By FX Empire.com

USD/JPY Fundamental Analysis March 8, 2012, Forecast

Analysis and Recommendation: (close of Asian session)

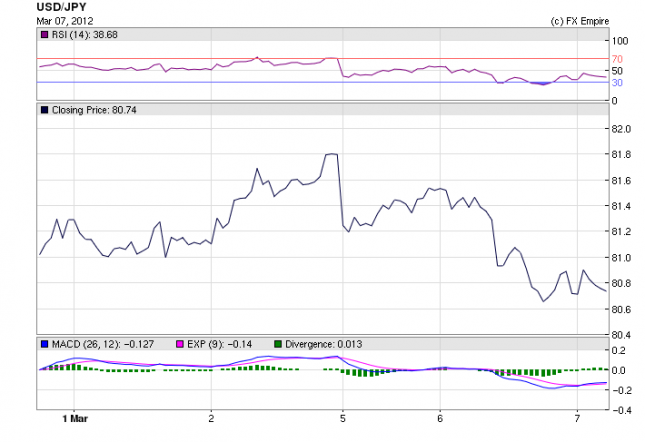

USD/JPY is trading at 80.77 after hitting a high earlier of 80.94 and then settling as investors were reassured over Greece.

The Yen benefited as a safe haven escape as worries that Greece was still at risk of a pushed investors to move from risky assets. Doubts about the success of the Greek debt-swap deal on Thursday have risen with only 20 per cent of private creditors so far agreeing to the deal. The Greek government has set a 75 per cent participation rate as a threshold for proceeding with the transaction.

There is an immense amount of risk surrounding this scenario if it doesn’t go according to plan there will be huge risk aversion taking place – which might push the Yen even higher..

Greece and the IIF seem to have calmed the markets by assuring publicly that everything was on track late in the day as pressure seemed to ease of and the investors moved back out of the yen.

The statements over the weekend by the Chinese Premier, reducing growth estimates for 2012 is having a reverberating effect the entire pacific.

March 7, 2012 Economic Release actual v. forecast

|

AUD |

GDP (QoQ) |

0.4% |

0.7% |

0.8% |

March 6, 2012 Economic Releases actual v. forecast

|

AUD |

Current Account |

-8.4B |

-8.0B |

-5.8B |

|

AUD |

Interest Rate Decision |

4.25% |

4.25% |

4.25% |

|

GBP |

Halifax House Price Index (MoM) |

-0.5% |

0.3% |

0.6% |

|

EUR |

GDP (QoQ) |

-0.3% |

-0.3% |

-0.3% |

| Ivey PMI |

66.5 |

62.1 |

64.1 |

Scheduled Economic Events for March 8, 2012 (GMT)

00:30 AUD Employment Change 5.0K 46.3K

00:30 AUD Unemployment Rate 5.2% 5.1%

Employment Change measures the change in the number of people employed. Job creation is an important indicator of consumer spending. The Unemployment Rate measures the percentage of the total work force that is unemployed and actively seeking employment during the previous month.

13:30 USD Initial Jobless Claims 350K 351K

13:30 USD Continuing Jobless Claims 3385K 3402K

Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data, but the market impact varies from week to week. Continuing Jobless Claims measures the number of unemployed individuals who qualify for benefits under unemployment insurance.

Sovereign Bond Auction Schedule

Mar 08 16:00 US Announces auctions of 3Y Notes

Mar 12, 10Y Notes on Mar 13 & 30Y Bonds on Mar 14

Mar 08 16:30 Italy Details BOT auction on Mar 13

Mar 09 11:00 Belgium OLO mini bond auction

Mar 09 16:30 Italy Details BTP/CCTeu on Mar 14

Originally posted here