For the purposes of this article, I assume that you are familiar with Hamzei Analytics’ Central Intelligence (CI) and Directional Volatility (DV) indicators — both are available on the eSignal platform.

In case you are not familiar with them, here are the URLs to the how-to PDFs for the Hamzei Analytics CI and DV indicators:

CI Indicator (PDF document)

DV Indicator (PDF document)

In the DV indicator PDF, you’ll see I talk about using the DV indicator to identify a high probability Big Range* day for a tradable asset in the very near term. What the DV indicator doesn’t tell us is which way we should trade it (long or short). That’s where the CI indicator comes in.

From the CI indicator PDF, you’ll recall that CI is a zero-lag momentum and trend combo indicator. When you combine the DV and CI indicators in one chart, and add some common-sense money management principles, you have a recipe for high probability winning trades. Remember: There is no Holy Grail. What you are looking for is the opportunity to improve your odds against the uninformed herd.

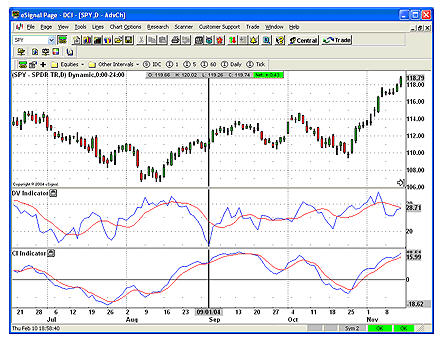

I will now revisit the three examples I pointed out in the DV indicator PDF. They were based on SPDRs (SPY) price action in 2004. This methodology is valid for other liquid (and popular) tracking stocks, such as QQQQ, as well as S&P 500 and NASDAQ 100 Stock Index Futures (ES or NQ). It also works very nicely for hi-beta momentum stocks such as GOOG, AAPL, BRCM or MRVL.

On May 24, 2004, notice that the DV indicator warned us of an impending Big Range day coming up. Observe what the CI indicator was up to immediately preceding May 24: While the price was making a higher low, the CI indicator, on the other hand, was pointing to a bullish trade. On May 25, SPY put in an outside bar reversal and the price flew up from there for 10 days!

Now, let’s look at the next trade on September 1: This trade is a no-brainer. Because the DV indicator has sunk to the bottom, we know that volatility is ready to explode. The beauty here is that the CI indicator has been shooting up on a steady slope since early August. (As we say at Hamzei Analytics, its CI Diff is positive.) Go LONG the next day, and you will be rewarded handsomely. OK, this was easy!

Here is another example: All through late December, the DV indicator is falling. The CI indicator has been whipsawing. So, we know a Big Range day is coming. Starting on December 29, the DV indicator’s fall accelerates while the CI indicator begins a modest retreat. (In our parlance, the CI Diff is negative here.) On January 3 and 4, 2005, we have two Big Range days, not just one. This was a very clean short and was detected nicely.

Please notice that not all setups are this clean, and you may not get a lot of heads-up time. Although this method is ideal for day trading, and, in most cases, one may see a follow-through, we do not recommend that you use this methodology for long-term plays.

The combination of the Directional Volatility (DV) and Central Intelligence (CI) indicators can pinpoint the timing and the direction of the big trade. Keep in mind: Good stop management is always a very prudent practice and can protect your risk capital (and your emotions) in these treacherous markets.

*A Big Range (High minus Low) day is defined as a day when the market opened at or near the low [or high] of the day and closed on the opposite end at or near the high [or low] of that day.