US stock futures point to a slightly higher open again Monday after a strong three-day bounce last week saw the bulls retake control of the market. The key level to watch last week was the 50-day moving average, and Thursday the bulls were able to get a close above and extend beyond it Friday. This morning’s gap up should trigger more short covering from stubborn bears, adding fuel to the rekindled market fire. This morning’s pre-market gains come despite grave news regarding the nuclear crisis in Japan, where highly water at one of the reactors is causing great concern and hampering efforts to end the catastrophe. In Libya, however, news that Western-backed rebel forces are now taking the fight to government troops has triggered a drop in oil prices and boosted the market.

The S&P is now approaching resistance at the apex of the wedge pattern that was formed in late February-early March. The question now is whether the market will be patient and choppy in getting back to highs, or whether more short covering and aggressive buying will propel stocks higher early this week. After underpeforming during the brief correction, tech stocks have helped lead the market back from the brink.

For more market and stock commentary, watch the T3Live.com Morning Call with Scott Redler below.

Among the leading tech stocks right now are three of the hottest Chinese names: Baidu.com, Inc. (BIDU), SINA Corporation (SINA), and Sohu.com Inc. (SOHU). Also acting well once again after bouts of weakness are Netflix, Inc. (NFLX) and Apple Inc. (AAPL). Netflix was sold off harshly after soaring to new highs in mid-February as investors flinch at any mention of a possible competitor for the company. After dipping below its 50-day moving average, Netflix has bounced back sharply and looks like it could test highs once again. Apple has been weighed down by uncertainty over Steve Jobs’ future with the company. The iconic Apple CEO took another medical-related leave of absence, and their have been suggestions that he could leave the company for good. Supply chain fears related to Japan have also given investors pause, but the cheap valuation for Apple has kept investors coming back for more. Priceline.com, incorporated (PCLN) is another tech leader that perked up after breaking a mini-downtrend Wednesday, and looks set to hit $500 soon.

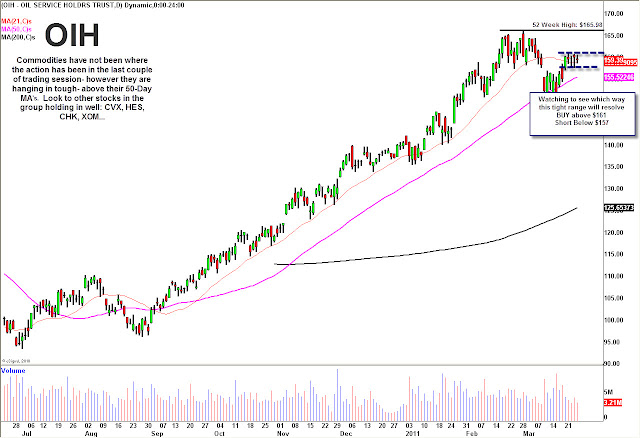

Commodity stocks were not the center of attention late last week during the bounce, but some look ready to go. None have a better set-up right now than the Oil Service HOLDRs (ETF) (OIH), which consolidated in a tight bull flag all week. After resting just above its 21-day moving average, look for the OIH to get a pop early this week. Others to watch in the sector that look good but have slightly different set-ups include Chevron Corporation (CVX), Hess Corp. (HES), Chesapeke Energy Corporation (CHK), and Exxon Mobil Corporation (XOM).

Best Bank Could Play Catch-Up

When a market begins to bounce after a correction, the first stocks and sector to go are the ones that held up the best. Up to this point we have looked, for the most part, for stocks that held above key levels and moving averages. However, as a rally gets back more in full swing, you can start taking a look at more laggard type plays for good potential momentum. The banking sector fits the bill of a laggard. When playing a lagging sector, you always want to play the strongest stock in the group, and right now that is JP Morgan Chase & Co. (JPM). JPM is back above its moving averages and holding up well, so we expect it to be back to 52-week highs above $48.

*DISCLOSURE: Scott is long FCX, NYX, LEI, VLO, AMZN, SOHU, JDSU.

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.