By FX Empire.com

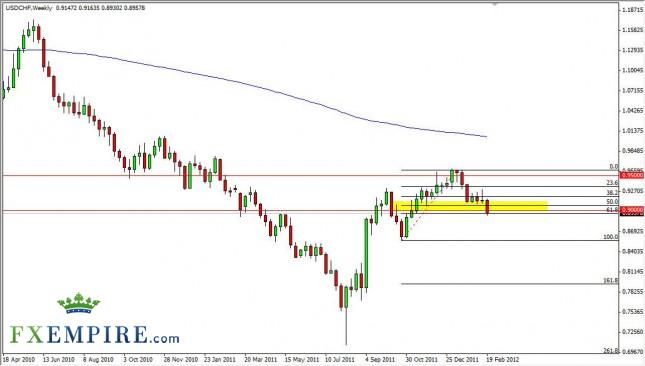

USD/CHF fell for the week, and is currently sitting on the 61.8% Fibonacci retracement level. The pair did manage to break the 0.90 level during the week, but the Swiss National Bank is currently working the value of the Franc lower when it can, and has put in a “floor” in the EUR/CHF pair. The 1.20 level is a “line in the sand” for the SNB, and any break below of that level should invite intervention by the central bank. If this happens, we would expect to see this pair rises as well. In this scenario, we can only sell as long as the EUR/CHF manages to stay above the 1.20 level. However, with this in mind, we prefer to buy signs of support if we get them, as it negates the whole issue of SNB interference.

USD/CHF Forecast for the Week of February 27, 2012, Technical Analysis

Originally posted here