EUR/USD

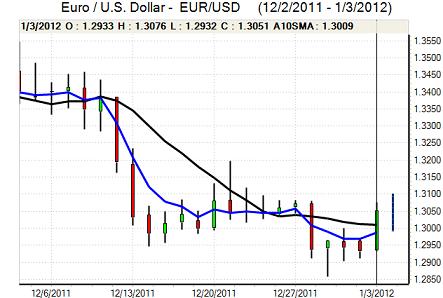

The Euro mounted a challenge on the 1.30 level against the dollar on Tuesday and pushed higher as stop losses were triggered, maintaining momentum during the European session.

There was no revision to the PMI manufacturing data while there was a stronger than expected reading for German unemployment as it fell 22,000 for December. In contrast, there was a further increase in unemployment for Spain, illustrating the continuing divergence within the Euro area.

There was a warning from Greek officials that they would have to leave the Euro area if a second rescue package failed and underlying sentiment inevitably remained very fragile. In particular, markets remained uneasy over the very heavy timetable of debt issuance over the next few weeks which will test investor confidence in the region.

There was some easing of Euro-zone money-market tensions as demand for emergency loans eased, but underlying stresses continued to increase as dollar Libor rates and Libor-OIS spreads both widened to the highest level since May 2009.

The US ISM manufacturing data was stronger than expected with an increase to a six-month high of 53.9 for December from 52.7 previously which maintained the sense of cautious optimism towards the US outlook, especially as the orders component was strong. The FOMC minutes from December’s meeting were broadly in line with expectations. The Fed did indicate that its internal Fed Funds forecasts would in future be released with the minutes and there was some speculation that this would lead to interest rates being left at ultra-low levels for even longer.

The Euro pushed to highs around 1.3075 against the dollar before retreating back to the 1.3030 area in Asia on Wednesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make any headway against the yen during Tuesday as the US currency was subjected to underlying selling pressure. The Euro did find support in the 99.60 area against the Japanese yen before hitting fresh selling on any move back above 100 with cross-related moves tending to dominate.

There was a general improvement in risk conditions and commodity currencies were generally firmer. The yen was, however, still broadly resilient on a trade-weighted basis which suggests that there is still an important reluctance to sell the yen.

There were no major moves in Tokyo trading on Wednesday as Japanese markets returned from holiday as volumes were still relatively low with the dollar trapped near 76.60.

Sterling

Sterling maintained a firm tone on Tuesday and was able to gain ground against the dollar and Euro as UK markets opened for their first session of 2012.

The latest PMI manufacturing index was stronger than expected with a recovery to 49.6 for December from a revised 47.7 previously. Despite some relief over the headline figure, there were still major concerns over the economy as industrial confidence remained very fragile. There will also have been a significant boost from favourable weather conditions and underlying demand was still weak as order books continued to decline.

Sterling gained some support from the PMI data, although a recovery in risk appetite had a more tangible impact with a peak around 1.5670 against the dollar as the UK currency also advanced to 0.8330 against the Euro. Comments from Bank of England officials will remain under close scrutiny in the short term, especially with speculation over further quantitative easing at February’s meeting.

Swiss franc

The dollar dipped to lows around 0.9310 against the franc on Tuesday and was generally on the defensive despite a brief move back above the 0.9350 region as the Euro stalled around the 1.2180 area.

The latest Swiss PMI index was stronger than expected with a recovery to 50.7 for December from 44.8 previously. Although the series is inevitably volatile, especially around the year-end period, there will be some relief over a recovery. The National Bank will continue to monitor the situation closely, but immediate pressure for a raising of the minimum Euro level should ease slightly, especially if there is a higher than expected inflation reading later this week.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar maintained a firm tone on Tuesday and pushed to highs around 1.0380 against the US currency before drifting weaker. There was a general improvement in risk appetite and a series of firmer than expected PMI releases globally triggered some speculation that the outlook may be more favourable than expected.

The currency also gained support from gains in commodity prices, although there was still a high degree of caution given stresses within the global banking sector.