By FXEmpire.com

USD/CHF Fundamental Analysis April 3, 2012, Forecast

Analysis and Recommendations:

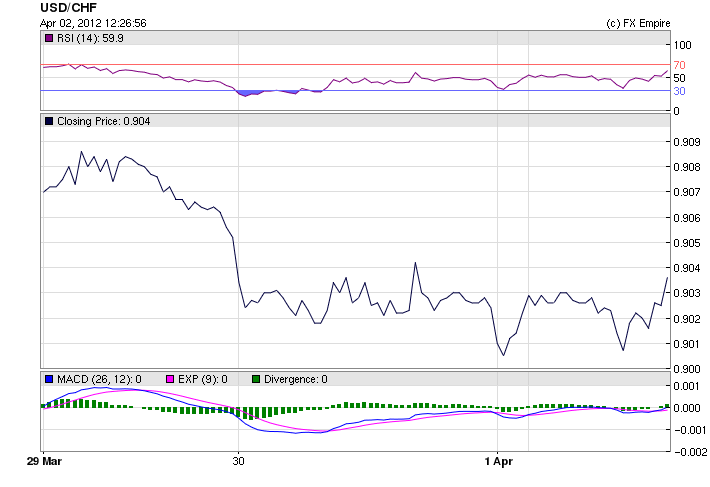

The USD/CHF is trading at 0.9036 up slightly. The Swiss SVME PMI reported slightly above forecast today, while Swiss retail sales tumbled far beyond expectations.

The US was supported by a strong manufacturer’s index, giving a boost to the greenback.

The pair moved between the high of 0.9070 and the low of 0.9002.

Economic Data for April 2, 2012 actual v. forecast

|

00:00 |

KRW |

South Korean CPI (YoY) |

2.6% |

3.1% |

3.1% |

|

00:50 |

JPY |

Tankan Large Manufacturers Index |

-4 |

-1 |

-4 |

|

02:30 |

AUD |

Building Approvals (MoM) |

-7.8% |

0.3% |

1.1% |

|

06:05 |

INR |

Indian Trade Balance |

-15.2B |

-13.0B |

-14.8B |

|

08:00 |

DKK |

Danish Retail Sales (YoY) |

-0.5% |

-1.7% |

-3.3% |

|

08:15 |

CHF |

Retail Sales (YoY) |

0.8% |

3.2% |

4.7% |

|

08:30 |

CHF |

SVME PMI |

51.1 |

49.5 |

49.0 |

|

08:50 |

EUR |

French Manufacturing PMI |

46.7 |

47.6 |

47.6 |

|

08:55 |

EUR |

German Manufacturing PMI |

48.4 |

48.1 |

48.1 |

|

09:00 |

EUR |

Manufacturing PMI |

47.7 |

47.7 |

47.7 |

|

09:30 |

GBP |

Manufacturing PMI |

52.1 |

50.5 |

51.5 |

|

10:00 |

EUR |

Unemployment Rate |

10.8% |

10.8% |

10.7% |

|

15:00 |

USD |

ISM Manufacturing Index |

53.4 |

53.0 |

52.4 |

Economic Events scheduled for April 3, 2012 that affect the European and American Markets

T.B.D GBP Halifax House Price Index (MoM) -0.3% -0.5%

The Halifax House Price Index measures the change in the price of homes and properties financed by Halifax Bank of Scotland (HBOS), one of the U.K.’s largest mortgage lenders. It is a leading indicator of health in the housing sector.

10:00 EUR GDP (QoQ) -0.3% -0.3%

Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health.

19:00 USD FOMC Meeting Minutes

The Federal Open Market Committee (FOMC) Meeting Minutes are a detailed record of the committee’s policy-setting meeting held about two weeks earlier. The minutes offer detailed insights regarding the FOMC’s stance on monetary policy, so currency traders carefully examine them for clues regarding the outcome of future interest rate decisions.

Government Bond Auctions (this week)

Apr 03 09:30 Belgium Auctions 3 & 6M T-bills

Apr 03 09:30 UK Conventional Gilt Auction

Apr 04 08:30 Spain Bono auction

Apr 04 14:30 Sweden Details T-bill auction on Apr 11

Apr 05 08:50 France OAT auction

Apr 05 15:00 US Announces auctions

Apr 05 15:30 Italy Details BOT on Apr 11 & BTP/CCTeu on Apr 12

Originally posted here