By FXEmpire.com

USD/JPY Fundamental Analysis April 4, 2012, Forecast

Analysis and Recommendation: (close of Asian session)

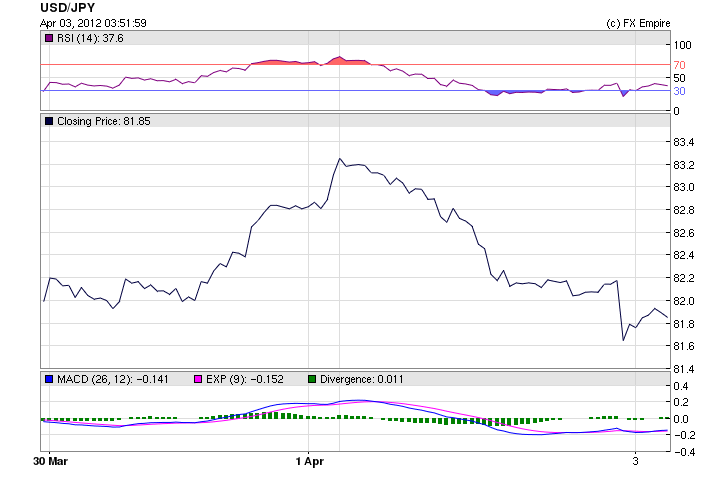

The USD/JPY was changing hands at ?81.97 in early Asian trade, down from ?82.06 and above ?83.00 a day earlier.

The strong yen could weigh on market sentiment. A strong yen hurts Japanese exporters and dampens the stock market.

There were several economic reports released in Japan today, the monetary base reported in below forecast but the Average Cash Earning came in at 0.7% when the markets were expecting 0.2%

Economic Reports for April 3, 2012 actual v. forecast (Asian Session)

|

Currency |

Event |

Actual |

Forecast |

Previous |

|

JPY |

Monetary Base (YoY) |

-0.2% |

12.6% |

11.3% |

|

JPY |

Average Cash Earnings (YoY) |

0.7% |

0.2% |

0.0% |

|

AUD |

Retail Sales (MoM) |

0.2% |

0.3% |

0.3% |

Economic Data for April 2, 2012 actual v. forecast

|

KRW |

South Korean CPI (YoY) |

2.6% |

3.1% |

3.1% |

|

JPY |

Tankan Large Manufacturers Index |

-4 |

-1 |

-4 |

|

AUD |

Building Approvals (MoM) |

-7.8% |

0.3% |

1.1% |

|

INR |

Indian Trade Balance |

-15.2B |

-13.0B |

-14.8B |

|

DKK |

Danish Retail Sales (YoY) |

-0.5% |

-1.7% |

-3.3% |

|

CHF |

Retail Sales (YoY) |

0.8% |

3.2% |

4.7% |

|

CHF |

SVME PMI |

51.1 |

49.5 |

49.0 |

|

EUR |

French Manufacturing PMI |

46.7 |

47.6 |

47.6 |

|

EUR |

German Manufacturing PMI |

48.4 |

48.1 |

48.1 |

|

EUR |

Manufacturing PMI |

47.7 |

47.7 |

47.7 |

|

GBP |

Manufacturing PMI |

52.1 |

50.5 |

51.5 |

|

EUR |

Unemployment Rate |

10.8% |

10.8% |

10.7% |

|

USD |

ISM Manufacturing Index |

53.4 |

53.0 |

52.4 |

Economic Data Monday April 4, 2012 actual v. forecast that affects the NZD, AUD, and JPY

02:30 AUD Trade Balance 1.00B -0.67B

The Trade Balance measures the difference in value between imported and exported goods and services over the reported period. A positive number indicates that more goods and services were exported than imported.

13:00 USD Treasury Secretary Geithner Speaks

U.S. Treasury Secretary Timothy Geithner (January 2009 – January 2013) is to speak. He speaks frequently on a broad range of subjects and his speeches are often used to signal policy shifts to the public and to foreign governments.

13:15 USD ADP Nonfarm Employment Change 200K 216K

The ADP National Employment Report is a measure of the monthly change in non-farm, private employment, based on the payroll data of approximately 400,000 U.S. business clients. The release, two days ahead of government data, is a good predictor of the government’s non-farm payroll report. The change in this indicator can be very volatile.

15:00 USD ISM Non-Manufacturing Index 57.0 57.3

The Institute of Supply Management (ISM) Non-Manufacturing Purchasing Managers’ Index (PMI) (also known as the ISM Services PMI ) rates the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories. The data is compiled from a survey of approximately 400 purchasing managers in the non-manufacturing sector. On the index, a level above 50 indicates expansion; below indicates contraction.

Government Bond Auctions (this week)

Apr 03 09:30 Belgium Auctions 3 & 6M T-bills

Apr 03 09:30 UK Conventional Gilt Auction

Apr 04 08:30 Spain Bono auction

Apr 04 14:30 Sweden Details T-bill auction on Apr 11

Apr 05 08:50 France OAT auction

Apr 05 15:00 US Announces auctions

Apr 05 15:30 Italy Details BOT on Apr 11 & BTP/CCTeu on Apr 12

Originally posted here