By FXEmpire.com

USD/CNY Weekly Fundamental Analysis April 23-27, 2012, Forecast

Introduction: For years, other countries have been asking China to let the yuan, also called then renminbi, to float more freely on the currency market. It appears that China is doing that now, with an announcement that the yuan will be allowed to float more freely against the US dollar.

China announced that it will allow the yuan to float a little more freely against the US dollar, allowing the currency to move one per cent to either side of the US dollar currency peg. The yuan will not be a truly free floating currency as a result of the new policy, but it will have a little more flexibility.

For years, Western countries, especially the United States, have charged that the Chinese undervalue their currency, keeping it artificially low against the US dollar. This allows for an edge in exports, as a weaker yuan makes goods cheaper to purchase by consumers in other countries. Many expect that if Chinese policymakers were to ever let the yuan freely float, it would appreciate quite quickly.

Weekly Analysis and Recommendation:

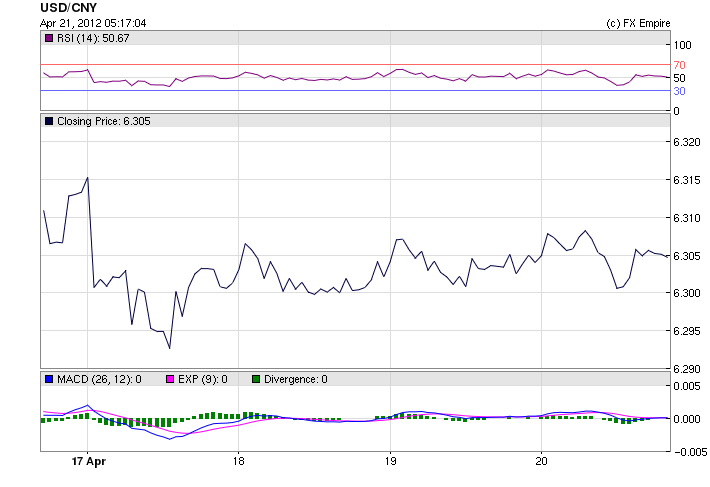

The USD/CNY closed the week at 6.3047 after bouncing around all week on worries over Chinese and US economic recovery. The yuan traded as low as 6.2924 and hit a high of 6.3202.

As the weekends, worries over Euro Zone debt and economic growth in the US and China continue to grip commodities and were seen trading in a very tight range waiting for fresh cues for further directional moves. In a lackluster trading, spot gold held steady. Base metals in LME traded mostly flat as investors remained cautious after weak economic indicators from the U.S. Though, successful French and Spanish bond auction allayed concerns over Euro Zone’s deteriorating financial health to some extent. Unexpected rise in German business climate assessed by Ifo lifted the sentiments too. LME copper managed to hang above $8000 a ton. In tandem with the international market, movements in MCX base metal complex and bullions were dreary. Crude oil rose for the first time in three days supported by positive German data. Meanwhile, G-20 finance ministers and central bankers are to meet in Washington later today. The Indian rupee was seen bouncing off a 3-month low it hit during previous session at 52.11 up 0.17 percent

Market emotions remained rather subdued in the wake of persistent debt concerns in the Euro region in spite of a strong German business sentiment. Looking into the evening, no major economic data is slated for release. The ongoing G-20 finance minister’s meet in Washington would be the key event markets would be looking up to take cues from. With Chinese economy going through a lean patch, possible Chinese Central bank liquidity action in the coming days could be a marquee event and have a real impact on the commodities.

The manager of China’s massive foreign exchange reserves and lenders are working together to ease funding for overseas investments. But major state-owned enterprises are preferred and financing is only available for projects that fit the government’s “going out” strategy

China’s yuan meanwhile took a slight drop lower against the dollar after the country’s central bank widened the daily trading band for the closely-controlled currency to 1.0 percent above and below a daily midpoint, double the previous 0.5 percent.

The operator of Hong Kong’s stock and futures exchange said late Thursday it plans to introduce offshore yuan futures in the third quarter to provide a way for investors to hedge their exposure to the Chinese currency.

The number of Americans who filed requests for jobless benefits totaled 386,000 last week, keeping claims at a four-month high, the U.S. Labor Department said Thursday. Claims from two weeks ago were revised up to 388,000 from an initial reading of 380,000. Economists had projected claims would drop to a seasonally adjusted 374,000 in the week ended April 14, so the number is likely to disappoint investors. The average of new claims over the past four weeks, meanwhile, rose by 5,500 to 374,750, the highest level since late January. Continuing claims increased by 26,000 to a seasonally adjusted 3.3 million in the week ended April 7, the Labor Department said.

Sales of existing homes fell 2.6% in March, the second monthly drop though the sales pace in the first quarter was the best in five years, according to data released Thursday. The National Association of Realtors said.

A gradual improvement in U.S. economic growth is expected past the summer, the Conference Board said Thursday as it reported that its index of leading economic indicators increased 0.3% in March, led by the interest rate spread.

Economic Highlights of the coming week that affect the Yuan, Yen, Aussie and Kiwi

|

AUD |

CPI (QoQ) |

0.6% |

|

|

AUD |

Trimmed Mean CPI (QoQ) |

0.6% |

0.6% |

|

USD |

New Home Sales |

320K |

313K |

|

USD |

CB Consumer Confidence |

70.3 |

70.8 |

|

USD |

Durable Goods Orders (MoM) |

-1.5% |

2.4% |

|

USD |

Core Durable Goods Orders (MoM) |

0.5% |

1.8% |

|

USD |

Interest Rate Decision |

||

|

NZD |

Interest Rate Decision |

2.50% |

2.50% |

|

JPY |

Tokyo Core CPI (YoY) |

-0.4% |

-0.3% |

|

JPY |

Unemployment Rate |

4.5% |

4.5% |

|

JPY |

Retail Sales (YoY) |

9.8% |

3.5% |

|

JPY |

Interest Rate Decision |

0.10% |

Click here for updated USD/CNY News.

Originally posted here