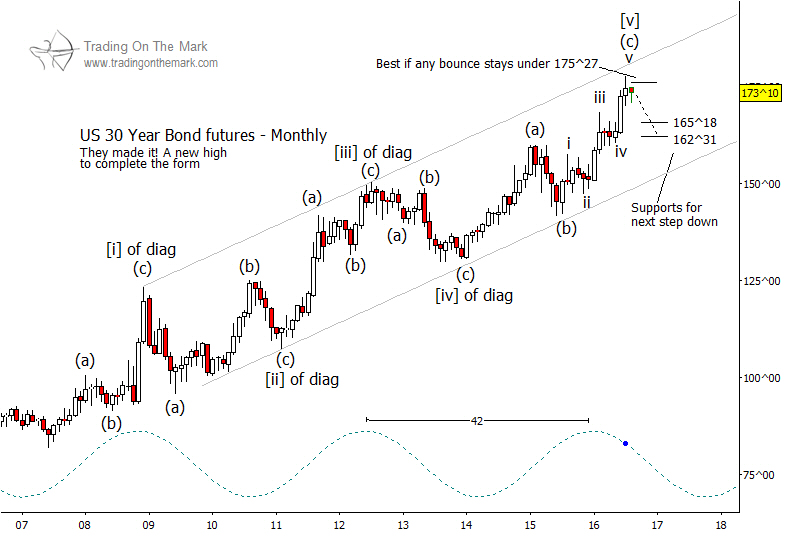

With interest rates at historic lows, the 30-year U.S. treasury bond has reached new highs since we last wrote about it in March. We continue to believe bonds are going through a topping process, and in fact the high may already have been reached.

The big-picture Elliott wave pattern for treasuries has taken the form of an ending diagonal, with five overlapping moves consisting of three smaller waves each. The rise since June 2015 has completed five sub-waves, which meets the criteria for completion of the entire structure that began in 2007. To confirm this view, we will be watching for bonds to form a lower high sometime this year.

A lower high in treasuries ideally would stay beneath the Gann-related retracement level at 175^27. If a downward move starts gaining momentum, then the support levels near 165^18 and possibly 162^31 should work as initial targets. Note that the 42-month dominant cycle will lend downward pressure into mid-2017.

Follow on Twitter and facebook to get timely market updates from Trading On The Mark!