I have been a sentiment trader for a very long time and for the most part, it has kept me on the right side of the trade.

I believe one of the most important things a trader has to control, is their emotions. When you feel like you have to do something now, that is your emotions getting the best of you and you will make the wrong trading decision 99% of the time.

Let the tape come to you, because when you chase it, you will end up chasing your tail and losing money on most of your trades.

There are a number of ways to measure sentiment and I have teamed up with whom many believe to be the “master of sentiment” Woody Dorsey and publish the weekly Behavioral Market Trading newsletter. The way Woody measures sentiment, his firm polls 1000’s of people in the financial industry, to get their view of the short-intermediate and long term direction of the stock market.

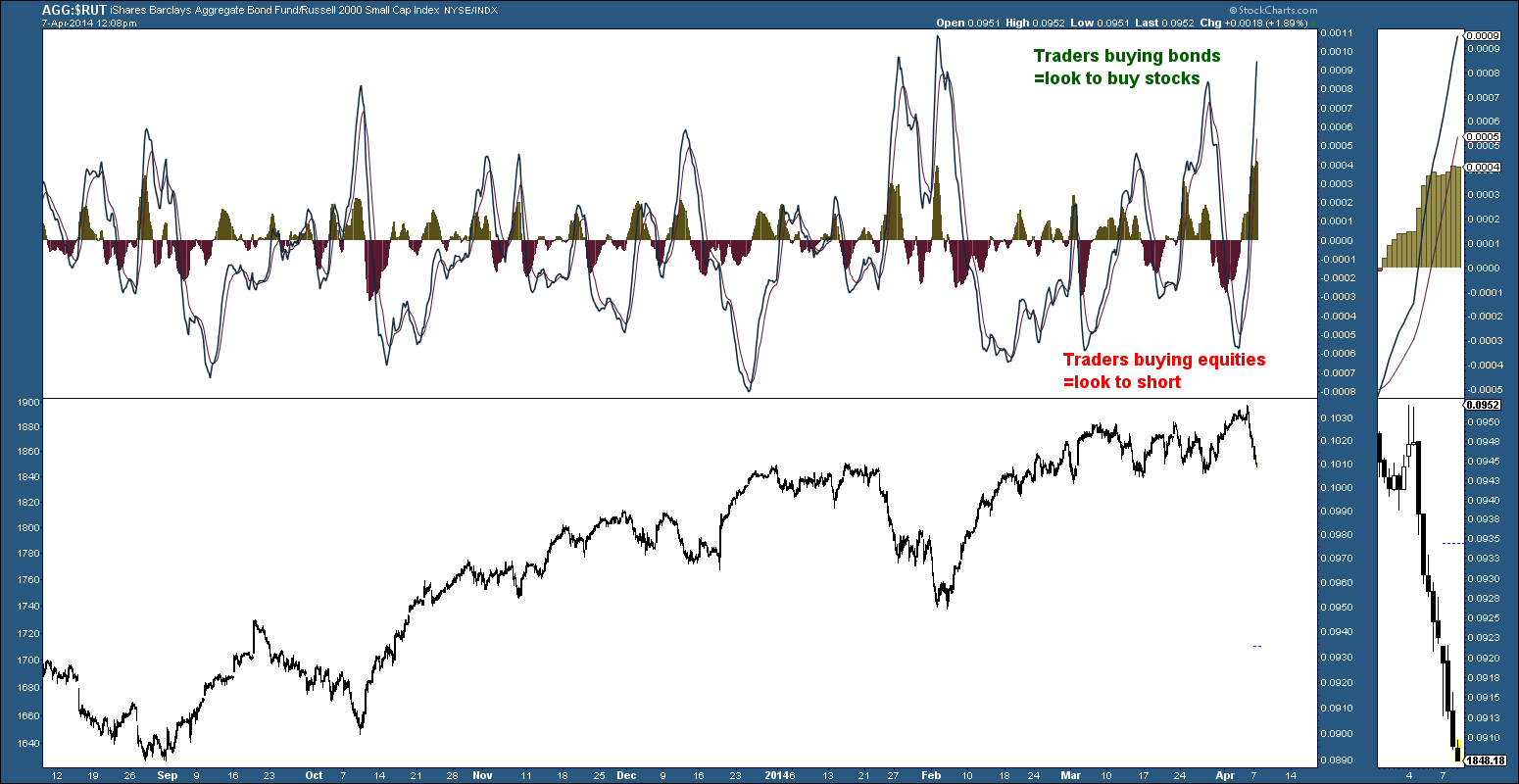

I have the luxury of seeing his sentiment work, but I also use my own, which is nowhere near as complex as his, but quite effective. I use a simply stock/bond ratio chart to gauge short term investor sentiment.

HOW IT WORKS

When the indexes are weak, typically traders will move to safety and buy bonds. When the indexes are strong, they will sell safety (bonds) and move into riskier assets like the stock market. When I see too many flocking to safety (bonds) it is time to look for support and buy. When too many are selling safety (bonds) and are in risk assets, (stocks) it is time to look for resistance and short or sell.

= = =

Click here to see the stock bond ratio charts in action on different time frames.