By FXEmpire.com

USD/JPY Fundamental Analysis April 9, 2012, Forecast

Analysis and Recommendation: (close of Asian session)

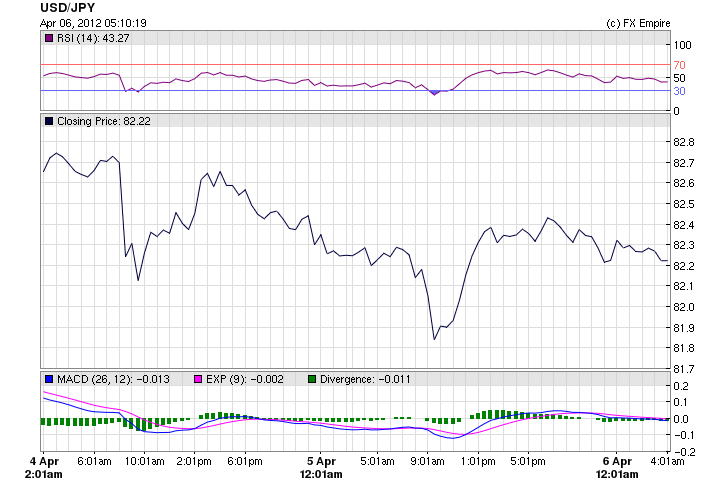

USD/JPY was trading at 82.22, down 0.17% as markets closed; down from ?82.57

The pair was likely to find support at 81.56, Monday’s low, and resistance at 83.30.

A rally on Chinese equity markets has helped the Australian dollar to recover from a three month low.

The currency had received some support from Chinese stock markets, which reopened after three days of public holidays.

Tepid demand at a Spanish government bond auction spooked investors who had been upbeat about global growth prospects and sparked a sell-off in higher-yielding, or riskier, assets.

Reflecting the negative risk sentiment, the safe-haven US dollar and Japanese Yen strengthened against all of the major currencies pushing the kiwi dollar down.

Against the Japanese yen, the euro fell 0.7% to ?107.62.

Most Western Markets are Closed on Friday April 6, 2012 and many are Closed on Monday April 9, 2012.

Economic Events April 5, 2012 actual v. forecast

|

CHF |

CPI (MoM) |

0.6% |

0.4% |

0.3% |

|

EUR |

Dutch CPI (YoY) |

2.50% |

2.20% |

2.50% |

|

GBP |

Industrial Production (MoM) |

0.4% |

0.3% |

-0.6% |

|

GBP |

Manufacturing Production |

-1.0% |

0.1% |

-0.3% |

|

GBP |

Interest Rate Decision |

0.50% |

0.50% |

0.50% |

|

GBP |

BOE QE Total |

325B |

325B |

325B |

|

BRL |

Brazilian CPI (YoY) |

5.2% |

5.4% |

5.8% |

|

Building Permits (MoM) |

7.5% |

3.0% |

-11.4% |

|

|

CAD |

Employment Change |

82.3K |

10.0K |

-2.8K |

|

USD |

Initial Jobless Claims |

357K |

355K |

363K |

|

CAD |

Unemployment Rate |

7.2% |

8.0% |

7.4% |

|

USD |

Continuing Jobless Claims |

3338K |

3350K |

3354K |

|

CAD |

Ivey PMI |

63.5 |

66.0 |

66.5 |

|

GBP |

NIESR GDP Estimate |

0.1% |

0.1% |

Economic Events scheduled for April 9, 2012

02:30 CNY Chinese CPI (YoY) 3.3% 3.2%

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

02:30 CNY Chinese PPI (YoY) -0.2%

The Producer Price Index (PPI) measures the change in the price of goods sold by manufacturers. It is a leading indicator of consumer price inflation, which accounts for the majority of overall inflation.

10:00 EUR Greek CPI (YoY) 2.10%

Consumer Price index is the most frequently used indicator of inflation and reflect changes in the cost of acquiring a fixed basket of goods and services by the average consumer.

Originally posted here