By FXEmpire.com

USD/CHF Weekly Fundamental Analysis March 26-30, 2012, Forecast

Introduction: The pair tends to break to an all-time low, and then range back to the previous low. The ranges are very distinct. A break to the upside will likely meet another previous low. Pair is reliable.

- Global stability and global recovery will send USD/CHF higher

- USD/CHF rallies on geopolitical instability

Analysis and Recommendations:

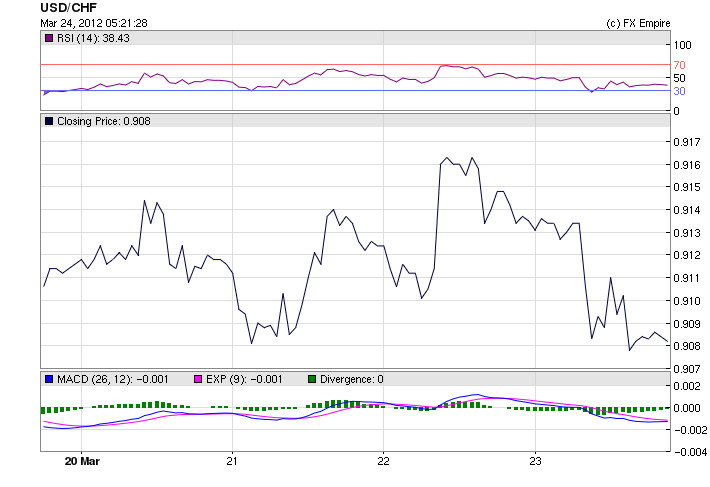

The USD/CHFtraded in a wide range this week, moving from a low of 0.9068 to a high of 0.9179 ending the week at 0.9080, as the USD swung randomly all week as investors moved from the USD in early week trading to look for more risk, to coming running back midweek, when worries about a slowdown in China began to pressure the markets. Towards the end of the week a slightly down housing report had investors moving once again from the USD.

The Swissie itself just slept through all the movement. All in all, it was China weighing down sentiment.

Both Geithner and Bernanke were busy this week, politicking and supporting recovery.

The pair hit a midweek high of 1.3293, but the euro could not break into the 1.33 range. This week should see the euro continue to fall, coming close to the 1.30-1.31. as the month comes to a close and worries are growing over Spain and Italy.

This week begins the end of the month reporting cycle, highlighted by fourth quarter GDP data is due in the US. British GDP figures are also due, as well as current account numbers

On Monday, the US pending home sales index for February is set for release. Economists are expecting the date to show a 1% in sales for the month.

Monday also brings a speech from US Federal Reserve chairman Ben Bernanke to the National Association for Business Economics economic policy conference.

The Dallas Federal Reserve manufacturing survey is also due.

In the United Kingdom, nationwide housing prices data for February is expected.

Tuesdaybrings consumer confidence data for March in the US, as well as the Standard & Poors-Case Shiller home price index for January. Analysts are tipping confidence to have fallen by 0.3 points to 70.5 in March.

The Richmond Federal Reserve manufacturing index for March will also be released.

In the UK, third quarter GDP data is due. Current account figures for the fourth quarter are also on tap, along with total business investment data for the same period. Wrapping up a busy day, the March CBI distributive trades survey is awaited.

Wednesday sees the release of US durable goods orders data for February. Orders are expected to have risen 2.5 per cent in the month. Also the weekly Energy Information Administration petroleum status report is due.

Elsewhere, European Monetary Union money supply data for February is due.

Thursdaybrings highly anticipated US GDP data for the fourth quarter. Economists are predicting the figures will show the US economy grew around 3 per cent during the period.

Real personal consumption expenditures and gross domestic purchases price index for the quarter will also be released.

Also weekly US jobless claims figure are due.

In the UK, Gfk consumer confidence for March will be released, alongside consumer credit data for February.

Index of services figures for the three months to February is awaited, along with mortgage approvals data for the month. M4 Money Supply for February is also on tap.

US personal income and outlays data for February is awaited on Friday, as well as consumer sentiment figures. Economists are tipping spending to have lifted 0.6 per cent in the period, while income is expected to have grown 0.4 per cent.

The Chicago purchasing managers index for March is also on tap, alongside the Michigan Consumer Sentiment Index for the month.

The European Banking Authority is expected to release a consultation paper on reporting large exposures.

Last week’s highlights from around the globe:

The good:

Initial Jobless Claims fall to 348k, the lowest since Mar ’08 a drop of 5000 under forecast.

Multifamily housing starts jump again in Feb and permits rise to the most since Oct ’08.

Greek CDS payments clear smoothly. Greek Default date passes.

Portuguese 10 yr bond yield falls 108 bps in spite of concerns with it post Greece.

French business confidence rises 3 pts to a 4 month high

The not so bad:

China slowdown concerns grow.

HSBC preliminary manufacturers fall to 48.1 from 49.6, 5th month below 50.

More cities report home price decreases and fewer report home price increases.

BHP and Rio express reservations over pace of Chinese growth.

Official at China Assoc of Auto Mfr’s says auto sales likely to miss their estimates in 2012.

China raises gasoline and diesel prices.

Spanish and Italian 10 yr yields rise almost 20 bps on the week.

German and French manufacturers PMI fall back below 50.

Euro zone manufacturers and services composite index unexpectedly falls to 48.7 from 49.3.

UK retail sales below estimates and consumer confidence falls.

Feb US New Home Sales unexpectedly drop to 313k, a still anemic level and months’ supply up a touch to 5.8 from 5.7.

Existing Home Sales month’s supply rises to 6.4 from 6.0. Feb sales light but Jan revised up.

NAHB home builder survey unchanged at 28 vs. estimate of 30.

Single family housing starts flat, seeing no weather induced improvement.

Historical

Highest: 1.1664 CHF on 07 Jun 2010.

Average: 0.9699 CHF over this period.

Lowest: 0.7224 CHF on 09 Aug 2011.

Economic Highlights of the coming week that affect the Euro, the USD and the Franc

|

Mar. 26 |

07:00 |

EUR |

GfK German Consumer Climate |

|

09:00 |

EUR |

German Ifo Business Climate Index |

|

|

15:00 |

USD |

Pending Home Sales (MoM) |

|

|

Mar. 27 |

07:45 |

EUR |

French Consumer Spending (MoM) |

|

09:30 |

GBP |

Business Investment (QoQ) |

|

|

09:30 |

GBP |

Current Account |

|

|

09:30 |

GBP |

GDP (QoQ) |

|

|

12:00 |

GBP |

CBI Distributive Trades Survey |

|

|

15:00 |

USD |

CB Consumer Confidence |

|

|

17:45 |

USD |

Fed Chairman Bernanke Speaks |

|

|

Mar. 28 |

13:30 |

USD |

Core Durable Goods Orders (MoM) |

|

Mar. 29 |

08:00 |

CHF |

KOF Leading Indicators |

|

08:55 |

EUR |

German Unemployment Rate |

|

|

13:30 |

USD |

Initial Jobless Claims |

|

|

13:30 |

USD |

GDP (QoQ) |

|

|

17:45 |

USD |

Fed Chairman Bernanke Speaks |

|

|

Mar. 30 |

10:00 |

EUR |

CPI (YoY) |

|

13:30 |

USD |

Core PCE Price Index (MoM) |

|

|

13:30 |

USD |

Personal Spending (MoM) |

|

|

14:45 |

USD |

Chicago PMI |

|

|

14:55 |

USD |

Michigan Consumer Sentiment Index |

Government Bond Auctions (this week)

Mar 26 09:10 Norway Nok 3.0bn NST 474 3.75% May 2021 Bond

Mar 26 10:30 Germany Eur 3.0bn new Mar 2013 Bubill

Mar 26 15:30 Italy Details BTP/CCTeu auction on Mar 29

Mar 27 09:10 Italy CTZ/BTPei auction

Mar 27 08:30 Spain 3 & 6M T-bill auction

Mar 27 17:00 US Auctions 2Y Notes

Mar 28 09:10 Italy BOT auction

Mar 28 17:00 US Auctions 3Y Notes

Mar 29 09:10 Italy BTP/CCTeu auction

Mar 29 17:00 US Auctions 7Y Notes

Originally posted here