75.1 for February from a revised 74.2 for January. There will be further optimism surrounding the near-term growth outlook which will help maintain a degree of yield support for the US currency.

The latest IMM speculative data recorded a further increase in net short dollar positions which will maintain the potential for a covering in positions which could provide some degree of dollar support, especially if there is a general rise in risk aversion. The Euro rebounded to the 1.3550 area on Monday, but was struggling to make any strong impression.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar maintained a strong tone on Friday and pushed to a high of 83.60 before retreating back towards 83.30 following the US trade data. Risk appetite conditions will continue to be watched closely and the yen will gain some defensive support if confidence in emerging markets deteriorates.

The latest Japanese data recorded a 0.3% decline in fourth-quarter GDP, the first retreat for five quarters, although this was slightly better than expected. There will still be expectations of a slightly firmer economy which will provide some yen support, although underlying confidence in the fundamental conditions is still likely to be weak.

Capital repatriation will remain a significant focus and exporter selling will also increase if the yen comes under pressure. In these circumstances, the dollar will still find it difficult to gain full advantage from the improved yield support and was blocked below 83.50 on Monday.

Sterling

After testing support below 1.6050 against the dollar on Friday, there was an increase in selling pressure with a test of support below 1.60. There were reports of option-related and stop-loss selling which pushed the currency sharply weaker.

The latest producer prices data was again stronger than expected with input prices registering an annual increase of 13.4% in the year to January. The data will reinforce unease over inflation trends and there will be expectations that the headline inflation rate will rise to at least twice the government’s official 2.0% target when released on Tuesday.

Interest rate expectations will continue to be debated very closely, especially with the very important Bank of England inflation report due on Wednesday. There have been growing market doubts whether Sterling can gain support from higher inflation. Business Secretary Cable commented on Monday that he supported low interest rates as the UK was actually close to deflationary conditions. Sterling did recover back to the 1.6060 area on Monday after finding buying support below 1.60.

Swiss franc

The Euro remained generally resilient against the Franc during Friday and the dollar was able to push to a high around 0.9770 before retreating back to the 0.9725 area in Asian trading on Monday.

The Swiss currency is finding it more difficult to gain safe-haven support as there were no strong franc gains even as speculation over a Portuguese bailout increased. The currency will be hampered by renewed deflation fears following the weaker than expected consumer inflation data last week. Any serious deterioration in wider risk appetite could still trigger defensive capital flight into the currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

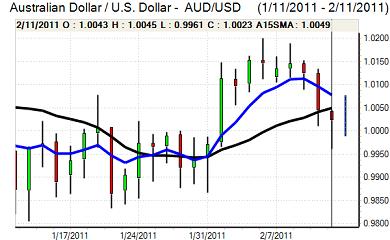

Australian dollar

The Australian dollar found support close to 0.9960 against the US currency during Friday and despite choppy trading conditions, there was a recovery to the 1.0050 area as risk appetite attempted to recover.

The latest Australian data recorded a 2.1% increase in home loans which will provide some support to confidence, but there will still be reservations over the economic outlook, especially with the Reserve Bank looking to keep monetary policy on hold. Uncertainty over China and the wider Asian economy is also likely to increase and any net outflow from emerging markets would tend to limit support for the Australian dollar.