EUR/USD

There was further choppy trading conditions against the dollar on Thursday with the Euro broadly resilient despite a further increase in underlying stresses.

There was a weak Spanish bond auction which pushed yields higher while French yield spreads over German bunds also rose to fresh EMU highs above 200 basis points. New Italian Prime Minister Monti announced a comprehensive reform package for the Italian economy, although these measures would only have an impact in the longer term.

There were further important stresses within the financing markets as 3-month Libor rates continued to increase to the highest level since mid 2010. There was also a further increase in the dollar funding costs through the Euro swaps markets as inter-bank lending continued to decline.

There were reports of more aggressive ECB buying of peripheral debt which put a cap on Italian yields, but there will be major doubts whether the policy is sustainable. There were also rumours that the ECB would lend funds to the IMF which would buy peripheral bonds but, if there is intense German and ECB opposition to direct funding, there will be major reservations over indirect funding as well, especially with political tensions increasing.

The US jobless claims data was again better than expected with a decline to fresh 7-month lows of 388,000 from 393,000 previously, maintaining the solid tone of recent data. The Philadelphia Fed index dipped to 3.6 for November from 8.7 previously, although there was an improvement in the employment component to the highest level for close to 18 months.

Federal Reserve Governor Dudley stated that a lot of action had already been taken, but that the Fed could take additional measures if there was evidence of renewed economic deterioration.

The Euro found support on dips to the 1.3420 area and moved back toward the 1.35 area even though the dollar retained a firm tone on the crosses.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make any impression on the yen during Thursday and retreated to lows below 76.90, although ranges remained extremely narrow. The dollar failed to gain any support from the firmer than expected US employment and housing data as permits rose strongly.

There was a further deterioration in financing conditions during the day and there was a sharp decline in Asian equity markets on Friday as global growth concerns increased. In this environment, there was further defensive support for the yen as risk appetite deteriorated.

Underlying stresses within the Euro-zone also maintained the threat of capital repatriation with Euro-area bond holdings scaled back. The dollar was also unable to make any impression on the yen in Asia on Friday.

Sterling

Sterling found support in the 1.57 area against the dollar during Thursday and tested resistance just above the 1.58 area, although it was unable to sustain the gains as the UK currency also stalled against the Euro.

The latest headline retail sales data was stronger than expected with a 0.6% increase for the month. The evidence suggested that the figure had been boosted by retailers discounting ahead of the Christmas period with underlying fears over the spending outlook. MPC member Weale stated that there was a strong case for further quantitative easing which will maintain speculation over further Bank of England action.

The banking sector will inevitably be an important focus in the short term, especially with an increase in financing pressures. There will be fears that the banks will cut back on lending which will further undermine growth in the economy. There will also still be fears that there will be a withdrawal of funds by the European banks which could put Sterling under heavy selling pressure.

Swiss franc

The dollar hit resistance above 0.9225 against the franc on Thursday, but found support on dips to the 0.9150 area and consolidated near the middle of this range as the franc maintained a generally soft tone on the crosses.

The latest ZEW business confidence index retreated to -64.3 for November from -54.4 the previous month, which will maintain fears over a sharp deterioration in economic conditions. There has been further speculation that the National Bank will look to push the franc weaker, although high volatility will be a key feature, especially if there is further instability in the European banking sector.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

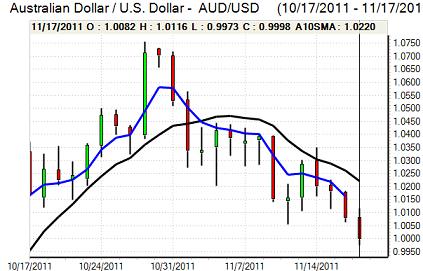

Australian dollar

The Australian dollar was capped in the 1.01 area against the US currency during Thursday and dipped to test support below parity during the US session with fresh selling pressure in Asia on Friday as commodity currencies came under pressure.

International considerations continued to dominate and the currency was undermined by a renewed deterioration in risk appetite. In particular, there were further doubts surrounding the global banking sector and the impact on regional growth which would also have an important impact on the Australian economy.