By FXEmpire.com

USD/JPY Fundamental Analysis April 18, 2012, Forecast

Analysis and Recommendation: (close of Asian session)

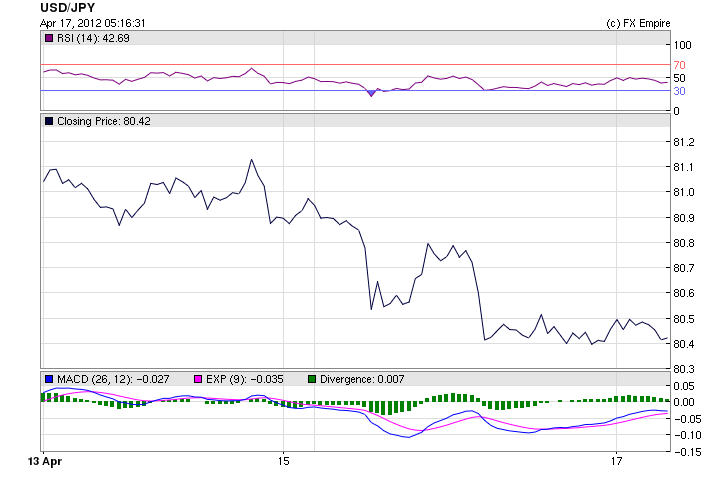

The USD/JPY has moved up a bit to trade at 80.4645 at the close of the Asian session. The dollar bought 80.46 yen, against ?80.47 in late trading on Monday.

The currency ended where it had started. Japanese industrial production reports showed a larger then forecast drop in production.

The JPY is stronger, up 0.2% from Friday’s close, as FX markets continue to show signs of risk aversion. However, safe haven gains in yen are being dampened by dovish rhetoric from the BoJ ahead of the April 27th policy meeting. Governor Shirakawa has stated that the BoJ is maintaining its effort to battle deflation; while market expectations are that the central bank will pursue further easing, in the form of asset purchases.

Economic Reports for April 16-17, 2012 actual v. forecast

|

13:30 |

USD |

Core Retail Sales (MoM) |

0.8% |

0.6% |

0.9% |

|

13:30 |

Foreign Securities Purchases |

12.50B |

7.23B |

-4.28B |

|

|

13:30 |

USD |

Retail Sales (MoM) |

0.8% |

0.3% |

1.0% |

|

13:30 |

USD |

NY Empire State Manufacturing Index |

6.6 |

18.0 |

20.2 |

|

14:00 |

USD |

TIC Net Long-Term Transactions |

10.1B |

41.3B |

102.4B |

|

Apr. 17 |

02:30 |

AUD |

Monetary Policy Meeting Minutes |

||

|

05:30 |

JPY |

Industrial Production (MoM) |

-1.6% |

-1.2% |

-1.2% |

|

06:30 |

INR |

Indian Interest Rate Decision |

8.00% |

8.30% |

8.50% |

Economic Events scheduled for April 18, 2012 that affect the NZD, AUD, and JPY

00:30:00 AUD Conference Board Australia Leading Index 1.10%

The Conference Board Australia leading Index released by the Conference Board measures future trends of the overall economic activity including employment, average manufacturing workweek, initial claims, permits for new housing construction, stock prices and yield curve. It forecasts short to mid-term growth in the Australian economy. Generally, a high reading is seen as positive (or bullish) for the AUD, while a low reading is seen as negative (or bearish).

22:45:00 NZD Consumer Price Index (QoQ) 0.60% -0.30%

Consumer Price Index released by the Statistics New Zealand is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services . The purchase power of NZD is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. A high reading is seen as positive (or bullish) for the NZD, while a low reading is seen as negative.

23:50:00 JPY Merchandise Trade Balance Total ?-220.0B ?32.9B

The Merchandise Trade Balance Total released by the Ministry of Finance is a measure of balance amount between import and export. A positive value shows a trade surplus while a negative value shows a trade deficit. Japan is so much dependant on exports that the Japanese economy heavily relies on a trade surplus. Therefore, any variation in the figures influences the domestic economy. If a steady demand in exchange for Japanese exports is seen, that

Government Bond Auctions (this week)

Apr 18 09:10 Sweden Nominal bond auction

Apr 18 09:30 Germany Eur 5.0bn 0.25% Mar 2014 Schatz

Apr 18 14:30 Sweden Details T-bill auction on Apr 25

Apr 19 08:30 Spain Obligacion auction

Apr 19 08:50 France BTAN auction

Apr 19 09:30 UK Auctions 0.125% I/L Gilt 2029

Apr 19 09:50 France OATi auction

Originally posted here