By FX Empire.com

USD/CAD Fundamental Analysis March 7, 2012, Forecast

Analysis and Recommendations:

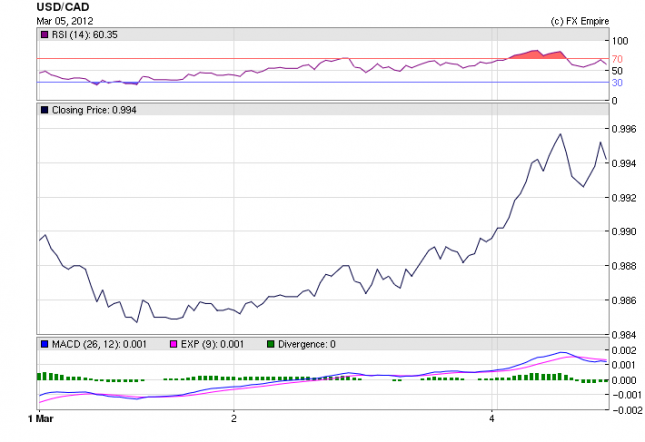

The USD/CAD is swapping at 1.0015 as the greenback gained strength on weakness in Europe. The Canadian PMI released this Tuesday afternoon surprised economists coming in well above forecast, but not enough to push the CAD over the USD. The USD was supported by worries throughout the eurozone over an overall downturn in the economy and investors were spooked as the deadline for the Greek PSI bond swap grew near, rumors were flying everywhere, all turning out to be false but still worrisome to investors.

Major Greek bondholders announced their support for a deal that will deeply cut the value of their holdings as their contribution to keeping the country afloat. The steering committee of creditors, which includes 12 major investors in Greek bonds and was involved in drawing up last month’s landmark deal, said it would accept the bond swap offer.

EU’s Rehn: Eurozone Currently in a Mild Recession but Signs of Improvement but, risk of credit crunch in European economy has been prevented largely due to long-term liquidity offer of ECB. The Commission supports combining remaining resources of EFSF with ESM to make sturdier European firewall.

Eurozone GDP tallied at forecast. Nothing worth noting in today’s release.

March 6, 2012 Economic Releases actual v. forecast

|

AUD |

Current Account |

-8.4B |

-8.0B |

-5.8B |

|

AUD |

Interest Rate Decision |

4.25% |

4.25% |

4.25% |

|

GBP |

Halifax House Price Index (MoM) |

-0.5% |

0.3% |

0.6% |

|

EUR |

GDP (QoQ) |

-0.3% |

-0.3% |

-0.3% |

|

CAD |

Ivey PMI |

66.5 |

62.1 |

64.1 |

Scheduled Economic Events for March 7, 2012 (GMT)

13:15 USD ADP Nonfarm Employment 205K 170K

13:30 USD Nonfarm Productivity (QoQ) 0.8% 0.7%

13:30 USD Unit Labor Costs (QoQ) 1.2% 1.2%

The ADP National Employment Report is a measure of the monthly change in non-farm, private employment, based on the payroll data of approximately 400,000 U.S. business clients. The release, two days ahead of government data, is a good predictor of the government’s non-farm payroll report. The change in this indicator can be very volatile.

Nonfarm Productivity measures the annualized change in labor efficiency when producing goods and services, excluding the farming industry. Productivity and labor-related inflation are directly linked-a drop in a worker’s productivity is equivalent to a rise in their wage.

Unit Labor Costs measure the annualized change in the price businesses pay for labor, excluding the farming industry. It is a leading indicator of consumer inflation.

Sovereign Bond Auction Schedule

Mar 07 10:10 Sweden Nominal bond auction

Mar 07 10:30 Germany Eur 4.0bn Feb 2017 Bobl

Mar 07 10.30 UK Auctions new Sep 2017 conventional Gilt

Mar 08 16:00 US Announces auctions of 3Y Notes on Mar 12, 10Y Notes on Mar 13 & 30Y Bonds on Mar 14

Mar 08 16:30 Italy Details BOT auction on Mar 13

Mar 09 11:00 Belgium OLO mini bond auction

Mar 09 16:30 Italy Details BTP/CCTeu on Mar 14

Originally posted here