By FXEmpire.com

USD/CAD Fundamental Analysis March 20, 2012, Forecast

Analysis and Recommendations:

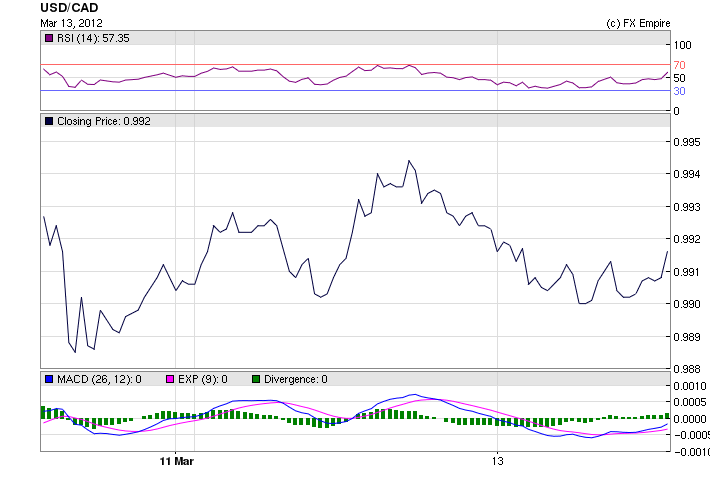

The USD/CAD is trading down following the common trend today. The pair have fallen in early trading dropping to 0.9869 from the opening at 0.9912. The USD has just lost steam around the world today, it began in late day trading on Friday as confident investors began to move into more risk securities and equities.

There has been little in the way of economic data, with Canadian Wholesale Prices coming in below forecast, and in the US, confidence by builders of new single-family homes remained unchanged in March. Sentiment for builders of new single-family homes stayed at the highest level in close to five years.

Improvements in U.S. job market trends and an upward revision in income growth are important factors that could help the housing market turn a corner, though rising gasoline prices may pose a hurdle, according to mortgage company Fannie Mae (FNMA).

This should be a quiet week for the duo, with little information or market news expected. Although with two housing reports due on Tuesday, strong data might give a push to the greenback.

Economic Data for March 19, 2012 actual v. forecast

|

GBP |

Rightmove House Price Index (MoM) |

1.6% |

4.1% |

|

|

AUD |

RBA Governor Stevens Speaks |

|||

|

EUR |

Current Account |

4.5B |

4.3B |

3.4B |

|

EUR |

Italian Industrial New Orders (MoM) |

-7.4% |

-3.8% |

5.2% |

|

CLP |

Chilean GDP (YoY) |

4.5% |

4.2% |

3.7% |

|

CAD |

Wholesale Sales (MoM) |

-1.0% |

0.4% |

1.0% |

|

USD |

NAHB Housing Market Index |

28 |

30 |

28 |

|

USD |

3-Month Bill Auction |

0.095% |

0.095% |

Economic Events Scheduled for March 20, 2012 Europe and Americas

09:15 CHF Industrial Production (QoQ)

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

10:30 GBP Core CPI (YoY)

10:30 GBP CPI (YoY)

The Core Consumer Price Index (CPI) measures the changes in the price of goods and services, excluding food and energy. The CPI measures price change from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

12:00 GBP CBI Industrial Trends Orders

The Confederation of British Industry (CBI) Industrial Trends Orders measures the economic expectations of the manufacturing executives in the U.K. It is a leading indicator of business conditions. A level above zero indicates order volume is expected to increase; a level below zero indicates expectations are for lower volumes. The reading is compiled from a survey of about 550 manufacturers.

13:30 USD Building Permits

Building Permits measures the change in the number of new building permits issued by the government. Building permits are a key indicator of demand in the housing market.

13:30 USD Housing Starts

Housing starts measures the change in the annualized number of new residential buildings that began construction during the reported month. It is a leading indicator of strength in the housing sector.

Government Bond Auctions (this week)

Mar 21 10:10 Sweden Nominal bond auction

Mar 21 10:30 Germany Eur 5.0bn Mar 2014 Schatz

Mar 21 10:30 Portugal Eur 0.75-1.0bn 4 & 6M T-bills

Mar 22 10:10 Sweden I/L bond auction

Mar 22 10.30 UK Auctions 0.625% 2042 I/L Gilt

Mar 22 15:00 US

Announces auctions of 2Y Notes on Mar 27, 5Y Notes on Mar

28 & 7Y Notes on Mar 29

Originally posted here