By FXEmpire.com

The USD/CAD pair fell rapidly on Tuesday as the Canadian dollar made massive gains for the session. The Bank of Canada came out with a semi-bullish monetary policy report for the month of January. The report suggested that the Europeans would emerge from recession in the second half of 2012, and the US would grow a bit stronger as well. Because of this, they expected the energy sector to do quite well over time.

The pair will often trade based upon the outlook for the US economy, seeing the Loonie appreciate when things are going well in America. This is mainly because of the fact that 80% of Canadian exports end up in the United States. It is a pair that serves as a barometer for the idea of a robust economy in America, and by extension the world.

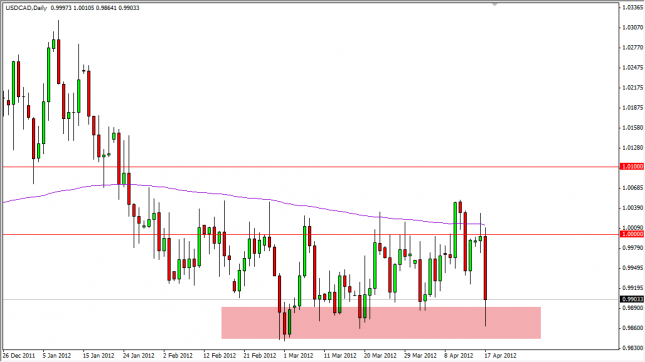

However, as the pair fell apart during the Tuesday session, the bottom of the massive consolidation area has held again, and the pair bounced from the lows. The 0.9850 level has been strong lately, and it is worth noting that the pair managed to stop right at the bottom of that rectangle. With this being said, the pair is bearish, but is well supported at this area.

The bounce can be bought on supportive candles, even on a shorter timeframe chart. Four hour and even hourly charts can be beneficial to the timing of the trade. However, the parity level looks as if it is far too resistive to be broken to the upside for any real length of time. The 200 day EMA is just above that area, and as a result we think that it will continue to push the prices down in this market. The candle from the session on Tuesday is very long, but gave up0 quite a bit on the bounce late in the session.

However, the 0.9850 level now becomes more interesting. If the market falls below the 0.98 level, we could see a real move lower. However, as the bottom of the consolidation level has held so well over time, we believe the more likely scenario is a return to parity on the bounce and continuation of consolidation in this pair.

USD/CAD Forecast April 18, 2012, Technical Analysis

Originally posted here