By FXEmpire.com

The USD/JPY pair fell on Thursday as the fears of a slowdown in China took center stage. However, the fact is the “slowdown” is from 12% growth to a “mere” 7% growth, and it was known that the Chinese central bank was working to cool off the economy in order to avoid some of the bubbles seen in the West recently.

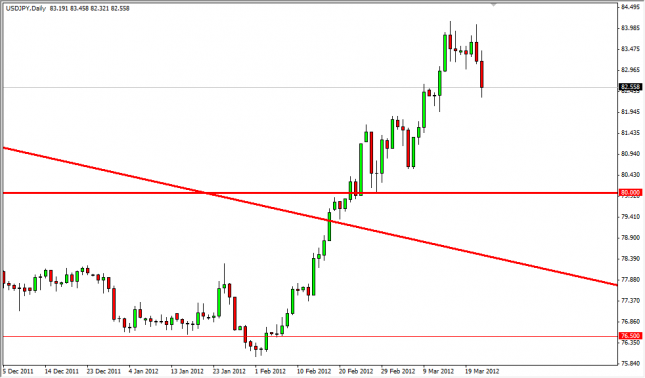

Because of this, the Asian currencies on a whole gained. However, this pair has recently broken out of a massive downtrend line, and this move should simply be a pullback that allows those who have missed the move a chance to get involved going forward. The pair has support levels at 82, 81, and most certainly at the 80 handle. The 80 handle is in fact the “line in the sand” for the bulls, and if it gives way – then we could see real trouble to the downside.

The Bank of Japan has expanded its bond buyback program of JGBs, and this is akin to printing Yen and circulating them into the economy. As with anything that gets flooded into the markets, the desire to own them shrinks. It is in this light that many of the professionals around the world look at the Yen on the whole. With the US economy looking a bit stronger, this should continue to drive money flows into the US as well.

The candle for the Thursday session closed towards the low of the session, and this shows that there may be a bit more interest in selling at this time. This bodes well though, as the fundamental and technical indications point towards a higher price in this pair and we now can buy on signs of support.

We are waiting to see some kind of supportive daily candle, perhaps a hammer or bullish engulfing candle from which to buy. We would like to see it at one of the handles between here and the 80 level. The market cannot be sold until we close well below the 80 handle as this latest move has been very bullish.

USD/JPY Forecast March 23, 2012, Technical Analysis

Originally posted here