“Beware the Ides of March” was the warning Julius Caesar was given before he was assassinated.

Traders should beware the Ides of September. The next two weeks are likely to see the most volatile moves in many months across a variety of markets.

WAR TALK

The proximate cause is the on-again-off-again war talk in Washington. The president’s decision to refer plans for military intervention in Syria to the Congress was a smart political move —the political class may talk him out of doing something dumb, and at the least will share the blame if he goes ahead anyway — but it has certainly disrupted the markets.

The joint U.S.-Israeli missile test overnight will ratchet up the tension and so will the continuing debate in Washington.

For the next few weeks trying to anticipate where the markets will go will be an exercise in trying to predict political events. It has become a guessing game.

For the prudent, the best thing might be to simply stand aside until the shooting starts — or stops. For the more adventurous, here’s what we think will happen to the market most likely to react violently, the oil futures.

CRUDE OIL

War in the Middle East adds a fear premium to oil prices. We saw them spike last week when the war talk got hot, and retrace when the rhetoric cooled. Expect more of the same. There will be more extreme moves in the next two weeks.

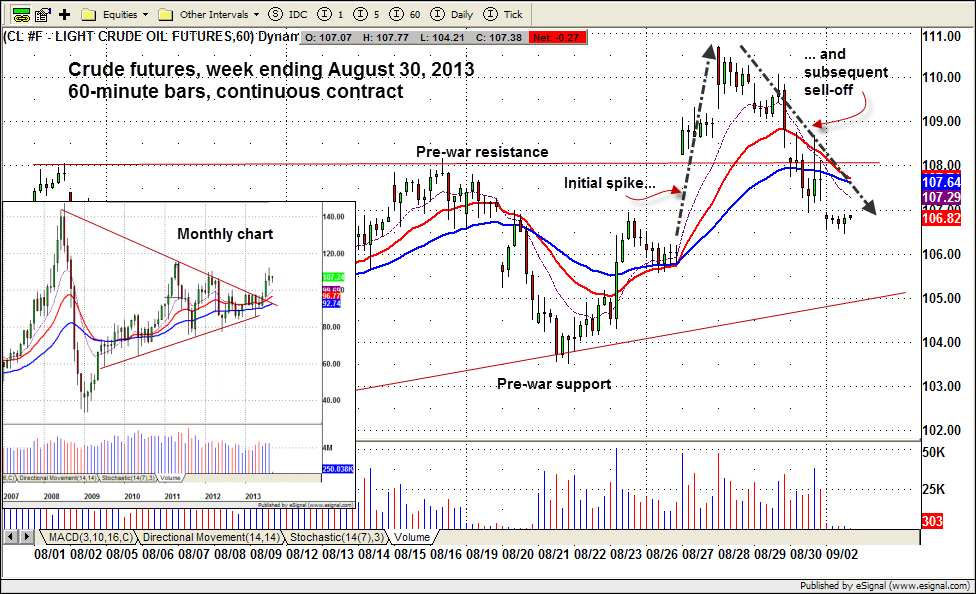

Technically, oil is trading within a narrow triangle pattern, except for a sharp spike immediately following the first speech directly threatening an attack on Syria, followed by a sell-off when the UK declined to join the fun.

We expect more wild moves. But the price needs to move outside this small triangle to build momentum for a run up to 110. The first sign of an upside breakout will be a break above 108.25. We think this is the more likely scenario.

But if peace breaks out, the triangle may be broken to the downside. The first sign will be a drop below 103.50 and the downside target will be 102.25.

This chart shows the current situation.

There will be similar disruptions in other markets: if there is war, equities fall, and gold bounces. We discussed the specifics last week. This week they are closer to being realized.

= = =

Polly Dampier is the brains behind Naturus.com, a real-time subscription service for active traders. For more information visit www.naturus.com