By FXEmpire.com

USD/CAD Weekly Fundamental Analysis April 23-27, 2012, Forecast

Introduction: The Canadian Dollar moves in reaction to the US Dollar. Movements are small and easy to track and trade. The Canadian Dollar also responds to economic reports within Canada. It has little action against foreign currencies except during major moves or crisis.

The USD/CAD is the single biggest beneficiary of rising oil prices. Canada which is already the biggest exporter of oil to the US will experience a boost to its economy when oil price continue to increase. Therefore, if oil rises the Canadian dollar is likely to follow. Over the past years, the correlation between the Canadian dollar and oil prices has been approximately 81%.

Analysis and Recommendation:

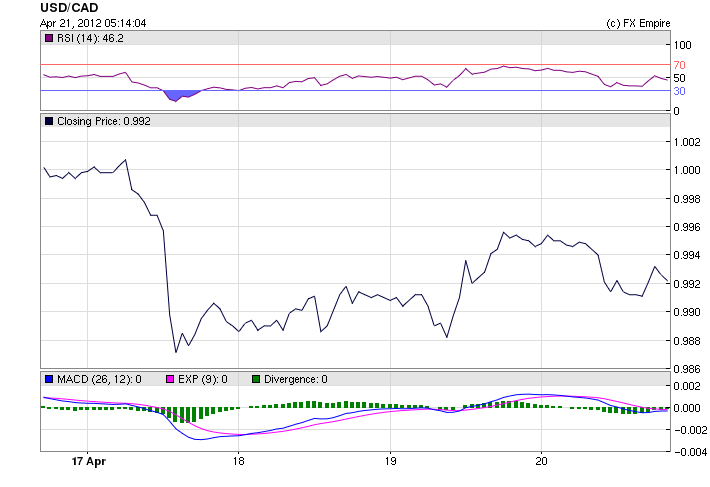

The USD/CAD is trading at 0.9922, the week started off with the USD as high as 1.0033.

As the weekends, worries over Euro Zone debt and economic growth in the US and China continue to grip commodities and were seen trading in a very tight range waiting for fresh cues for further directional moves. In a lackluster trading, spot gold held steady. Base metals in LME traded mostly flat as investors remained cautious after weak economic indicators from the U.S. Though, successful French and Spanish bond auction allayed concerns over Euro Zone’s deteriorating financial health to some extent. Unexpected rise in German business climate assessed by Ifo lifted the sentiments too. LME copper managed to hang above $8000 a ton. In tandem with the international market, movements in MCX base metal complex and bullions were dreary. Crude oil rose for the first time in three days supported by positive German data. Meanwhile, G-20 finance ministers and central bankers are to meet in Washington later today. The Indian rupee was seen bouncing off a 3-month low it hit during previous session at 52.11 up 0.17 percent

Market emotions remained rather subdued in the wake of persistent debt concerns in the Euro region in spite of a strong German business sentiment. Looking into the evening, no major economic data is slated for release. The ongoing G-20 finance minister’s meet in Washington would be the key event markets would be looking up to take cues from. With Chinese economy going through a lean patch, possible Chinese Central bank liquidity action in the coming days could be a marquee event and have a real impact on the commodities.

Overall, the week has witnessed Euro zone debt crisis scaling up with yields on Spanish and Italian bonds reaching unacceptable levels, which prompted Greece, Ireland and Portugal to ask for bailout.

Consumer price inflation in Canada rose less-than-expected last month, official data showed on Friday. In a report, Statistics Canada said that Canadian consumer price inflation rose to a seasonally adjusted 0.4%, from 0.4% in the preceding month. Analysts had expected Canadian consumer price inflation to rise 1.0% last month.

The Bank of Canada announced Tuesday that it will keep its benchmark interest rate unchanged at 1%. The overnight lending rate has been kept at this level since September 2010. The bank said Canadian economic momentum is “slightly firmer”

The number of Americans who filed requests for jobless benefits totaled 386,000 last week, keeping claims at a four-month high, the U.S. Labor Department said Thursday. Claims from two weeks ago were revised up to 388,000 from an initial reading of 380,000. Economists had projected claims would drop to a seasonally adjusted 374,000 in the week ended April 14, so the number is likely to disappoint investors. The average of new claims over the past four weeks, meanwhile, rose by 5,500 to 374,750, the highest level since late January. Continuing claims increased by 26,000 to a seasonally adjusted 3.3 million in the week ended April 7, the Labor Department said.

Sales of existing homes fell 2.6% in March, the second monthly drop though the sales pace in the first quarter was the best in five years, according to data released Thursday. The National Association of Realtors said.

A gradual improvement in U.S. economic growth is expected past the summer, the Conference Board said Thursday as it reported that its index of leading economic indicators increased 0.3% in March, led by the interest rate spread.

Construction employment should continue to stabilize as those workers finishing jobs have opportunities for new ones Although U.S. builders start work on new homes at a sharply slower March pace, construction permits jump to their highest level in 3 1/2 years, data showed. Builders began construction on new U.S. homes at a slower pace in March, but permits jumped to the highest level since September 2008, the Commerce Department reported Tuesday. Housing starts fell 5.8% last month to an annual rate of 654,000.

Major Economic Events for the past week actual v. forecast

|

USD |

Retail Sales (MoM) |

0.8% |

0.3% |

1.0% |

|

USD |

Core Retail Sales (MoM) |

0.8% |

0.6% |

0.9% |

|

AUD |

Monetary Policy Meeting Minutes |

|||

|

EUR |

ECB President Draghi Speaks |

|||

|

CAD |

Interest Rate Decision |

1.00% |

1.00% |

1.00% |

|

GBP |

MPC Meeting Minutes |

|||

|

GBP |

Claimant Count Change |

3.6K |

7.0K |

4.5K |

|

CAD |

BoC Monetary Policy Report |

|||

|

USD |

Initial Jobless Claims |

386K |

370K |

388K |

|

USD |

Existing Home Sales |

4.48M |

4.62M |

4.60M |

|

GBP |

Retail Sales (MoM) |

1.8% |

0.5% |

-0.8% |

|

GBP |

Retail Sales (YoY) |

3.3% |

1.4% |

1.0% |

|

CAD |

Core CPI (MoM) |

0.3% |

0.4% |

Historical:

Highest: 1.0842 CAD on 01 Nov 2009.

Average: 1.0147 CAD over this period.

Lowest: 0.9435 CAD on 26 Jul 2011.

Economic Highlights of the coming week that affect the American and Canadian Markets.

|

CAD |

Wholesale Sales (MoM) |

-1.0% |

-1.0% |

|

CAD |

Retail Sales (MoM) |

0.5% |

|

|

CAD |

Core Retail Sales (MoM) |

1.0% |

-0.5% |

|

USD |

New Home Sales |

320K |

313K |

|

USD |

CB Consumer Confidence |

70.3 |

70.8 |

|

USD |

Core Durable Goods Orders (MoM) |

0.5% |

1.8% |

|

USD |

Durable Goods Orders (MoM) |

-1.5% |

2.4% |

|

USD |

Interest Rate Decision |

Click here to read USD/CAD Technical Analysis.

Originally posted here