By FXEmpire.com

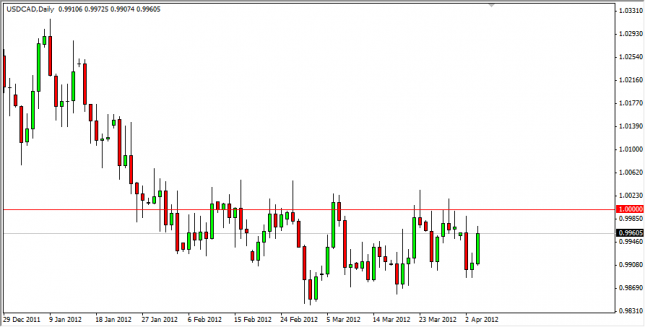

The USD/CAD pair rose during the session on Wednesday as the oil markets fell. The oil markets have been slamming this pair around over time, and this should continue to be the case. The pair has also been heavily influenced by the parity level, as that area has held prices lower for some time now.

The 200 day EMA is just above it, and now it looks as if the trend traders could be entering the fray as sellers as well. The current attitude of the market is sideways, and this is common with the USD/CAD pair. With this in mind, we are selling at the parity level, and covering our shorts 75 pips lower.

USD/CAD Forecast April 5, 2012, Technical Analysis

Originally posted here