One of the hot areas in this market continues to be materials and oil service stocks.

Names like HAL, HES, and SLB have all seen clean breakouts and range extensions to new 52 week highs, and news driven plays like LNG have rewarded investors several times over.

One oil play that hasn’t broken out but looks ready to is BHI.

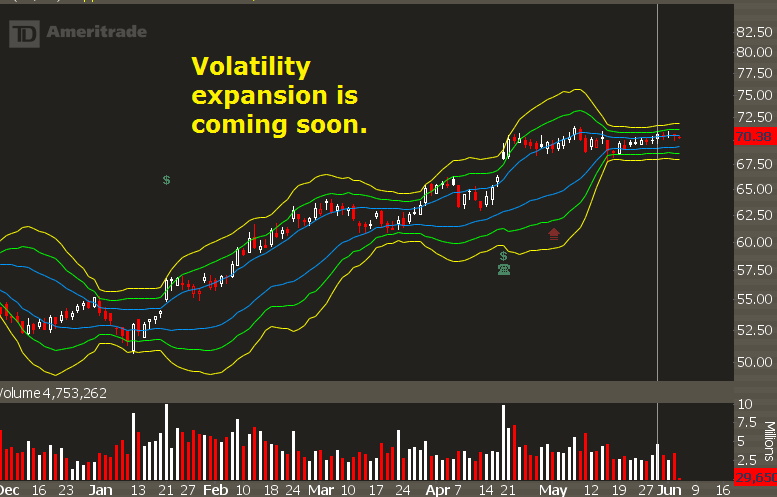

After a strong gap higher on earnings, the stock has been in an ever-tightening range with compressing volatility. This means that for about two months, buyers and sellers have been agreeing on price, but this cannot last much longer.

As the major trend is up, when there is volatility expansion it will most likely follow the uptrend as well. Watch for a break and hold of 71, with a measured move target of about 74-75 per share.