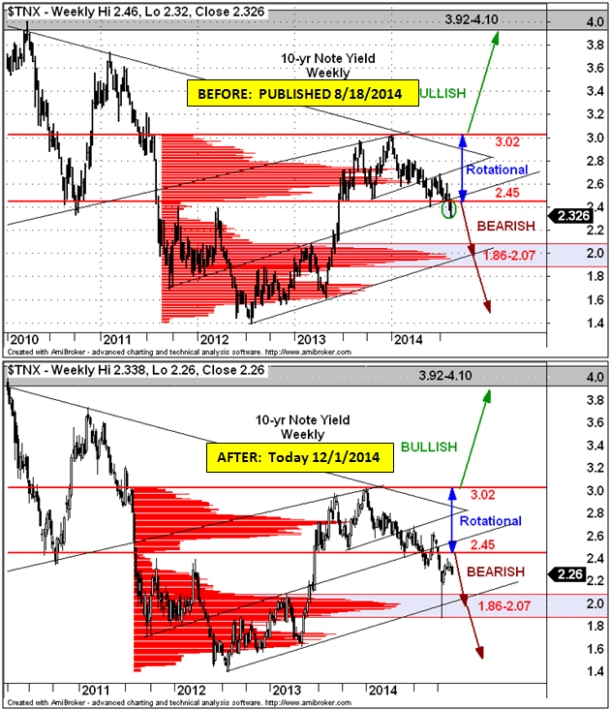

After interest rates spent the last half of 2013 and the beginning of 2014 in a sideways consolidation pattern, a majority of analysts and opinion-makers were calling for higher interest rates. In our August 18th article here on TraderPlanet, we challenged that view and stated that we saw rates moving lower, not higher. As you can see in the chart comparison below, along with our published comments at the time, we were not only correct on the direction, but we were also correct on the support zone into which rates spiked.

At i10 Research, we let the charts do the talking and the chart of the TNX, which is the 10-year interest rate, shows that rates are not headed higher. They are moving lower. The trend in interest rates has been bearish since the start of 2014 and has now broken key near-term support.

The break of 2.45, which was an area of support for nearly a year, signals that rates are moving down and the next area of support that we are targeting is 1.86 – 2.07.

#####

If you would like to see more research and analysis from i10 Research, click here.