By FXEmpire.com

USD/JPY Weekly Fundamental Analysis April 16-20, 2012, Forecast

Introduction: In the USD/JPY trade, trying to pick tops or bottoms during that time would have been difficult. However, with the bull trend so dominant, the far easier and smarter trade was to look for technical opportunities to go with the fundamental theme and trade with the market trend rather than to trying to fade it.

Against the Japanese yen, whose central bank held rates steady at zero, the dollar appreciated 19% from its lowest to highest levels. USD/JPY was in a very strong uptrend throughout the year, but even so, there were plenty of retraces along the way. These pullbacks were perfect opportunities for traders to combine technicals with fundamentals to enter the trade at an opportune moment.

- The interest rate differential between the Bank of Japan(BoJ) and the Federal Reserve

- Japanese government intervention to maintain their currency sends USD/JPY lower

Analysis and Recommendation:

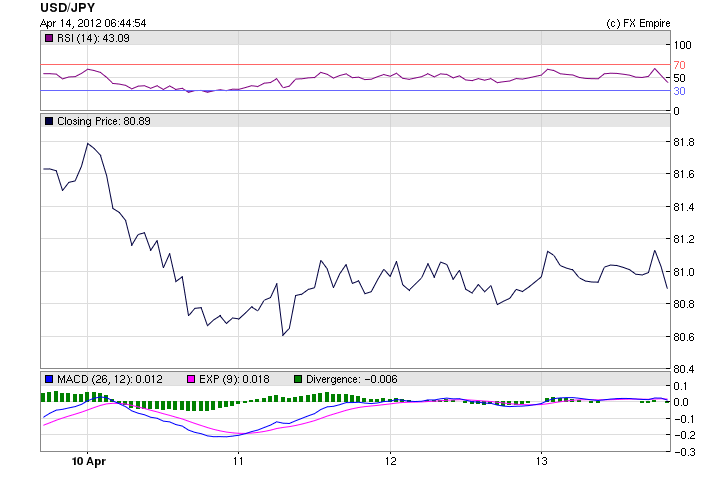

The USD/JPY continued to fall at week’s end closing the week at 80.92. JPY is flat from yesterday’s close despite FX performance that is suggestive of risk aversion, an indication that market participants are beginning to believe in the increasing possibility of further BoJ easing at the upcoming meeting on April 27th. Movement since Tuesday’s BoJ meeting has been limited. This week for the yen has been all about Chinese and US data.

|

Date |

Open |

High |

Low |

Change % |

|

|

04/13/2012 |

80.92 |

80.95 |

81.19 |

80.83 |

-0.04% |

|

04/12/2012 |

80.94 |

81.00 |

81.13 |

80.74 |

-0.07% |

|

04/11/2012 |

81.00 |

80.68 |

81.12 |

80.59 |

0.40% |

|

04/10/2012 |

80.68 |

81.65 |

81.86 |

80.65 |

-1.19% |

|

04/09/2012 |

81.64 |

81.30 |

81.67 |

81.23 |

0.43% |

Major Economic Events for the past week actual v. forecast

|

Apr. 09 |

CNY |

Chinese CPI (YoY) |

3.6% |

3.3% |

3.2% |

|

Apr. 10 |

USD |

Fed Chairman Bernanke Speaks |

|||

|

JPY |

Interest Rate Decision |

0.10% |

0.10% |

0.10% |

|

|

JPY |

BoJ Press Conference |

||||

|

Apr. 12 |

Trade Balance |

0.3B |

2.0B |

2.0B |

|

|

USD |

Trade Balance |

-46.0B |

-52.0B |

-52.5B |

|

|

USD |

Initial Jobless Claims |

380K |

355K |

367K |

|

|

Apr. 13 |

CNY |

Chinese GDP (YoY) |

8.1% |

8.3% |

8.9% |

|

USD |

Core CPI (MoM) |

0.2% |

0.2% |

0.1% |

Last week’s positives:

-Fed’s Beige Book said the “economy continued to expand at a modest to moderate pace from mid Feb thru late Mar”

-Germany continues its European economic outperformance as exports unexpectedly rise in Feb

-Chinese loan growth in March raises 1.01T yuan, well above estimates of 797.5b and the most since Jan ’11

-Chinese retail sales and IP both up

-US PPI flat m/o/m vs. forecast of up .3% but core rate rises .3% vs. expectations of up .2%

Last week’s negatives:

– Spanish and Italian bond yields jump again, IBEX and MIB stock indexes both fall more than 5% on the week, Spanish CDS at record high and not too far from Hungary

– French business confidence holds at lowest since Sept ’09 and IP and manufacturing production both less than expected

– China’s GDP grows 8.1% in Q1 vs. estimate of 8.4%, Mar CPI up 3.6%

– Initial Jobless Claims rise to 380k, a 10 week high.

– Chinese CPI rate of change in line but index at new record high and continues rising faster than wage growth

– consumer confidence down slightly but components mixed as while Current Conditions fell, the Outlook rose to the highest since Sept ’09,

– The NFIB small business optimism index falls to 4 month low

– Markets searching for some hope of QE from the Feds

Economic Highlights of the coming week that affect the Yen, the Aussie, the Kiwi and the Chinese Yuan

|

Apr. 17 |

05:30 |

JPY |

Industrial Production (MoM) |

-1.2% |

|

Apr. 18 |

23:45 |

NZD |

CPI (QoQ) |

-0.3% |

Economic Highlights of the coming week that affect the US Dollar

|

Apr. 16 |

13:30 |

USD |

Core Retail Sales (MoM) |

0.6% |

0.9% |

|

13:30 |

USD |

Retail Sales (MoM) |

0.4% |

1.1% |

|

|

13:30 |

USD |

NY Empire State Manufacturing Index |

21.1 |

20.2 |

|

|

14:00 |

USD |

TIC Net Long-Term Transactions |

101.0B |

||

|

Apr. 17 |

13:30 |

USD |

Building Permits |

0.71M |

0.71M |

|

13:30 |

USD |

Housing Starts |

0.70M |

0.70M |

|

|

14:15 |

USD |

Industrial Production (MoM) |

0.5% |

Government Bond Auctions (this week)

Apr 16-30 n/a UK Re-opened 3.75% 2052 Conventional Gilt syndication

Apr 16 09:10 Slovakia Auctions floating rate Nov 2016 & 4.35% Oct 2025 & Bonds

Apr 16 09:10 Norway T-bill auction

Apr 17 08:30 Spain 12 & 18M T-bill auction

Apr 17 09:30 Belgium Auctions 3 & 12M T-bills

Apr 18 09:10 Sweden Nominal bond auction

Apr 18 09:30 Germany Eur 5.0bn 0.25% Mar 2014 Schatz

Apr 18 14:30 Sweden Details T-bill auction on Apr 25

Apr 19 08:30 Spain Obligacion auction

Apr 19 08:50 France BTAN auction

Apr 19 09:30 UK Auctions 0.125% I/L Gilt 2029

Apr 19 09:50 France OATi auction

Originally posted here