By FXEmpire.com

USD/CNY Fundamental Analysis April 11, 2012 Forecast

Analysis and Recommendation: (close of Asian session)

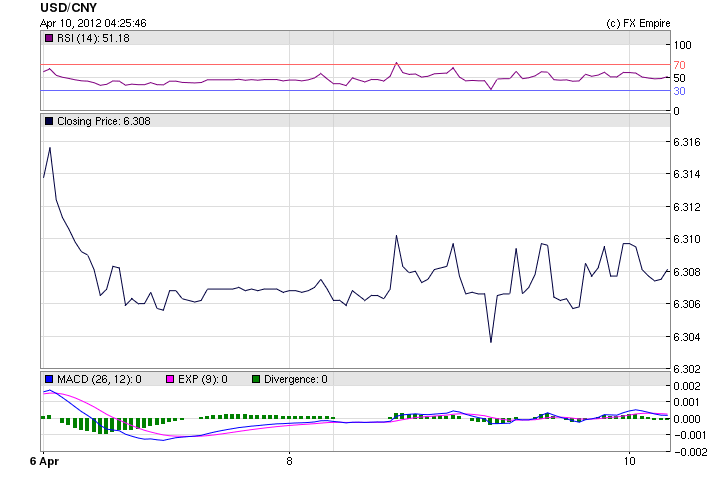

The USD/CNY is trading at 6.3084 as the USD lost ground after the negative employment reports

Chinese CPI rose 3.6 per cent in March from a year earlier, compared to a rise of 3.2 per cent in February.

Chinese balance of trade figures are expected on Tuesday, and gross domestic product data is due on Friday.

Economic Data for April 9-10, 2012 actual v. forecast

|

Apr. 09 |

JPY |

Adjusted Current Account |

0.85T |

0.66T |

0.14T |

|

CNY |

Chinese CPI (YoY) |

3.6% |

3.3% |

3.2% |

|

|

CNY |

Chinese PPI (YoY) |

-0.3% |

-0.2% |

0.0% |

|

|

JPY |

Economy Watchers Current Index |

51.8 |

46.5 |

45.9 |

|

|

RUB |

Russian Interest Rate Decision |

8.00% |

8.00% |

8.00% |

|

|

TRY |

Turkish Industrial Production (YoY) |

4.40% |

3.50% |

1.50% |

|

|

TWD |

Taiwanese Trade Balance |

2.36B |

2.19B |

2.83B |

|

|

EUR |

Greek CPI (YoY) |

1.70% |

2.10% |

||

|

EUR |

Greek Industrial Production (YoY) |

-8.30% |

-5.00% |

||

|

EUR |

Portuguese Trade Balance |

-2.88B |

-3.08B |

||

|

USD |

CB Employment Trends Index |

107.28 |

107.47 |

||

|

USD |

3-Month Bill Auction |

0.085% |

0.075% |

||

|

USD |

6-Month Bill Auction |

0.150% |

0.140% |

||

|

Apr. 10 |

GBP |

RICS House Price Balance |

-10% |

-12% |

-13% |

|

USD |

Fed Chairman Bernanke Speaks |

||||

|

AUD |

AIG Construction Index |

36.2 |

35.6 |

||

|

AUD |

NAB Business Confidence |

3 |

1 |

||

|

MYR |

Malaysian Trade Balance |

10.58B |

9.20B |

8.75B |

|

|

MYR |

Malaysian Industrial Production (YoY) |

7.5% |

6.5% |

0.3% |

Economic Events for April, 11, 2012

02:30 AUD Home Loans (MoM) -3.5% -1.2%

Home Loans record the change in the number of new loans granted for owner-occupied homes. It is a leading indicator of demand in the housing market.

13:30 USD Import Price Index (MoM) 0.8% 0.4%

The Import Price Index measures the change in the price of imported goods and services purchased domestically.

19:00 USD Federal Budget Balance -201.5B -232.0B

The Federal Budget Balance measures the difference in value between the federal government’s income and expenditure during the reported month. A positive number indicates a budget surplus; a negative number indicates a deficit.

Government Bond Auctions April 10-20, 2012

Apr 11 09:10 Italy BOT auction

Apr 11 09:30 Germany Eur 5.0bn new Jul 2022 Bund

Apr 11 09:10 Sweden Sek 5.0bn Jul 2012 & Sek 5.0bn Sep 2012 T-bills

Apr 11 09:30 Swiss Bond auction

Apr 11 09:30 UK Gbp 4.5bn 1.0% Sep 2017 Conventional Gilt

Apr 11 10:00 Norway Details T-bill auction on Apr 16

Apr 11 14:30 Sweden Details nominal bond auction on Apr 18

Apr 11 17:00 US Auctions 10Y Notes

Apr 12 09:10 Italy BTP/CCTeu auction

Apr 12 09:30 UK Gbp 2.0bn 4.25% Jun 2032 Conventional Gilt

Apr 12 15:00 US Announces auction of 5Y TIPS on Apr 19

Apr 12 17:00 US Auctions 30Y Bonds

Apr 13 10:00 Belgium OLO mini bond auction

Apr 16-30 n/a UK Re-opened 3.75% 2052 Conventional Gilt syndication

Apr 16 09:10 Slovakia Auctions floating rate Nov 2016 & 4.35% Oct 2025 & Bonds

Apr 16 09:10 Norway T-bill auction

Apr 17 08:30 Spain 12 & 18M T-bill auction

Apr 17 09:30 Belgium Auctions 3 & 12M T-bills

Apr 18 09:10 Sweden Nominal bond auction

Apr 18 09:30 Germany Eur 5.0bn 0.25% Mar 2014 Schatz

Apr 18 14:30 Sweden Details T-bill auction on Apr 25

Apr 19 08:30 Spain Obligacion auction

Apr 19 08:50 France BTAN auction

Apr 19 09:30 UK Auctions 0.125% I/L Gilt 2029

Apr 19 09:50 France OATi auction

Apr 19 15:00 US Announces 2Y Notes on Apr 24, 5Y Notes on Apr 25 & 7Y Notes on Apr 26

Apr 19 17:00 US Auctions 5Y TIPS

Apr 20 15:30 Italy Details CTZ/BTPei on Apr 24 & BOT on Apr 26

Originally posted here