By FXEmpire.com

USD/CAD Fundamental Analysis April 18, 2012, Forecast

Analysis and Recommendations:

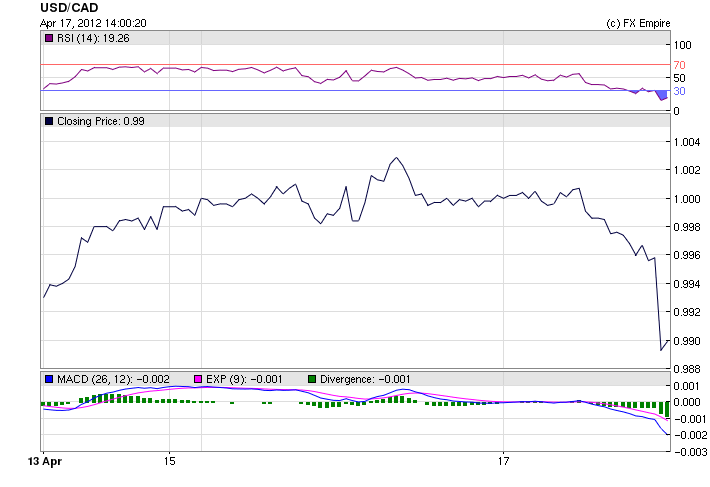

The USD/CAD is trading at 0.9869 falling from the high of 1.0011 on news from the BoC.

The Bank of Canada announced Tuesday that it will keep its benchmark interest rate unchanged at 1%. The overnight lending rate has been kept at this level since September 2010. The bank said Canadian economic momentum is “slightly firmer”

Although U.S. builders start work on new homes at a sharply slower March pace, construction permits jump to their highest level in 3 1/2 years, data showed. Builders began construction on new U.S. homes at a slower pace in March, but permits jumped to the highest level since September 2008, the Commerce Department reported Tuesday. Housing starts fell 5.8% last month to an annual rate of 654,000.

Industrial production was unchanged for the second month running in March, the Federal Reserve said. Economists had forecast a 0.3% gain. While utilities output gained 1.5%, manufacturing output slipped 0.2%

The surprise today, came from the White House, the Obama administration proposed new measures Tuesday to limit speculation in the oil markets, seeking to draw a contrast with Republicans who have been calling for more domestic drilling during a time of near record gasoline prices.

Economic Reports April 17, 2012 actual v. forecast

|

Apr. 17 |

AUD |

Monetary Policy Meeting Minutes |

||

|

JPY |

Industrial Production (MoM) |

-1.6% |

-1.2% |

-1.2% |

|

INR |

Indian Interest Rate Decision |

8.00% |

8.30% |

8.50% |

|

GBP |

Core CPI (YoY) |

2.5% |

2.4% |

2.4% |

|

GBP |

CPI (YoY) |

3.5% |

3.5% |

3.4% |

|

GBP |

CPI (MoM) |

0.3% |

0.3% |

0.6% |

|

EUR |

CPI (YoY) |

2.7% |

2.6% |

2.6% |

|

EUR |

German ZEW Economic Sentiment |

23.4 |

20.0 |

22.3 |

|

EUR |

ZEW Economic Sentiment |

13.1 |

10.7 |

11.0 |

|

EUR |

Core CPI (YoY) |

1.6% |

1.5% |

|

|

USD |

Building Permits |

0.747M |

0.710M |

0.715M |

|

USD |

Housing Starts |

0.654M |

0.705M |

0.694M |

|

CAD |

Manufacturing Sales (MoM) |

-0.30% |

-1.00% |

-1.30% |

|

EUR |

ECB President Draghi Speaks |

|||

|

CAD |

Interest Rate Decision |

1.00% |

1.00% |

1.00% |

|

USD |

Industrial Production (MoM) |

0.0% |

0.3% |

0.0% |

Economic Events scheduled for April 18, 2012 that affect the Canadian and American Markets

14:30:00 CAD Bank of Canada Monetary Policy Report

The Bank of Canada publishes a study of economic movements in Canada. It indicates a sign of new fiscal policy. Any changes in this report tend to affect the CAD volatility. If the BoC report shows a hawkish outlook, that is seen as positive (or bullish) for the CAD, while a dovish outlook is seen as negative (or bearish).

Government Bond Auctions (this week)

Apr 18 09:10 Sweden Nominal bond auction

Apr 18 09:30 Germany Eur 5.0bn 0.25% Mar 2014 Schatz

Apr 18 14:30 Sweden Details T-bill auction on Apr 25

Apr 19 08:30 Spain Obligacion auction

Apr 19 08:50 France BTAN auction

Apr 19 09:30 UK Auctions 0.125% I/L Gilt 2029

Apr 19 09:50 France OATi auction

Originally posted here