By FXEmpire.com

USD/CAD Fundamental Analysis April 5, 2012, Forecast

Analysis and Recommendations:

REMEMBER, MOST GLOBAL MARKETS ARE CLOSED ON FRIDAY APRIL 6, 2012 AND MANY ARE CLOSED ON MONDAY APRIL 9, 2012 ALSO. VOLUME WILL BE LIGHT AND TRADERS WILL BE POSITIONING THEMSELVES FOR THE LONG HOLIDAY WEEKEND. ECONOMIC REPORTS WILL CONTINUE TO BE RELEASED ON FRIDAY, IN THE US THE NON FARMS PAYROLL REPORTS WILL BE ISSUED ON FRIDAY

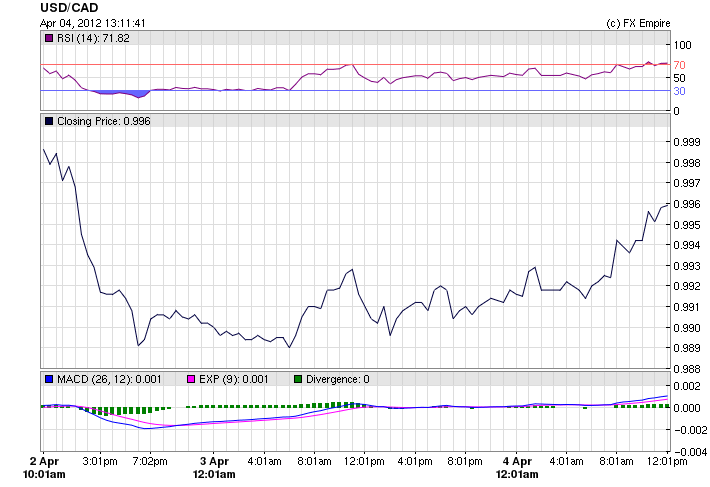

The USD/CAD is trading at 0.9951 as the greenback gathered strength from the FOMC minutes. There has been little in the way of support for the CAD until Thursday with slew of economic data is scheduled to be released.

The USD was further supported a labor market report showing improvement at a moderate pace, with private payrolls in March notching more than two years of gains, according to a monthly report released Wednesday by payrolls-processor Automatic Data Processing Inc.

Despite the moderate pace of the recovery, there were many reasons to be optimistic about the outlook, Treasury Secretary Timothy Geithner said Wednesday. In a speech to The Economic Club of Chicago, Geithner said that the economy was “making a lot of progress” working down excess debt. Household debt is down 17 percentage points relative to income since before the crisis, Geithner said. At the same time, financial sector leverage is down “substantially” and credit is expanding, he said. The challenge facing the American economy is not primarily about the health of the business community.

The number of mortgage applications filed in the U.S. last week rose 4.8% from the prior week, the Mortgage Bankers Association said Wednesday, as re-financings picked up following six straight weeks of declines

Economic Events April 4, 2012 actual v. forecast

|

AUD |

Trade Balance |

-0.48B |

1.00B |

-0.97B |

|

GBP |

Halifax House Price Index (MoM) |

2.2% |

-0.3% |

-0.4% |

|

GBP |

Services PMI |

55.3 |

53.5 |

53.8 |

|

EUR |

Retail Sales (MoM) |

-0.1% |

0.1% |

1.1% |

|

EUR |

German Factory Orders (MoM) |

0.3% |

1.2% |

-1.8% |

|

PLN |

Polish Interest Rate Decision |

4.50% |

4.50% |

4.50% |

|

EUR |

Interest Rate Decision |

1.00% |

1.00% |

1.00% |

|

USD |

Treasury Secretary Geithner Speaks |

|||

|

RUB |

Russian CPI (MoM) |

0.6% |

0.5% |

0.4% |

|

USD |

ADP Nonfarm Employment Change |

209K |

200K |

230K |

|

EUR |

ECB Press Conference |

|||

|

USD |

ISM Non-Manufacturing Index |

56.0 |

57.0 |

57.3 |

Economic Events scheduled for April 5, 2012 that affect the Canadian Dollar

13:30 CAD Building Permits (MoM) 3.0% -12.3%

Building Permits measures the change in the number of new building permits issued by the government. Building permits are a key indicator of demand in the housing market.

13:30 CAD Employment Change 10.0K -2.8K

Employment Change measures the change in the number of people employed. Job creation is an important indicator of consumer spending.

13:30 CAD Unemployment Rate 8.0% 7.4%

The Unemployment Rate measures the percentage of the total work force that is unemployed and actively seeking employment during the previous month.

13:30 USD Initial Jobless Claims 355K 359K

13:30 USD Continuing Jobless Claims 3350K 3340K

Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data, but the market impact varies from week to week. Continuing Jobless Claims measures the number of unemployed individuals who qualify for benefits under unemployment insurance. Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data, but the market impact varies from week to week.

15:00 CAD Ivey PMI 66.0 66.5

The Ivey Purchasing Managers’ Index (PMI) measures the activity level of purchasing managers in Canada. A reading above 50 indicates expansion; a reading below 50 indicates contraction. The index is a joint project of the Purchasing Management Association of Canada and the Richard Ivey School of Business. Traders watch these surveys closely as purchasing managers usually have early access to data about their company’s performance, which can be a leading indicator of overall economic performance.

Originally posted here