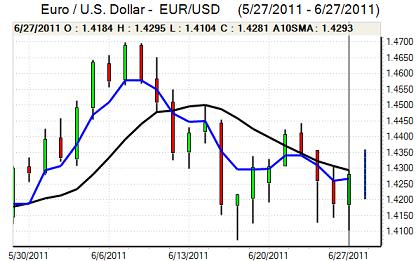

EUR/USD

The Euro found support on dips to the 1.4110 area in European trading on Monday and rallied quickly back to 1.42 as the holding of technical support triggered a covering of short positions. There was also evidence of strong sovereign Euro buying interest.

The Greek situation remained an important focus during the day as tensions remained high ahead of Wednesday’s scheduled austerity vote in parliament. There was also some optimism over the plan to roll-over Greek debt held by French banks. New bonds would be issued and there were also reports that the bonds could be guaranteed by the ESFS which would boost the bonds’ ratings. There was still controversy over the proposals as Euro funds would be used to curb bond-holder losses.

There was still a high degree of uncertainty over the Greek situation, especially with the PASOK party having only a very narrow majority within parliament. There was further strong pressure on the opposition parties to back the deal.

As far as monetary policy is concerned, ECB member Stark stated that the ECB was very vigilant and the bank still appears determined to press ahead with the July interest rate increase. The Euro will, therefore, gain support on yield grounds.

The US data recorded a higher than expected 0.3% core increase in the PCE index and there will be some doubts whether the Fed has got inflation under control. US Treasury yields still remained at low levels which curbed dollar support. The Dallas manufacturing PMI index declined sharply which also maintained fears over the manufacturing sector.

Increased confidence surrounding a voluntary Greek debt rescheduling pushed the Euro to a high above 1.43 before stabilisation.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on dips to just below the 80.60 area on Monday and nudged higher, but it unable to break above the 81 area. Although the latest US inflation data was higher than expected, the US currency was again unsettled by a lack of yield support.

Domestically, the latest retail sales data was stronger than expected with a 1.3% decline in the year to May compared with expectations of 2.5% fall, maintaining the recent evidence of a tentative recovery which should provide some limited yen support.

The yen’s correlation with risk conditions has tended to ease slightly over the past few days, but demand for the currency will still tend to decline if there is a sustained recovery in risk appetite.

Sterling

Sterling again found support in the 1.5915 area against the dollar during the European session on Monday. There were reports of option barriers towards the 1.59 level and there were also reported corporate dividend payments which had some positive impact. The UK currency rallied to a high just above 1.60, but failed to break resistance levels in choppy trading conditions.

There was little sign of any improvement in underlying sentiment as markets continued to fret over demand trends within the economy and there were further expectations that the Bank of England would maintain interest rates at extremely low levels. MPC member Posen, who has maintained a consistently dovish tone throughout the past year stated that it would be a nonsense to consider raising interest rates.

Bank of England evidence on the inflation report will be watched closely on Tuesday and Sterling will be vulnerable to renewed selling pressure if there are further concerns over the banking sector.

Swiss franc

The dollar found support close to 0.8320 against the franc on Monday and rallied to a peak above 0.8380 area, but it was unable to make any impression on resistance levels. The Euro found support close to the 1.1820 level against the Swiss currency and rallied to the 1.1950 area.

Euro-zone tensions continued to have an important impact during the day and some optimism surrounding a rollover of Greek debts lessened immediate demand for the franc as trading conditions remained choppy.

There will be further uncertainty over the next 24 hours with a reluctance to maintain speculative positions.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

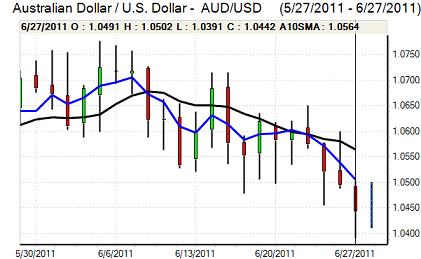

Australian dollar

The Australian dollar was subjected to renewed selling pressure in early US trading on Monday with a test of support of support below 1.04 against the US dollar for the first time in over two months.

Commodity prices remained under pressure which curbed demand for the Australian dollar and there was a further easing of domestic interest rate expectations.

There was further speculation that China would be less willing to interest rates and this provided some degree of support for the Australian dollar, although caution still tended to prevail.