EUR/USD

The Euro was generally confined to a 1.4200 – 1.4280 range during the European session on Tuesday as major volatility and a lack of confidence in both currencies maintained a high degree of caution. The Euro lost ground when equity markets weakened, but selling pressure was held in check.

There was also high volatility following the Federal Reserve interest rate decision with net Euro gains to a peak near 1.44 as the US currency was subjected to heavy selling. The FOMC left interest rates at 0.00-0.25% and resisted any immediate move to introduce fresh quantitative easing. The Fed was generally gloomy over the economic outlook stating that downside risks had increased and that inflation was expected to decline over the next few quarters. There was an important shift as the Fed pledged to maintain interest rates at exceptionally low levels at least through mid 2013. It also stated that it would employ policy tools as appropriate. The vote in favour was not unanimous with 3 FOMC members dissenting from the statement to put a timeframe on keeping interest rates at very low levels.

After initial volatility, the dollar weakened following the FOMC statement with expectations that the currency would continue to be the preferred global funding currency once the current wave of risk aversion eased. Fears over the global economic outlook still provided some degree of support for the US currency.

There was further ECB buying of Italian and Spanish debt during the day and benchmark yields declined further. There were still important tensions as French credit-default swaps increased.

The political situation also remained under close scrutiny as the Slovakian government stated its opposition to increased EFSF funding and there was also significant opposition from within Germany. Political considerations will remain extremely important as the ECB bond buying can only be a short-term solution, butt he Euro held above 1.4320 in Asia.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar tended to drift weaker during Tuesday as there was further defensive support for the yen as risk appetite remained extremely fragile

There was a further decline in US Treasury yields following the Federal Reserve meeting which sapped US support and it was blocked below the 77.50 area even though there was a strong rally in equity markets. There was a decline in five-year yield spreads to the lowest level since late 2008 which hurt the dollar.

Japanese officials continued to warn over the threat of intervention, but markets remained doubtful over the potential for effective action, especially as there were reports that the ECB had criticised the Bank of Japan for intervening last week. The dollar was unable to make any significant headway during the Asian session on Wednesday.

Sterling

Sterling hit resistance close to 1.64 against the dollar on Tuesday and weakened sharply during the day with notable selling pressure early in the New York session with lows near 1.6170 while the Euro challenged resistance above 0.88. Sterling came under pressure even though it was still gaining some defensive support with UK credit-default swaps dipping to below German levels during the day.

The latest industrial data was weaker than expected with production unchanged for June while manufacturing output declined. The latest trade data was also weaker than expected with a GBP8.9bn deficit compared with a GBP8.5bn shortfall the previous month as exports fell. There was a more positive NIESR report on July’s growth, but markets remained concerned over the growth outlook.

The UK currency was also damaged by the social unrest within the UK as rioting spread to other cities. Confidence remained very fragile and the Bank of England inflation report will be watched very closely on Wednesday.

Swiss franc

Swiss franc volatility increased to exceptionally high levels during Tuesday as fear dominated markets. After initial gains on equity-market weakness, the franc retreated, but there was a fresh surge during the New York session. A lack of confidence in the major alternatives triggered rapid franc appreciation with a move to beyond 1.01 against the Euro while the dollar also plunged by record amounts against the Swiss currency to lows near 0.8070.

There was a partial reversal as equity markets rallied and there will be intense pressure on the National Bank to take more aggressive action to stem franc gains, especially as industrial-sector fears have increased sharply.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

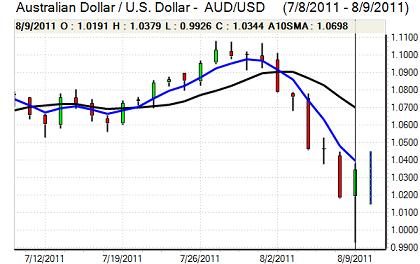

Australian dollar

The Australian dollar found buying support below parity against the US currency during Tuesday and quickly rallied back to the 1.02 area. There was further volatility during the day and the currency was only able to rally decisively following the Federal Reserve statement with highs just above 1.04.

The Australian dollar will gain support from an easing of fear as equity markets rallied and the Chinese trade data also provided some relief. There will still be fears over the global economic outlook which will stem buying support. Domestically, there was a further decline in consumer confidence according to the latest Westpac survey.