By FX Empire.com

Rule: In the USD/JPY trade, trying to pick tops or bottoms during that time would have been difficult. However, with the bull trend so dominant, the far easier and smarter trade was to look for technical opportunities to go with the fundamental theme and trade with the market trend rather than to trying to fade it.

Against the Japanese yen, whose central bank held rates steady at zero, the dollar appreciated 19% from its lowest to highest levels. USD/JPY was in a very strong uptrend throughout the year, but even so, there were plenty of retraces along the way. These pullbacks were perfect opportunities for traders to combine technicals with fundamentals to enter the trade at an opportune moment.

- The interest rate differential between the Bank of Japan (BoJ) and the Federal Reserve

- Japanese government intervention to maintain their currency sends USD/JPY lower

USD/JPY Weekly Fundamental Analysis March 12-16, 2012, Forecast

Analysis and Recommendation:

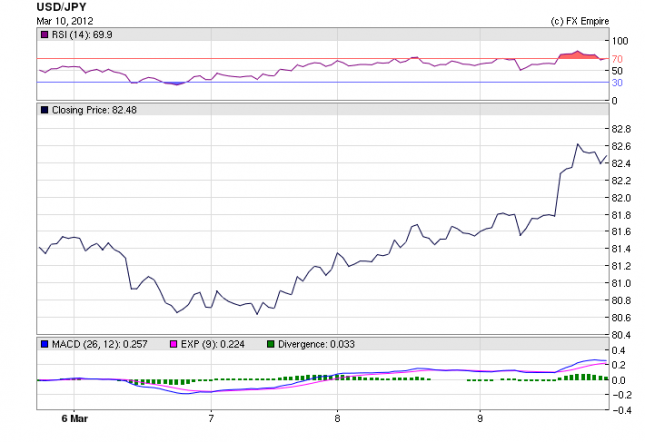

The USD/JPY is trading at 82.48 as the greenback climbed against all of its trading partners on above forecast jobs data. This was a tough week for the Yen, with a lot of negative news from Japan. The Yen traded as high as 82.64 but was coming off a bottom of 80.58 earlier this week. The pair are going to be unpredictable early in the week, as BoJ will be making announcements and policy decisions, which always seems to surprise the markets. This is a sit tight until Tuesday situation

Highlights of the past week

USA

The U.S. created 227,000 jobs in February and more people found work in the prior two months than previously reported, suggesting the economy’s recent momentum is likely to continue.

The unemployment rate, meanwhile, was unchanged at 8.3% as nearly half-a-million workers reentered the labor force in search of job, the Labor Department.

Household debt edged up 0.3% in the fourth quarter, the Fed reported in its flow-of-funds report, as consumer credit surged at a 7% annualized rate. Household debt had declined for 13 consecutive periods before the slender fourth-quarter advance.

The U.S. trade deficit widened sharply in January, driven higher by record imports of autos, capital goods and food, government data reported. The trade gap expanded 4.3% in January to $52.6 billion from $50.4 billion in December.

The Fed is considering a new form of “sterilized” quantitative easing that would allow asset purchases despite high oil prices, according to a report in The Wall Street Journal. Under the new approach, the Fed would print new money to buy long-term mortgage or Treasury bonds but effectively tie up that money by borrowing it back for short periods at low rates. The aim of such an approach would be to relieve anxieties that money printing could fuel inflation later, a fear widely expressed by critics of the Fed’s previous efforts to aid the recovery.

The Canadian Central Bank held rates today at 1% following the lead of banks around the world.

The Institute of Supply Management said its non-manufacturing PMI climbed to 57.3 in February from a reading of 56.8 the previous month. Economists had expected the index to decline to 56.1.

Another report showed that U.S. factory orders fell, but at a slower than forecast rate in January, declining by a seasonally adjusted 1.0%, compared to forecasts for a 1.3% slide.

Asia

Australia posted a seasonally-adjusted trade deficit of 673 million Australian dollars ($717.2 million) in January, the Australian Bureau of Statistics said Friday. Economists had been expecting a surplus of A$1.5 billion

China’s consumer price index rose at a weaker-than-expected rate of 3.2% in February from the same month a year earlier. The producer price index for February came in at 0%, also weaker than expected and slowing from January’s 0.7% year-on-year increase.

China’s industrial production and retail sales growth weakened in the first two months of 2012 from the year-earlier period, an official data release showed Friday.

The New Zealand Reserve Bank has held the official cash rate at its historic low of 2.5 per cent at its review. Reserve Bank Governor Alan Bollard opted against making a rate change when releasing the quarterly monetary policy statement. He said if the New Zealand dollar remained at its high levels it would lessen the need to raise the rate. Dr Bollard says the New Zealand economy was continuing to improve despite the export sector being impacted by the high dollar.

Australia’s seasonally-adjusted unemployment rate increased 0.1 percentage points to 5.2% in February, the Australian Bureau of Statistics said Thursday Australia’s fourth-quarter gross domestic product rose 0.4% against economists’ expectations of a 0.8% gain, disappointing government officials and the markets.

South Korea kept its key interest rate on hold at 3.25% on Thursday, according to reports. The decision was widely expected.

Japan’s trade deficit widened in January to 1.382 trillion yen ($17.0 billion), up 245.9% compared to the year past. Japan’s current account deficit totaled 437.3 billion yen in the month. The trade deficit and current account deficit were the largest on record.

China will extend yuan-denominated loans to other nations that make up the Bric group of nations.

Japan’s crude imports from Iran in January fell 23 percent from a year ago to 1.67 million kiloliters, or 338,900 barrels a day, according to data from the Ministry of Economy, Trade and Industry

Premier Wen Jiabao, in his annual state-of-the nation report to China’s parliament, reduces growth for 2012 of 7.5 percent. That would be the slowest pace of expansion since 1990 and well down on last year’s 9.2 percent growth rate.

Japan’s unemployment rate inched up to 4.6 per cent in January from a revised 4.5 per cent in the previous month.

January household spending fell by an inflation-adjusted 2.3 per cent year-on-year. The fall was bigger than a 0.8 per cent drop economists had expected.

The nation didn’t sell any of its currency from Jan. 30 to Feb. 27, the ministry’s month-end data posted on its website shows.

Companies’ capital spending jumped by the most in nearly five years in the fourth quarter. Capital spending excluding software rose 4.9 percent from a year earlier, after declining 11 percent in the previous quarter.

Economic Events for AUD-NZD-JPY-USD this week

|

Mar. 12 |

19:00 |

USD |

Federal Budget Balance |

|

Mar. 13 |

00:30 |

AUD |

Home Loans (MoM) |

|

00:30 |

AUD |

NAB Business Confidence |

|

|

03:30 |

JPY |

Interest Rate Decision |

|

|

Tentative |

JPY |

BoJ Press Conference |

|

|

12:30 |

USD |

Core Retail Sales (MoM) |

|

|

12:30 |

USD |

Retail Sales (MoM) |

|

|

18:00 |

USD |

10-Year Note Auction |

|

|

18:15 |

USD |

Interest Rate Decision |

|

|

18:15 |

USD |

FOMC Statement |

|

|

21:00 |

NZD |

Westpac Consumer Sentiment |

|

|

23:50 |

JPY |

BSI Large Manufacturing Conditions |

|

|

Mar. 14 |

05:00 |

JPY |

BoJ Monthly Report |

|

12:30 |

USD |

Current Account |

|

|

12:30 |

USD |

Import Price Index (MoM) |

|

|

23:30 |

AUD |

Westpac Consumer Sentiment |

|

|

23:50 |

JPY |

Tertiary Industry Activity Index (MoM) |

|

|

Mar. 15 |

00:30 |

AUD |

RBA Financial Stability Review |

|

04:30 |

JPY |

Industrial Production (MoM) |

|

|

12:30 |

USD |

Core PPI (MoM) |

|

|

12:30 |

USD |

PPI (MoM) |

|

|

12:30 |

USD |

Initial Jobless Claims |

|

|

12:30 |

USD |

NY Empire State Manufacturing Index |

|

|

12:30 |

USD |

Continuing Jobless Claims |

|

|

13:00 |

USD |

TIC Net Long-Term Transactions |

|

|

14:00 |

USD |

Philadelphia Fed Manufacturing Index |

|

|

23:50 |

JPY |

Monetary Policy Meeting Minutes |

|

|

Mar. 16 |

12:30 |

USD |

Core CPI (MoM) |

|

12:30 |

USD |

CPI (MoM) |

|

|

13:15 |

USD |

Industrial Production (MoM) |

|

|

13:55 |

USD |

Michigan Consumer Sentiment Index |

Government Bond Auction Schedule (this week)

Mar 12 10:30 Germany Eur 4.0bn new Sep 2012 Bubill

Mar 12 18:00 US Auctions 3Y Notes

Mar 13 09:30 Netherlands Eur 2.5bn-3.5bn re-opened Apr 2015 DSL

Mar 13 10:10 Italy BOT auction

Mar 13 10:30 Belgium Auctions 3 & 12M T-bills

Mar 13 15:30 UK Details gilt auction on Mar 22

Mar 13 18:00 US Auctions 10Y Notes

Mar 14 10:10 Italy BTP/CCTeu auction

Mar 14 10:10 Sweden Auctions T-bills

Mar 14 10:30 Swiss Bond auction

Mar 14 15:30 Sweden Details nominal bond exchange auction on Mar 21

Mar 14 18:00 US Auctions 30Y Bonds

Mar 15 09:30 Spain Obligacion auction

Mar 15 09:50 France BTAN auction

Mar 15 10.30 UK Auctions 4.5% 2042 conventional Gilt

Mar 15 10:50 France OATi auction

Mar 15 16:00 US Announces auction of 10Y TIPS on Mar 22

Originally posted here