By FXEmpire.com

USD/JPY Fundamental Analysis April 17, 2012, Forecast

Analysis and Recommendation: (close of Asian session)

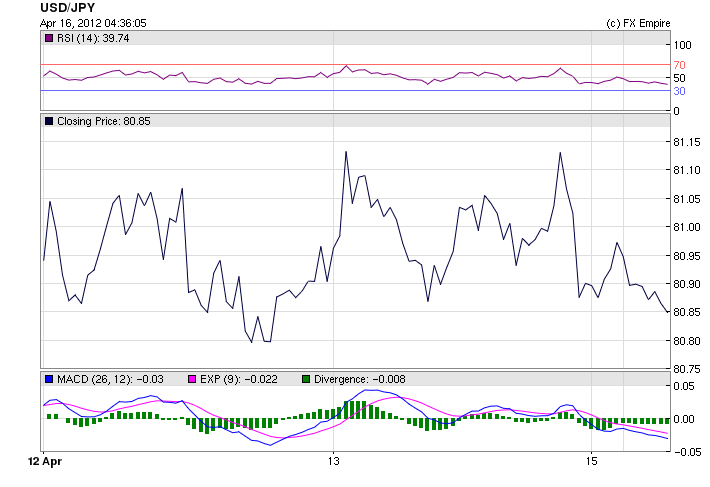

The USD/JPY fell in today’s session to 80.66. The USD was able to strength against all of most major asian currencies except the yen and the kiwi.

It is obvious that the primary flight of investors is to safety and that overall they favor the yen over the dollar.

The Chinese government announced on Saturday that it would allow the renminbi to vary more in value against the dollar during each day’s trading, but gave no hint that it would accept the Obama administration’s demands to allow the currency to show a longer-term trend of appreciation against the dollar.

Minutes from the BoJ meetings were released on Friday, but there was no hint of monetary policy to help push the yen into the spotlight.

Economic Data Released on April 13, 2012 actual v. forecast

|

JPY |

Monetary Policy Meeting Minutes |

|||

|

KRW |

South Korean Interest Rate Decision |

3.25% |

3.25% |

3.25% |

|

CNY |

Chinese Fixed Asset Investment (YoY) |

20.9% |

20.8% |

21.5% |

|

CNY |

Chinese GDP (YoY) |

8.1% |

8.3% |

8.9% |

|

CNY |

Chinese Industrial Production (YoY) |

11.9% |

11.5% |

11.4% |

|

CNY |

Chinese Retail Sales (YoY) |

15.2% |

15.0% |

14.7% |

|

EUR |

German CPI (MoM) |

0.3% |

0.3% |

0.3% |

|

EUR |

Finnish CPI (YoY) |

2.90% |

3.10% |

|

|

GBP |

PPI Input (MoM) |

1.9% |

1.2% |

2.5% |

|

BRL |

Brazilian Retail Sales (YoY) |

9.6% |

9.0% |

7.3% |

|

PLN |

Polish CPI (YoY) |

3.9% |

3.9% |

4.3% |

|

USD |

Core CPI (MoM) |

0.2% |

0.2% |

0.1% |

|

USD |

CPI (MoM) |

0.3% |

0.3% |

0.4% |

|

USD |

Michigan Consumer Sentiment Index |

75.7 |

76.2 |

76.2 |

|

USD |

Fed Chairman Bernanke Speaks |

Economic Events scheduled for April 17, 2012 that affect the NZD, AUD, and JPY

05:30 JPY Industrial Production (MoM) -1.2%

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

13:30 USD Building Permits 0.71M 0.71M

Building Permits measures the change in the number of new building permits issued by the government. Building permits are a key indicator of demand in the housing market.

13:30 USD Housing Starts 0.70M 0.70M

Housing starts measures the change in the annualized number of new residential buildings that began construction during the reported month. It is a leading indicator of strength in the housing sector.

14:15 USD Industrial Production (MoM) 0.5%

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

Government Bond Auctions (this week)

Apr 17 08:30 Spain 12 & 18M T-bill auction

Apr 17 09:30 Belgium Auctions 3 & 12M T-bills

Apr 18 09:10 Sweden Nominal bond auction

Apr 18 09:30 Germany Eur 5.0bn 0.25% Mar 2014 Schatz

Apr 18 14:30 Sweden Details T-bill auction on Apr 25

Apr 19 08:30 Spain Obligacion auction

Apr 19 08:50 France BTAN auction

Apr 19 09:30 UK Auctions 0.125% I/L Gilt 2029

Apr 19 09:50 France OATi auction

Originally posted here