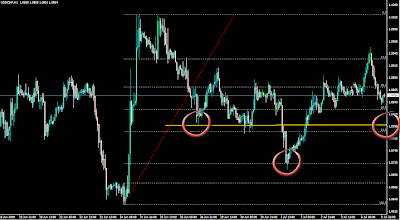

Usd-Chf 240 min chart looks a bit like continue pattern.

(EW works locates lower in the posts I did during the weekend), but I think it might makes sense to look 60 min chart. This might be inverse HS case and if that right shoulder could hit in next days and if it does eur-usd chart is proapbly solved & set at the same time. I had been trying to figure 240 min chart for any double or triple corrective in this triangle bottom field what tick is doing after impulse was finished but at so far no much luck to fully understand & breake it.

Aud-Jpy and also Eur-Usd 5 minute charts looks as inverse HS patterns in here also. Specially yen crosses really tries hard to get back inside to the 240 min log channels. At the same time for example Aud-Jpy 60 min chart was also HS, that´s why we dropped. So it was UsdJpy – but it smells for me these patterns are ready in here, AudJpy also retraced 78% – the same fibonacci support Usd-Yen did. Aud-Usd 60 min chart is also HS and also retraced now with 78%.

A real lot of 76-78 % retracements today !

To put all this together, bullside might have very clever attack plan very soon to protect bullish scenario, but good to follow what that Usd-Chf chart it will do in here, a lot of depends of it also.

By end of the day we don´t actually go anywhere with progressive movements, if I do look back a few months charts this is very much sideways progress. Eur-Aud and Usd-Chf are good examples. There´s very few pairs who had been able to do any kind of progresive movement. UsaCad, Cad-Jpy and Eur-Cad to mention those 3. To put it another way, this is trading market, but there´s not much opportunites for any large swings in my view.

Added Aud-Jpy 75,62 long also from asian market as it retraced it´s movement by 38.2%, so my Gbp-Jpy won´t feel so lonely ;).

To be serious I´ll set stops for my yen crosses 61.8% from todays upmovement by 61.8%.

Seems that Gbp-Jpy run pretty well in the last 2 hours also.