By FXEmpire.com

USD/CAD Weekly Fundamental Analysis April 16-20, 2012, Forecast

Introduction: The Canadian Dollar moves in reaction to the US Dollar. Movements are small and easy to track and trade. The Canadian Dollar also responds to economic reports within Canada. It has little action against foreign currencies except during major moves or crisis.

The USD/CAD is the single biggest beneficiary of rising oil prices. Canada which is already the biggest exporter of oil to the US will experience a boost to its economy when oil price continue to increase. Therefore, if oil rises the Canadian dollar is likely to follow. Over the past years, the correlation between the Canadian dollar and oil prices has been approximately 81%.

Analysis and Recommendation:

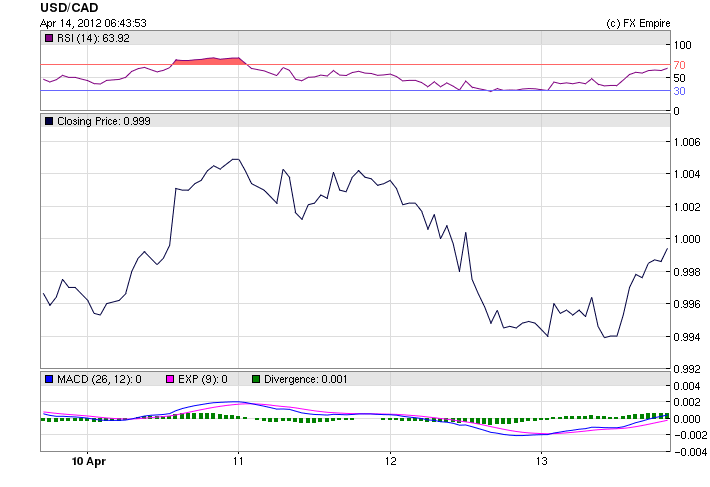

The USD/CAD closed the week at 0.9996 as the greenback picked up momentum as investors moved back to the safety of the USD after worries about Spain continued to surface. Friday also held disappointing news from China and the US.

|

Date |

Open |

High |

Low |

Change % |

|

|

04/13/2012 |

0.9996 |

0.9947 |

0.9996 |

0.9927 |

0.49% |

|

04/12/2012 |

0.9948 |

1.0033 |

1.0037 |

0.9941 |

-0.85% |

|

04/11/2012 |

1.0034 |

1.0049 |

1.0052 |

1.0009 |

-0.15% |

|

04/10/2012 |

1.0049 |

0.9968 |

1.0050 |

0.9951 |

0.81% |

|

04/09/2012 |

0.9968 |

0.9970 |

1.0002 |

0.9958 |

-0.02% |

This could be a big week for Canada with possible implications for the currency and the Canada curve. The Bank of Canada is widely expected to leave its key policy rate on hold in Tuesday’s rate statement, but it’s long anticipated Monetary Policy Report will shed additional light upon outstanding issues that remain to be addressed since the January MPR that was released prior to upward revisions to Q3 GDP growth and before we received Q4 GDP.

After the Bank of Canada statement, Canadian data risk will be primarily focused upon the March CPI report. February’s print showed accelerating headline inflation to 2.6% y/y but it isn’t clear whether this reverses a general downward trend in inflation from the 3.7% peak of last May that the Bank of Canada saw through. The Bank of Canada uses core CPI as its operational guide while targeting headline CPI under the belief that the two measures converge upon one another over time but that headline is the more volatile of the two. Thus, a general upward trend in core CPI to 2.3% is disconcerting, but is keyed off very weak year-ago base effects. Going forward, we think the resetting of this base effect will lead to a flattening out in core and headline inflation.

On the heels of disappointingly weak export figures, additional data risk could emanate from manufacturing shipments during February following the drop in the dollar value and volume of shipments in January that played a role in driving weak GDP growth of only 0.1% in January

Historical:

Highest: 1.0842 CAD on 01 Nov 2009.

Average: 1.0147 CAD over this period.

Lowest: 0.9435 CAD on 26 Jul 2011.

Economic Highlights of the coming week that affect the Canadian Dollar

|

Apr. 16 |

13:30 |

CAD |

Foreign Securities Purchases |

-4.19B |

|

Apr. 17 |

13:30 |

CAD |

Manufacturing Sales (MoM) |

-0.90% |

|

14:00 |

CAD |

Interest Rate Decision |

1.00% |

|

|

Apr. 20 |

12:00 |

CAD |

Core CPI (MoM) |

0.4% |

|

12:00 |

CAD |

CPI (MoM) |

0.4% |

|

|

13:30 |

CAD |

Leading Indicators (MoM) |

0.6% |

Economic Highlights of the coming week that affect the US Dollar

|

Apr. 16 |

13:30 |

USD |

Core Retail Sales (MoM) |

0.6% |

0.9% |

|

13:30 |

USD |

Retail Sales (MoM) |

0.4% |

1.1% |

|

|

13:30 |

USD |

NY Empire State Manufacturing Index |

21.1 |

20.2 |

|

|

14:00 |

USD |

TIC Net Long-Term Transactions |

101.0B |

||

|

Apr. 17 |

13:30 |

USD |

Building Permits |

0.71M |

0.71M |

|

13:30 |

USD |

Housing Starts |

0.70M |

0.70M |

|

|

14:15 |

USD |

Industrial Production (MoM) |

0.5% |

Originally posted here