By FXEmpire.com

USD/CAD Fundamental Analysis April 23, 2012, Forecast

Analysis and Recommendations:

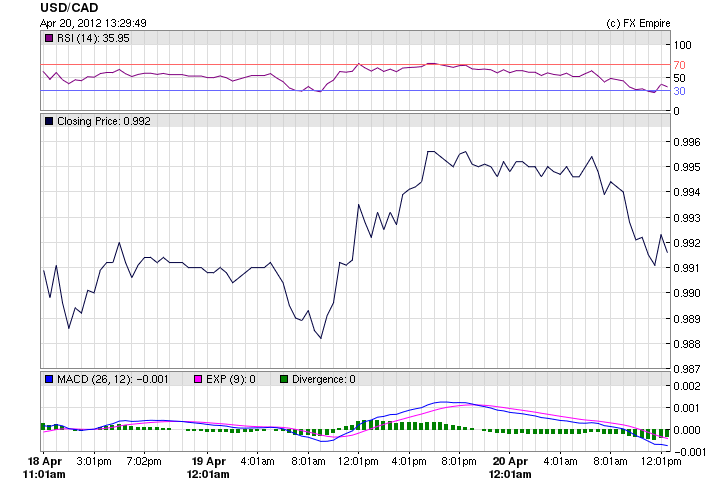

The USD/CAD is trading at 0.9905 down since yesterday. The USD was trading over 1.0014 earlier in the week. Earlier this week the BoC held rates and gave a flat assessment of the Canadian economy. With the huge increase in crude oil prices today, there should be some strength to the Looney, but there was little to no response. Canada saw some mixed eco data today

Consumer price inflation in Canada rose less-than-expected last month, official data showed on Friday. In a report, Statistics Canada said that Canadian consumer price inflation rose to a seasonally adjusted 0.4%, from 0.4% in the preceding month. Analysts had expected Canadian consumer price inflation to rise 1.0% last month.

Several economic releases were negative for the CAD today, disappointing the markets was a CPI coming in under forecast along with the monthly leading indicators report at 0.4% opposed to forecast of 1.0%

In the US, rising layoffs, falling home sales and slowing manufacturing activity are sparking fears that the economic recovery is headed for a springtime stall for the third year in a row has investors questioning the overall health of the US economy.

Economic Data for April 20, 2012 actual v. forecast

|

JPY |

Tertiary Industry Activity Index (MoM) |

0.0% |

0.8% |

-0.6% |

|

AUD |

Import Price Index (QoQ) |

-1.2% |

-1.0% |

2.5% |

|

EUR |

German PPI (MoM) |

0.6% |

0.4% |

0.4% |

|

EUR |

German PPI (YoY) |

3.3% |

3.1% |

3.2% |

|

EUR |

German Ifo Business Climate Index |

109.9 |

109.5 |

109.8 |

|

EUR |

German Current Assessment |

117.5 |

117.0 |

117.4 |

|

EUR |

German Business Expectations |

102.7 |

102.5 |

102.7 |

|

GBP |

Retail Sales (MoM) |

1.8% |

0.5% |

-0.8% |

|

GBP |

Retail Sales (YoY) |

3.3% |

1.4% |

1.0% |

|

CAD |

Core CPI (MoM) |

0.3% |

0.4% |

|

|

CAD |

CPI (MoM) |

0.4% |

1.0% |

0.4% |

|

CAD |

Leading Indicators (MoM) |

0.4% |

1.0% |

0.7% |

|

CAD |

CPI (YoY) |

1.9% |

2.0% |

2.6% |

|

MXN |

Mexican Unemployment Rate |

4.6% |

4.9% |

5.3% |

Economic Events scheduled for April 23, 2012 that affect the Canadian and American Markets

As we move to the latter half of the middle of the month, there are no eco releases scheduled on Monday in the US or Canada. It should make for a quiet day.

Government Bond Auctions (this week)

Apr 23-27 n/a UK Re-opened 3.75% 2052 Conventional Gilt syndication (further details tba)

Apr 23 09:30 Germany Eur 3.0bn new Apr 2013 (12M) Bubill

Apr 23 10:00 Belgium OLO Auction cancelled

Apr 23 15:30 Italy Details BTP/CCTeu on Apr 27

Apr 24 00:30 Japan Auctions 20Y JGBs

Apr 24 08:30 Holland Eur 1.5-2.5bn Jul 2014 & Jan 2037 DSL auction

Apr 24 08:30 Spain 3 & 6M T-bill auction

Apr 24 09:10 Italy Auctions CTZ/BTPei

Apr 24 14:30 UK Details Conventional Gilt auction on May 01 & I/L auction on May 03

Apr 24 17:00 US Auctions 2Y Notes

Apr 25 09:10 Sweden Auctions T-bills

Apr 25 09:30 Germany Eur 3.0bn new Jul 2044 Bund

Apr 25 14:30 Sweden Details nominal bond auction on May 02

Apr 25 17:00 US Auctions 5Y Notes

Apr 26 00:30 Japan Auctions 2Y JGBs

Click here to read USD/CAD Technical Analysis.

Originally posted here