By FXEmpire.com

USD/JPY Fundamental Analysis March 30, 2012, Forecast

Analysis and Recommendation: (close of Asian session)

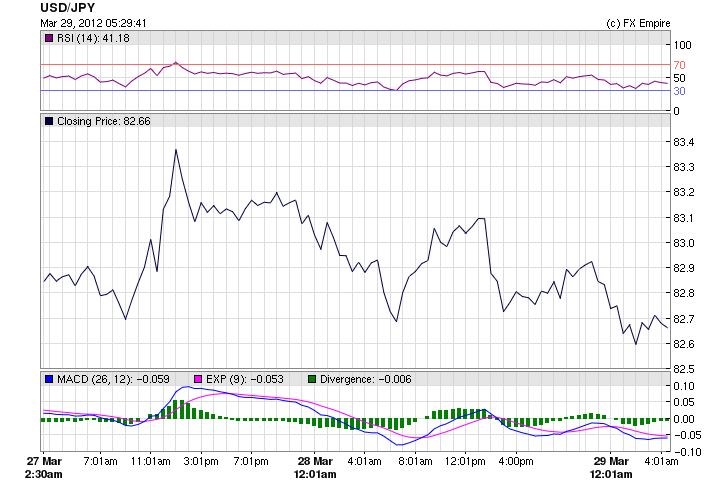

The USD/JPY is currently trading at ?82.65. With softer US durable goods data keeping the safe haven yen in demand, the dollar was trading in the Y82 range against levels above Y84 reached two weeks ago.

The dollar was quoted at ?82.82 in early Asian trade against ?82.86 in New York late on Wednesday. The euro bought $1.3330 and ?110.42 compared with $1.3316 and ?110.36 in New York.

Economic Data March 28, 2012 actual v. forecast

|

EUR |

French GDP (QoQ) |

0.2% |

0.2% |

0.2% |

|

EUR |

M3 Money Supply (YoY) |

2.8% |

2.5% |

2.5% |

|

EUR |

Private Loans (YoY) |

0.7% |

1.3% |

1.1% |

|

EUR |

Italian Business Confidence |

92.1 |

91.7 |

91.7 |

|

GBP |

Business Investment (QoQ) |

-3.3% |

-5.4% |

-5.6% |

|

GBP |

Current Account |

-8.5B |

-8.4B |

-10.5B |

|

GBP |

GDP (QoQ) |

-0.3% |

-0.2% |

-0.2% |

|

EUR |

Italian 6-Month BOT Auction |

1.12% |

1.20% |

|

|

USD |

MBA Mortgage Applications |

-2.7% |

-7.4% |

|

|

EUR |

German CPI (MoM) |

0.3% |

0.3% |

0.7% |

|

USD |

Core Durable Goods Orders (MoM) |

1.6% |

1.5% |

-3.0% |

|

USD |

Durable Goods Orders (MoM) |

2.2% |

3.0% |

-3.6% |

|

USD |

Crude Oil Inventories |

7.1M |

2.5M |

-1.2M |

|

USD |

Gasoline Inventories |

-3.5M |

-1.7M |

-1.2M |

Economic Events scheduled for March 30, 2012 that affect the JPY, AUD, and NZD

00:30 JPY Unemployment Rate 4.6% 4.6%

The Unemployment Rate measures the percentage of the total work force that is unemployed and actively seeking employment during the previous month. The data tends to have a muted impact relative to employment data from other countries because the Japanese economy is more reliant on the industrial sector than personal spending.

00:30 JPY Tokyo Core CPI (YoY) -0.3% -0.3%

The Tokyo Core Consumer Price Index (CPI) measures the change in the price of goods and services purchased by consumers in Tokyo, excluding fresh food.

00:50 JPY Industrial Production (MoM) 1.4% 1.9%

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

01:00 AUD HIA New Home Sales (MoM) -7.3%

Housing Industry Association (HIA) New Home Sales measures the change in the number of newly constructed homes sold.

13:30 USD Core PCE Price Index (MoM) 0.1% 0.2%

13:30 USD Personal Spending (MoM) 0.6% 0.2%

The Core Personal Consumption spending (PCE) Price Index measures the changes in the price of goods and services purchased by consumers for the purpose of consumption, excluding food and energy. Prices are weighted according to total expenditure per item. It measures price change from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

14:45 USD Chicago PMI 63.1 64.0

The Chicago Purchasing Managers’ Index (PMI) determines the economic health of the manufacturing sector in Chicago region. A reading above 50 indicates expansion of the manufacturing sector; a reading below indicates contraction. The Chicago PMI can be of some help in forecasting the ISM manufacturing PMI.

14:55 USD Michigan Consumer Sentiment Index 75.1 74.3

The University of Michigan Consumer Sentiment Index rates the relative level of current and future economic conditions. There are two versions of this data released two weeks apart, preliminary and revised. The preliminary data tends to have a greater impact. The reading is compiled from a survey of around 500 consumers.

Government Bond Auctions (this week)

Mar 29 00:30 Japan Auctions 2Y JGBs

Mar 29 09:10 Italy BTP/CCTeu auction

Mar 29 17:00 US Usd 29.0bn 7Y Notes

Mar 30 14:30 UK Publication of the DMO Q2 Gilt operations calendar

Mar 31 n/a Spain IGCP deadline for Q2 T-bill issuance programme

Apr 03 09:30 Belgium Auctions 3 & 6M T-bills

Apr 03 09:30 UK Conventional Gilt Auction

Apr 04 08:30 Spain Bono auction

Apr 04 14:30 Sweden Details T-bill auction on Apr 11

Apr 05 08:50 France OAT auction

Apr 05 15:00 US Announces auctions

Apr 05 15:30 Italy Details BOT on Apr 11 & BTP/CCTeu on Apr 12

Originally posted here