EUR/USD

The Euro generally consolidated just above the 1.38 level ahead of the US employment data on Friday with the currency unable to gain any fresh momentum as protracted political negotiations in Greece deterred aggressive action.

The currency was unsettled by weak euro-zone data as there was a further deterioration in the services PMI data for October and there were particularly weak readings for Italy and Spain which increased fears surrounding these major economies. There was also a much weaker than expected reading for German manufacturing orders which undermined the growth outlook.

The headline US employment data was slightly weaker than expected with an increase in payrolls of 80,000, although this was offset by an important upward revision to 158,000 for the September data. The unemployment rate also edged down to 9.0% from 9.1%. There was a further drop in government employment and the report overall maintained some slight optimism that the economy was improving, although the evidence remained mixed.

The Euro looked to advance initially as risk appetite improved, but was then subjected to renewed selling pressure as Euro-zone fears intensified again. There was a renewed increase in Italian government yields with markets fearing that the situation could escalate into a major crisis very quickly given the Italian debt dynamics as 10-year yields moved towards the 6.40% level.

The Greek government did win a confidence vote and, following protected negotiations over the weekend, there was an eventual agreement to form a new unity government with Papandreou resigning as Prime Minister. Elections are likely to be scheduled for February and the new government will pledge to support the EU loan package, but major uncertainties will continue.

Although there was Euro relief, the currency was blocked above 1.38 as the Italian situation deteriorated further with defections potentially costing the government its Lower-House majority which further soured confidence in planned austerity measures.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar gained some slight support following the US payroll data on Friday with a move to the 78.25 area against the yen, but it was unable to gain any significant traction with the yen still broadly resilient.

There were further doubts surrounding the Euro-zone outlook which limited any scope for capital flows out of Japan with investors still reluctant to chase high-yield currencies.

There were no substantive comments surrounding exchange rates from the G20 meeting and no major change in the yuan, although the Chinese movements will be watched closely. There was no evidence of intervention by the Bank of Japan, but markets inevitably remained very tense given the threat of further action.

Sterling

Sterling was generally weaker following the US payroll data as the Euro was subjected to fresh selling pressure on Italian fears.

There were no significant domestic developments during the day as markets continued to focus on Euro-zone developments. There was evidence of defensive demand for Sterling given fears of capital flight from the Euro area, especially with increased doubts surrounding Italy and Sterling pushed to a high above 1.6050 against the dollar before edging lower. The banking sector will also remain an important focus.

There was some speculation that the Bank of England could move to expand quantitative easing at this week’s MPC meeting which may unsettle the currency slightly, although international trends may continue to dominate for now.

Swiss franc

The franc was subjected to significant selling pressure in Europe on Friday as there was increased speculation that the National Bank would push for a higher minimum level against the Euro. The Euro rallied to above the 1.22 level which dragged the dollar to a peak near 0.89.

Following remarks by Danthine on Thursday, Bank president Hildebrand stated over the weekend that he expected the franc to weaken further in the medium term. There was also a further warning that all necessary measures would be taken to ensure that the currency did not strengthen again. These remarks put the franc under fresh selling pressure on Monday as the Euro tested resistance above 1.23 and volatile trading will remain a very important risk.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

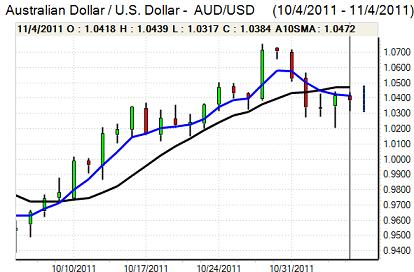

Australian dollar

The Australian dollar hit resistance above 1.0420 against the US dollar on Friday and dipped to lows near 1.0320 as it struggled to maintain more than a neutral tone even though risk appetite was slightly firmer following the US employment data. Although markets are starting to price in monetary relaxation by China, the Australian dollar is struggling to gain much benefit.

The domestic economic data releases failed to provide much support with a further decline in job ads according to the latest data while the construction-sector PMI index remained firmly below the 50 level despite a monthly recovery.