By FX Empire.com

USD/CAD Fundamental Analysis March 13, 2012, Forecast

Analysis and Recommendations:

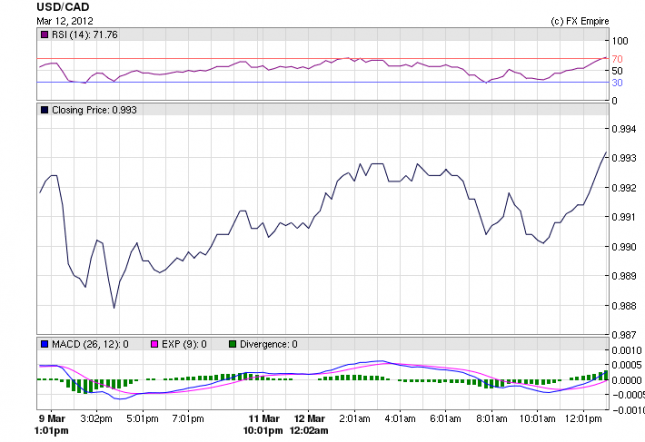

The USD/CAD is trading today at 0.9934 after opening at 0.9910. The USD has shown some strength here, but very little. There is little in the way of economic news in Canada or the US to move this pair today. The anticipation is the FOMC on Tuesday. Oil and Gold have dropped today, which has an overall effect on the CAD. The pair is no expected to do much until the FOMC statement and there is not much expected in the statement. It should be fairly quiet couple of days here, with low volume and little excitement.

March 12, 2012 Economic Releases actual v. forecast

|

Mar. 12 |

00:50 |

JPY |

CGPI (YoY) |

0.6% |

0.6% |

0.5% |

|

00:50 |

JPY |

Core Machinery Orders (MoM) |

3.4% |

2.3% |

-7.1% |

|

|

05:01 |

MYR |

Malaysian Industrial Production (YoY) |

0.2% |

4.1% |

2.9% |

|

|

06:00 |

JPY |

Household Confidence |

39.5 |

40.6 |

40.0 |

|

|

06:30 |

INR |

Indian Industrial Production (YoY) |

6.8% |

2.1% |

2.5% |

|

|

08:00 |

EUR |

German WPI (MoM) |

1.0% |

1.1% |

1.2% |

|

|

10:00 |

EUR |

Italian GDP (QoQ) |

-0.7% |

-0.7% |

-0.7% |

|

|

11:30 |

EUR |

German 6-Month Bubill Auction |

0.053% |

0.076% |

Scheduled Economic Events for March 13, 2012

US

13:30 USD Core Retail Sales (MoM) 0.8% 0.7%

13:30 USD Retail Sales (MoM) 1.0% 0.4%

(Core and ) Retail Sales measures the change in the total value of sales at the retail level in the U.S., excluding automobiles. It is an important indicator of consumer spending and is also considered as a pace indicator for the U.S. economy.

19:15 USD Interest Rate Decision 0.25% 0.25%

19:15 USD FOMC Statement

Federal Open Market Committee (FOMC) members vote on where to set the rate. Traders watch interest rate changes closely as short term interest rates are the primary factor in currency valuation. Along with the Decision the U.S. Federal Reserve’s Federal Open Market Committee (FOMC) statement is the primary tool the panel uses to communicate with investors about monetary policy. It contains the outcome of the vote on interest rates, discusses the economic outlook and offers clues on the outcome of future votes.

Government Bond Auction Schedule (this week)

Mar 13 09:30 Netherlands Eur 2.5bn-3.5bn re-opened Apr 2015 DSL

Mar 13 10:10 Italy BOT auction

Mar 13 10:30 Belgium Auctions 3 & 12M T-bills

Mar 13 15:30 UK Details gilt auction on Mar 22

Mar 13 18:00 US Auctions 10Y Notes

Mar 14 10:10 Italy BTP/CCTeu auction

Mar 14 10:10 Sweden Auctions T-bills

Mar 14 10:30 Swiss Bond auction

Mar 14 15:30 Sweden Details nominal bond exchange auction on Mar 21

Mar 14 18:00 US Auctions 30Y Bonds

Mar 15 09:30 Spain Obligacion auction

Mar 15 09:50 France BTAN auction

Mar 15 10.30 UK Auctions 4.5% 2042 conventional Gilt

Mar 15 10:50 France OATi auction

Mar 15 16:00 US Announces auction of 10Y TIPS on Mar 22

Originally posted here